EUR / USD

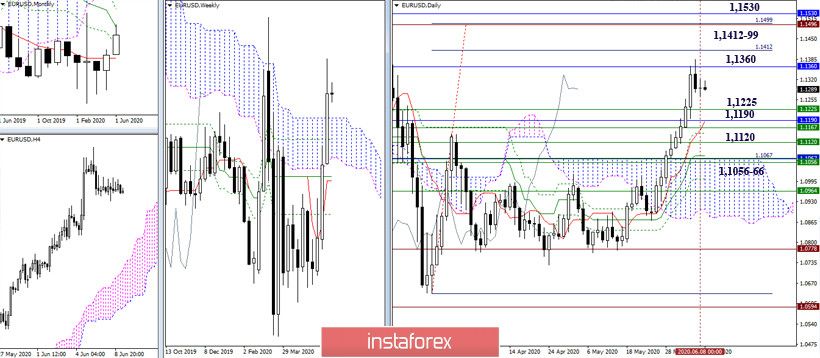

On the daily timeframe, the pair is currently in the correction zone, but the current decline has not yet received large-scale development. The previous levels indicated a fairly wide support zone, in which the most significant levels are 1.1225 (upper border of the weekly cloud) - 1.1190 (monthly Fibo Kijun + daily Tenkan) - 1.1120 (lower boundary of the weekly cloud) - 1.1056 -66 (weekly cross + monthly Tenkan + daily Kijun + upper border of the daily cloud). To exit the downward correction zone, players need to break through the resistance of the monthly medium-term trend (1.1360) to increase. Further, the upside target for the breakdown of the daily cloud (1.1412-99) and the final boundary of the monthly dead cross of Ichimoku (1.1530) will serve as the upward pivot points.

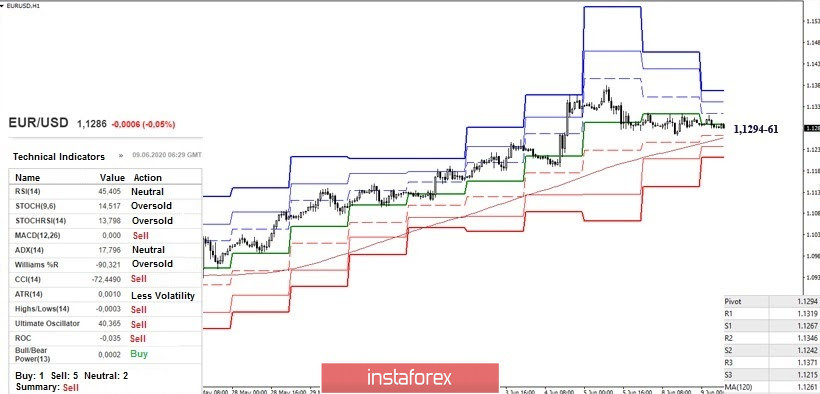

The correctional decline is developing quite slowly, however, the pair has already descended to the key support of the lower halves of 1.1294-61 (the Central Pivot level + the weekly long-term trend). A reliable consolidation will convey all the advantages to players to decline, who will focus on supporting higher halves in order to strengthen their moods. To restore the bullish prospects and opportunities, it is now advisable not to lose the key support of H1 (1.1294 - 61), and then update the correction maximum (1.1384), strengthened by the monthly medium-term trend (1.1360), firmly consolidating above.

GBP / USD

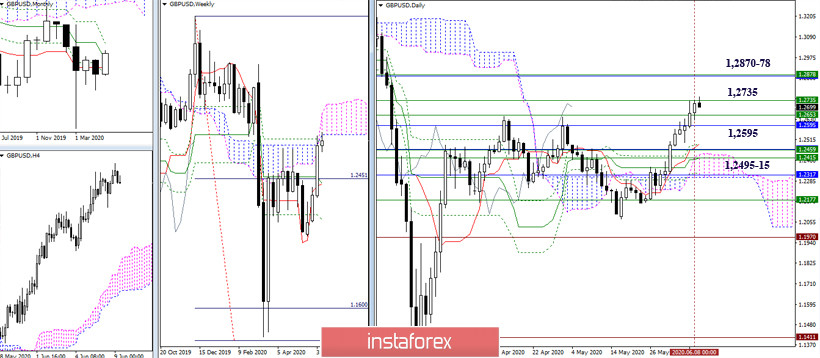

During the rise, the pound met a fairly wide and strong resistance zone. It climbed to its upper border slowly but surely, which is now forming the bottom of the weekly Ichimoku cloud (1.2735). As a result, the expectation of a correction still prevails. The levels 1.2653 (weekly Fibo Kijun) and 1.2595 (monthly Kijun) passed the day before can now slow down the development of a downward correction and work as support. The next bearish reference now is the accumulation of support in the region of 1.2495 - 15 (daily cross + daily cloud + weekly cross + monthly levels). In the case of breaking through 1.2735 and continuing the rise, the interest of players to increase will be directed to 1.2870-78 (the upper boundary of the weekly cloud + the final boundary of the monthly dead cross).

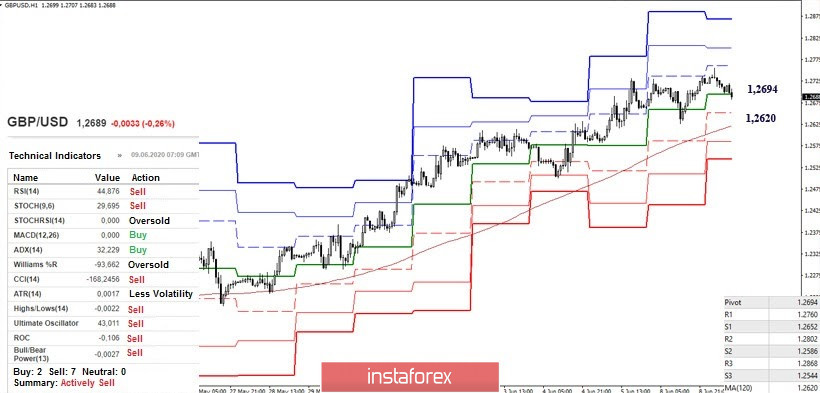

On the other hand, the bears, developing the correction, have already managed to enlist the support of most of the analyzed technical indicators. At the moment, they are trying to capture the first significant support of the lower halves – the Central pivot level (1.2694). If successful, their next target will be a weekly long-term trend (1.2620). Consolidating below can significantly affect the distribution of forces, giving preference to the further strengthening of bearish sentiment on H1.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)