EUR / USD

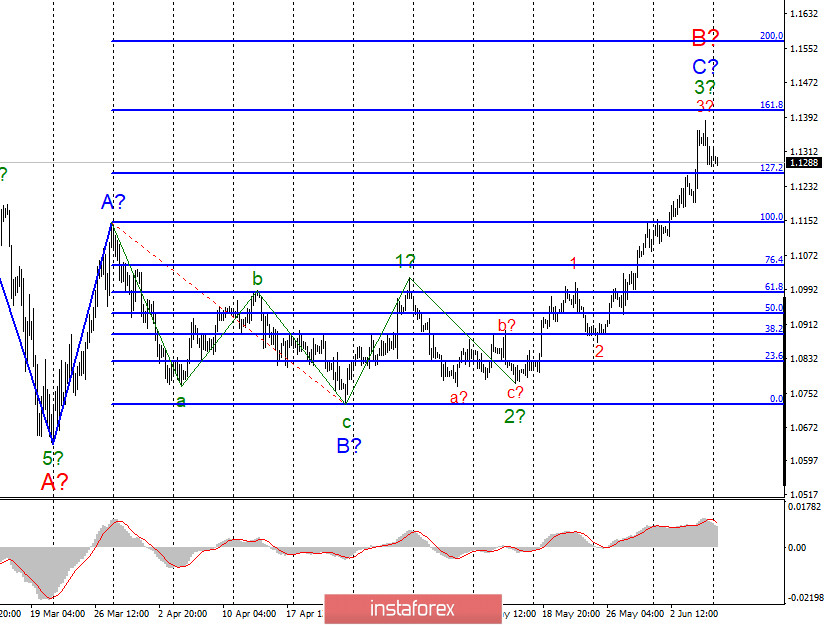

On June 5, the euro / dollar pair lost about 45 points, thus having hypothetically completed the formation of expected wave 3. If it is true, the currency pair has already begun building the 4 th correctional wave. As soon as its formation is over, the pair is expected to resume its upward move. At the same time, the current wave grid enables a much stronger increase. Indeed, analysts do not rule out the formation of wave 5 apart from C and B.

On June 5, the euro / dollar pair lost about 45 points, thus having hypothetically completed the formation of expected wave 3. If it is true, the currency pair has already begun building the 4 th correctional wave. As soon as its formation is over, the pair is expected to resume its upward move. At the same time, the current wave grid enables a much stronger increase. Indeed, analysts do not rule out the formation of wave 5 apart from C and B.

Fundamental analysis

On Friday, the US Department of Labor released data of crucial importance such as nonfarm payrolls, an unemployment rate, and average earnings. The market was amazed by unexpectedly strong figures. The unemployment rate went down. Besides, the US public and private sectors added 2 million jobs in May defying pessimistic forecasts. No wonder, demand for the US dollar boosted immediately. So, EUR / USD started forming a correctional wave. In addition, US Senator Rick Scott stated that China was allegedly disrupting US companies' work on inventing a vaccine. Interestingly, he said nothing what companies had been exposed and how exactly. Neither, he expanded on the details and provided any proof. Thus, the Senator's statement did not clear up the case. Likewise, US State Secretary Mike Pompeo said that Beijing ' s moves towards Hong Kong reminded him about the Nazi Germany's brutality during World War II. One thing is obvious. The verbal feud between Beijing and Washington is going on. Grim prospects are hanging over the trade relations of the two largest global economies. The White House warns to impose a batch of new sanctions, tariffs, and restrictions. In turn, Beijing threatens to cancel the trade deal. On Monday, Germany posted data on industrial production. The report reads that a factory output contracted 17.9% in April month-on month. In midday, investors are alert to a speech by ECB President Christine Lagarde. Grim prospects are hanging over the trade relations of the two largest global economies. The White House warns to impose a batch of new sanctions, tariffs, and restrictions. In turn, Beijing threatens to cancel the trade deal. On Monday, Germany posted data on industrial production. The report reads that a factory output contracted 17.9% in April month-on month. In midday, investors are alert to a speech by ECB President Christine Lagarde. Grim prospects are hanging over the trade relations of the two largest global economies. The White House warns to impose a batch of new sanctions, tariffs, and restrictions. In turn, Beijing threatens to cancel the trade deal. On Monday, Germany posted data on industrial production. The report reads that a factory output contracted 17.9% in April month-on month. In midday, investors are alert to a speech by ECB President Christine Lagarde.

Conclusion and trading recommendations

The euro / dollar is presumably carrying on with building upward wave C inside wave B. Therefore, I would recommend long deals on EUR / USD with targets set at 1.1406 and 1.1570 that are equal to161.8% and 200.0% Fibonacci correction for each of the new upward signal. Meanwhile, the currency pair has started plotting correctional wave 4.

GBP / USD

On June 5, GBP / USD gained another 60 points. Thus, the currency pair is still building the upward wave. As the price has broken the peak of wave b, the odds are that wave 2 or B is over and now wave 3 or C is keeping on its developments. If this is true, then after a successful attempt to break the maximum of wave b, the increase in quotes will continue with the goals located near the levels of 61.8% and 76.4% for Fibonacci.

Fundamental analysis

In the UK, at the end of last week, it became known that the next round of negotiations between London and Brussels ended in nothing. The representative of the European Commission, Michel Barnier, who is negotiating with London, said that the British side is deliberately delaying the negotiations and refuses to previously assumed obligations. A meeting between Ursula von der Leyen and Boris Johnson is due to take place in June, and politicians believe that only it can give a boost to the stalled negotiations. In the UK, no economic reports are expected today; in the US, the picture is the same. However, at the beginning of the new week, the British pound shows no signs of being ready to build a corrective wave.

Conclusions and trading recommendations

The pound / dollar pair is presumably carrying on with developing the upward wave. To sum it up, the idea of long deals is valid. Target levels could be placed at about 1.2844 and 1.3030 that correspond to 61.8% and 76.4% of Fibonacci correction. In case the level of 1.2698 (50.0% of Fibonacci) is breached successfully, this will signal the market's readiness for more long bets.