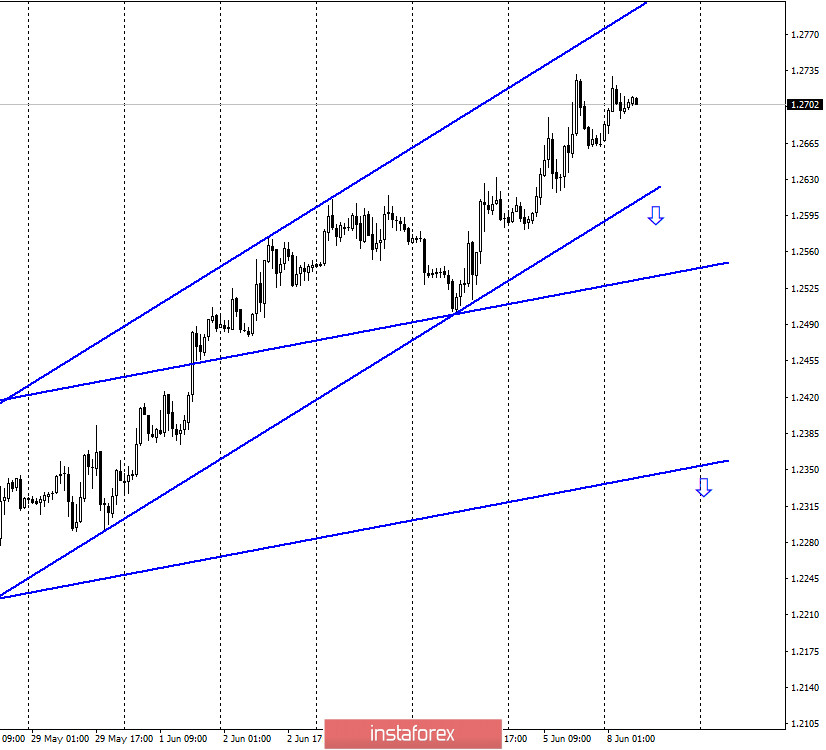

GBP/USD – 1H.

Hello, dear traders! On the hourly chart, the GBP/USD pair continues growing within the new uptrend corridor. The pound-dollar left the previous corridor through its upper boundary. That is, the bullish traders' sentiment has intensified in recent days. On Friday, even positive US statistics did not help the greenback increase. It seems like traders ignore everything that can support the US dollar. Meanwhile, now no news is coming out in the UK - neither good nor bad. Thus, the reasons for the current growth of the pound remain a mystery. As for the euro, the pound may try to close under the trend corridor in the coming days. However, there have been no graphic prerequisites for this so far. Last week, another round of negotiations took place between Britain and the European Union as part of the discussion of the Brexit agreement. This round of negotiations between Brussels and London also failed.

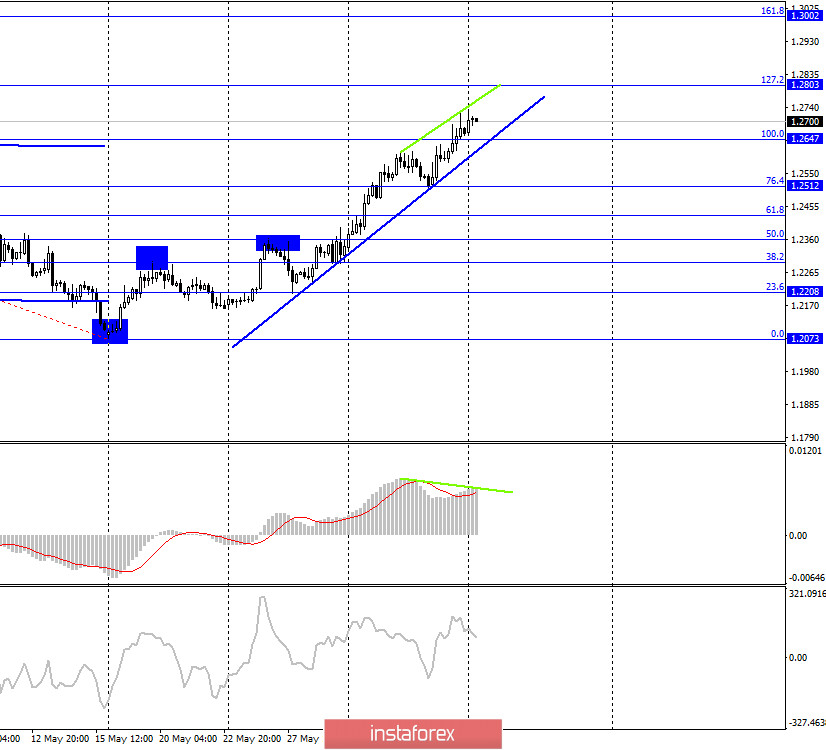

GBP/USD – 4H.

On the 4-hour chart, the GBP/USD pair continues growing in the direction of the correctional level of 127.2%-1.2803 on the new grid of Fibonacci retracement levels. A new rising trend line has also been formed, which also shows the current traders' sentiment. The closing of the pair under the trend line may coincide with the closing on the hourly chart along the corridors. This will immediately be a double signal for the sells of the pound. On June 8, a bearish divergence near the MACD indicator is also brewing, which may allow the pair to pull back.

GBP/USD – Daily.

On the daily chart, the quotes increased to the correction level of 61.8% - 1.2711. Thus, traders need to understand whether there will be a rebound or a breakthrough of this level at the moment. In one case, the pair may fall. Otherwise it is likely to continue rising.

GBP/USD – Weekly.

On the weekly chart, the pound-dollar pair made a false breakout at the bottom trend line and rebound from it. Thus, until the quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

News review:

There were no economic reports in the UK on Friday, while traders did not react to US statistics. The pound seems to continue to be in demand solely due to the current situation in the United States. As soon as mass rallies and protests are suppressed, the pound (as well as the euro) will be able to fall, or maybe even earlier.

News Calendar for USA and UK:

On June 8, there will be not a single important economic report in the UK and the US. Possibly, the White House or the British government will announce important news.

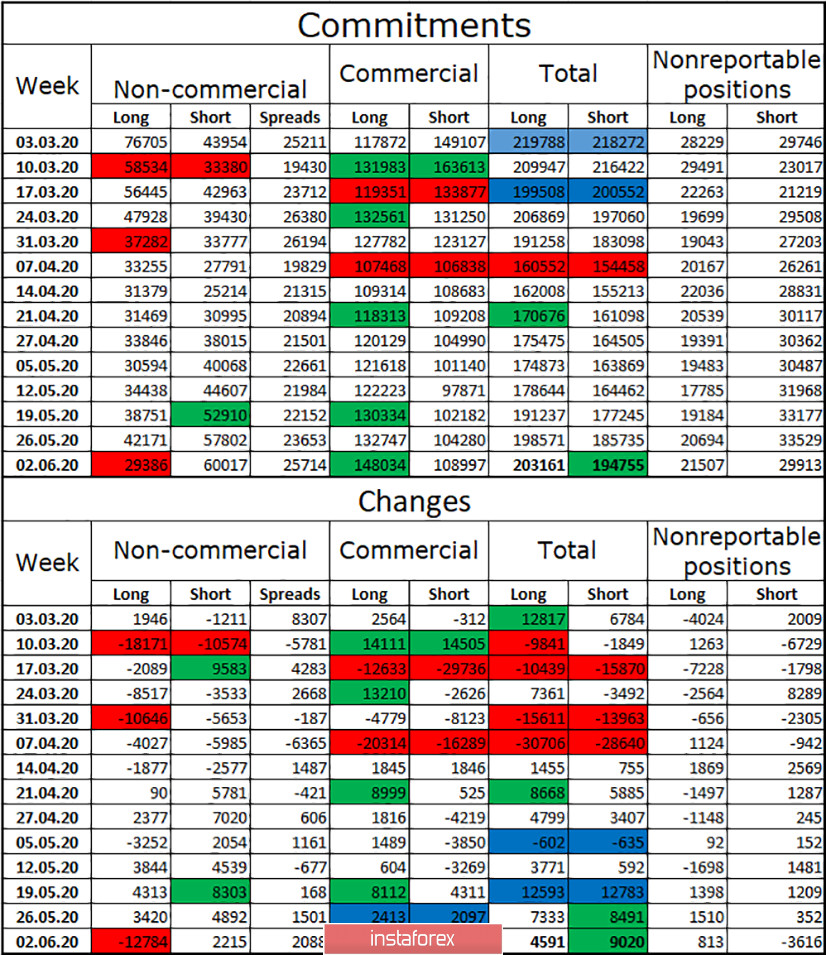

COT report (Commitments of traders):

Last Friday, a new COT report was released. It showed a strong reduction in Long-contracts among the Non-commercial group. This means that major market players who earn from changing the exchange rate, have got rid of the pound in the reporting week. Nevertheless, it was the pound that has increased recently. Thus, the sentiment of large speculators completely does not coincide with the general traders' sentiment for the pound-dollar pair. It could be assumed that the matter is in the total number of Long-contracts, which could significantly increase thanks to the Commercial or Non-reportable groups. However, the total number of Long-contracts decreased during the reporting week. Thus, a controversial situation occurred: traders were selling the pound, but the currency eventually grew. Perhaps traders were selling the US dollar even in larger volumes?

GBP/USD forecast and recommendations for traders:

Under current conditions, it is preferable to sell the pound with the targets at 1.2512 and 1.2429, if the closing price is under the trend line on the 4-hour chart and under the upward corridor on the 1-hour chart. It is better to continue buying the pair with the target at 1.2803 and a Stop Loss under the upward corridor on the hourly chart.

TERMS:

Non-commercial group is major market players: banks, hedge funds, investment funds, private and large investors.

Commercial group is commercial enterprises, firms, banks, corporations, companies that buy currency not for speculative profits, but for ensuring current activities or export-import operations.

Non-reportable positions are small traders who do not have a significant impact on the price.