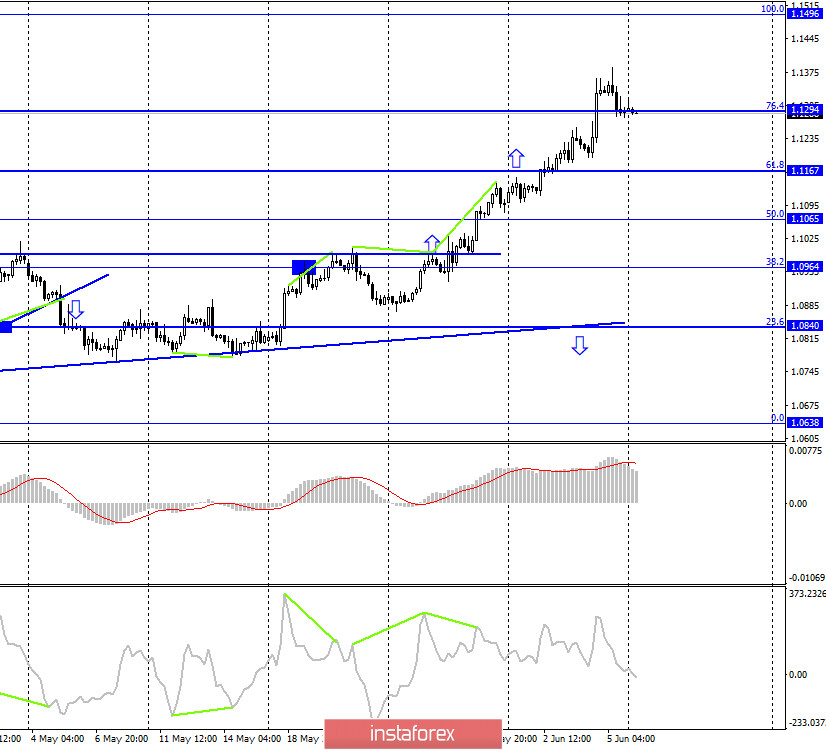

EUR/USD – 1H.

Good day, dear traders! The euro/dollar pair performed a reversal in favor of the US currency on the hourly chart on June 5 and began falling towards the lower border of the upward trend corridor. Thus, the "bullish" mood of most traders remains. No news was available on Friday and two weekends. In addition to the usual economic reports on June 5, traders continued to be interested in the already commonplace topics of rallies in the United States, the confrontation between China and the United States, and the like. But even on these topics, there has been no important or new information recently. Thus, the euro currency, which gained a lot after rallies and protests began in America related to the death of an African-American man at the hands of a white police officer, may now begin to return to more familiar movements. Namely, the fall against the US currency. At the moment, the pair's quotes are already approaching the lower border of the corridor and may soon start testing its strength.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair also performed a reversal in favor of the US dollar and began falling in the direction of the corrective level of 76.4% (1.1294). The pair's rebound from this Fibo level will work in favor of the euro currency and resume the growth process in the direction of the corrective level of 100.0% (1.1496). Fixing the pair's exchange rate under the Fibo level of 76.4% will increase the chances of a further fall towards the next corrective level of 61.8% (1.1167). There are no pending divergences observed in any indicator today.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation above the corrective level of 127.2% (1.1261). Therefore, the growth process can be continued towards the next level of 161.8% (1.1405).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the level of 1.1600 (the upper line of the "triangle"). Given the growth of the euro currency in recent days, this goal can be "taken" in the next week.

Overview of fundamentals:

On June 5, there were no important reports or news in the European Union. But in America, three important reports were released at once, the results of which surprised traders quite a lot. The unemployment rate in the US unexpectedly fell to 13.3% instead of rising to 19.8%, and the change in the number of people employed in the non-agricultural sector was +2.509 million instead of the expected -9 million. Average wages rose by 6.7% in May. Thus, the growth of the US dollar in the second half of Friday is fully justified.

News calendar for the United States and the European Union:

EU - ECB President Christine Lagarde will deliver a speech (13:45 GMT).

On June 8, the calendar of events contains only a speech by ECB Chairwoman Christine Lagarde, who will surely tell traders some new information on monetary policy.

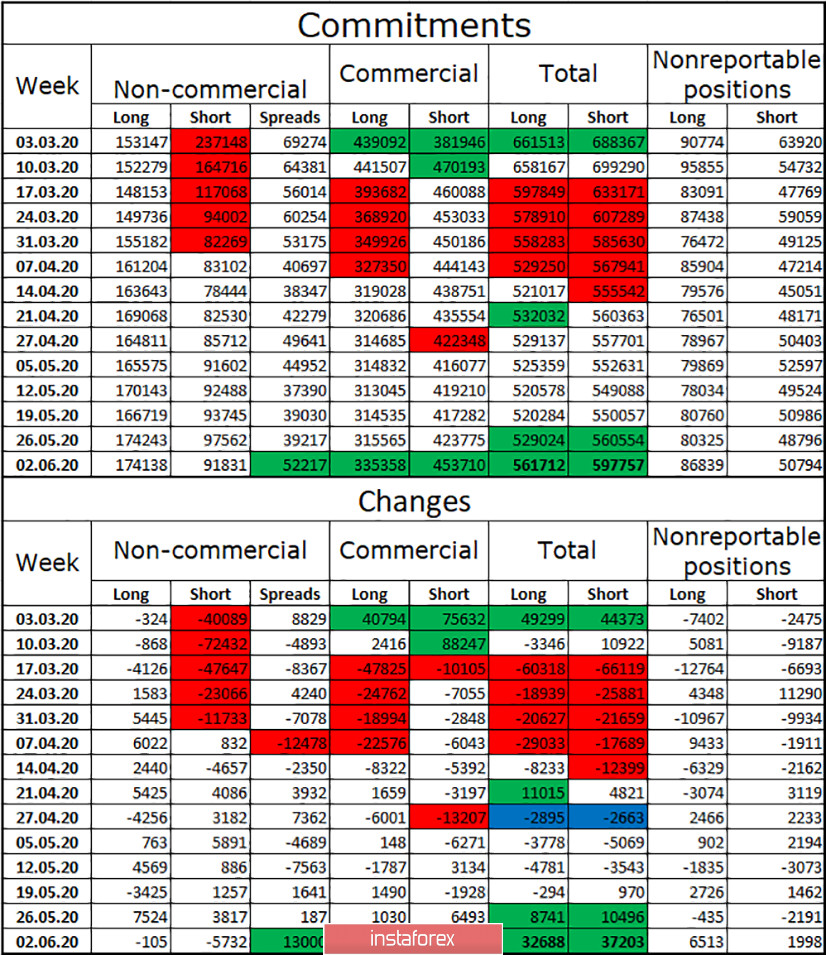

COT (Commitments of Traders) report:

Over the past week, the European currency has shown a very strong growth, so traders reasonably expected a high increase in the number of long positions in general and in the "Non-commercial" group. However, in practice, it turned out the opposite. According to a new report from COT, a group of speculators strenuously got rid of short-contracts during the reporting week, which led to exactly the same effect as the build-up of long-contracts. Thus, the difference between the number of long and short contracts in the hands of large speculators for the reporting week has increased, which is perfectly compared with what is happening in the currency market. I also note the increased activity of major players, as the total number of open contracts increased in 1 week by as much as 70,000.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1167, if it is fixed under the ascending channel on the hourly chart. I recommend supporting the pair's purchases with the goal of 1.1496 before closing under the upward trend corridor on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.