The latest COT report (Commitments of Traders). Weekly prospects for EUR/USD

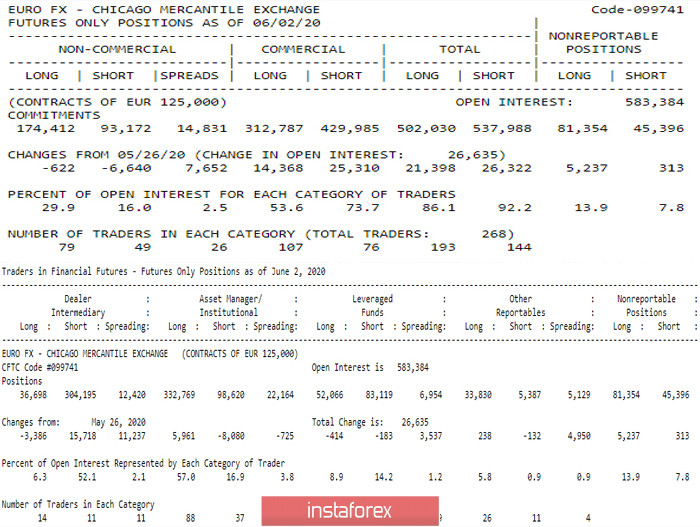

According to the latest report of COT (Commitments of Traders), open interest in the euro has increased again (583,384 against 547,206). It should be noted that a group of major players (Non-Commercial) for the last reporting period actively reduced short positions (-6.640), while it strengthened its net position while continuing to support players to increase (81.24 against 75.22). Meanwhile, the group (Commercials) increased its investments in euros, both in the long position (+14.368) and in the short position (+25.312), leaving the overall balance of power distribution at about the same level (53.6 against 73.7). From the detailed financial report it can also be concluded that the most mobile part of market participants has long positions in priority, the gap between bulls and bears remains and widens in favor of the bulls.

Main conclusion

The trend set earlier and developed before will continue to exist. On the daily bullish trend, corrections are still possible, but there are no prerequisites for changing preferences in the long-term.

Technical picture

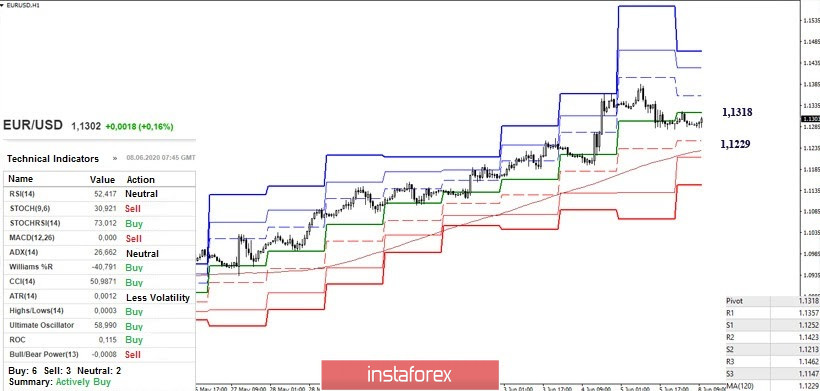

On Friday, after the data taken into account in the report (the report is published on Friday with data for Tuesday of the current week), there was a slight daily correction. As a result, the weekly candle has a longer upper shadow and is practically devoid of a lower shadow. Therefore, the expected downward correction is likely to get its design and implementation this week. As a support in this situation, a daily cross and a day cloud will act. The daily short-term trend is now located at 1.1160, the cloud is still forming support at 1.1065. The continuation of the upward trend has interesting prospects, which are described in more detail in my daily comments on the movement of the euro.

At the lower time intervals of the pair, the development of a downward correction can be observed, which has already led to the loss of one of the important supports on H1 - the central Pivot level (1.1318). The next significant support for this correction is now at 1.1229 (weekly long-term trend). Consolidation below can change the current balance of power in lower halves and serve to reduce the bears to the reference points of higher halves. The completion of the downward correction within the key supports of H1 and the exit from the correction zone (1.1384) will allow us to consider testing new upward benchmarks. Today's intraday is 1.1423 (R2) and 1.1462 (R3).