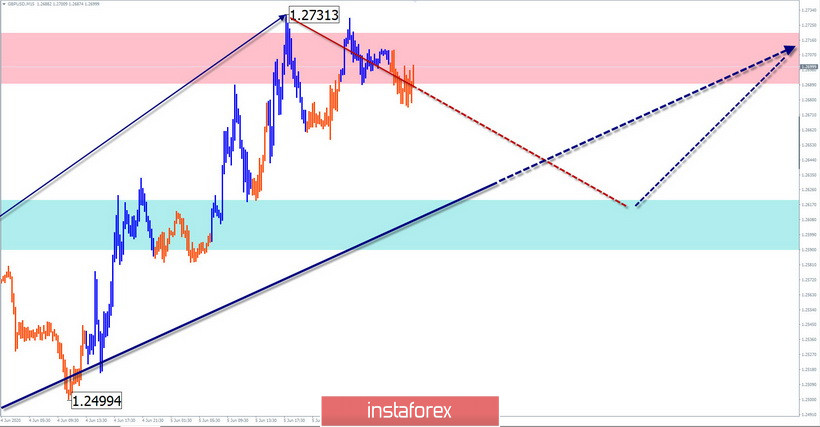

GBP/USD

Analysis:

Since mid-March, the formation of an upward wave continues on the chart of the British pound. The price has reached the lower limit of a strong potential reversal zone on a large scale and the wave structure is not complete today.

Forecast:

Today, the price is expected to move mainly in the lateral plane. The lower limit of the daily corridor is the estimated support. At the end of the day, the probability of a return to the bullish mood of the movement increases.

Potential reversal zones

Resistance:

- 1.2690/1.2720

Support:

- 1.2620/1.2590

Recommendations:

The safest tactic today is to refrain from trading the pound in the market until the upcoming pullback is complete. During the intra-session trading, short-term sales with a reduced lot are possible. In the area of the support zone, it is recommended to track purchase signals.

USD/JPY

Analysis:

The direction of movement of the major Japanese yen is set by an ascending wave. Since May 6, it completes a larger upward wave of the higher timeframe and the price has reached the lower limit of a strong resistance area.

Forecast:

Today, the most likely scenario for the pair's movement is to move in a side corridor, between the nearest oncoming zones. In the first half of the day, you can expect a downward rate. Then it is expected to return to the main rate from the support zone.

Potential reversal zones

Resistance:

- 109.70/110.00

Support:

- 109.10/108.80

Recommendations:

Trading on the pair's market today is only possible within the intraday style. It is better to focus on buying a tool. When selling, you should be careful and reduce the lot.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!