If the single European currency behaved well and practically did not move, then the pound showed some independence, although nothing troublesome or scandalous was predicted. The macroeconomic calendar was completely empty, but this, of course, is not entirely true, but more on that later. On the other hand, riots on the streets of American cities are gradually disappearing. And the general informational background was quite calm and even. But, apparently, this is precisely what haunts the restless and determined British soul. So Britain confidently announced that negotiations with Japan over a new free trade agreement would begin on Tuesday. However, London has long been living on the principle that PR is more important than reality itself, so it was presented that an agreement with the Land of the Rising Sun will replace a missing trade agreement with Europe. Apparently, they realized that Brussels did not intend to make concessions in London, and began to look for some alternative options. However, they had to start looking for them on the same day as the results of the referendum became known. But the way London presents all this causes an exceptional laughter. Like, Europe rests and does not want to make concessions to us, so we will take and conclude a deal with Japan. So, with all due respect to Japan, with all the desire, it is unable to replace the loss of the European market. At least for the simple reason that the size of its economy is about four times smaller than that of the European Union. In addition, the Japanese economy is purely export-oriented and its internal problems are very similar to European ones, so Tokyo should rather look for ways to expand the export expansion of its companies, rather than let someone enter their territory. Moreover, even if London succeeds (by some miracle) in knocking out preferences for equity, in terms of access to the Japanese market, British companies are unlikely to succeed. Just look at the almost official slogan of the Japanese government, urging you to buy Japanese products, even if it is worse. So in Japan, those are still protectionist economic measures. In other words, London may end up in exactly the same situation as it is in terms of negotiations with Brussels. The main thing is loud advertising. It doesn't matter what it is. They just made a lot of noise. But it is worth admitting that the psychological effect has had its effect, at least some of the market participants. Apparently, those who do not know what Japanese economic policy is, and what the Japanese economy is. So the pound was able to grow a little. Soon, these traders will realize that London has nothing but words, and Boris Johnson is just leading them. That's when we'll see what happens to the pound.

However, we cannot say that there was no macroeconomic data at all yesterday. In Germany, data on industrial production were published, which showed an acceleration of its decline from a record 8.9% to an even more record 17.9% and this is the data for April. Let's just say that there has never been such a massive decline in industrial production since the reunification of Germany. From this, it follows a simple conclusion that the current economic downturn will be the most terrible for at least the last thirty years. Moreover, given that the rate of decline is only accelerating, it means that the decline in GDP in the second quarter may be much deeper than you could imagine.

Industrial production (Germany):

As for the recession itself and its depth, the third estimate of European GDP for the first quarter is published today So, if the previous assessment showed a change in the growth rate of 1.0% to a decline of 3.2%, then everything is a little worse this time. The rate of decline may reach as much as 3.3%. And this considering the fact that restrictive measures designed to curb the spread of the coronavirus pandemic began to be introduced only in mid-March. That is, at the very end of the first quarter. And the decline is very significant and this was only half a month. Of course, this clearly demonstrates that there were problems in the economy before that, and the coronavirus pandemic only accelerated and strengthened the onset of a full-fledged crisis. Nevertheless, just yesterday's data on the industry in Germany clearly suggests that the decline in the end will be incredibly deep. Most likely, in global terms, it may become the most terrible in the entire post-war period.

GDP growth rate (Europe):

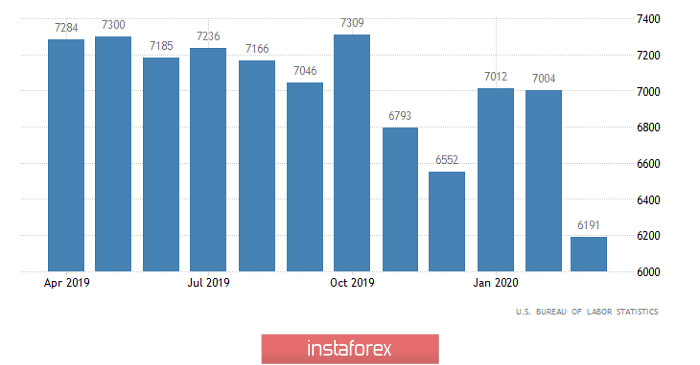

JOLTS data on open vacancies in the United States will also be published, which may show a decline from 6.2 million to 5.3 million. However, in light of the extremely mixed content of the report of the Department of Labor, the reaction to these data may be restrained and cautious. Indeed, it is completely unclear at the moment how to interpret the decline in the number of open vacancies due to the massive bankruptcies of various small companies or like the fact that people suddenly quickly found a new job, and because of this, employers are less and less in need of working hands. So there are a lot of questions.

Number of Job Openings JOLTS (United States):

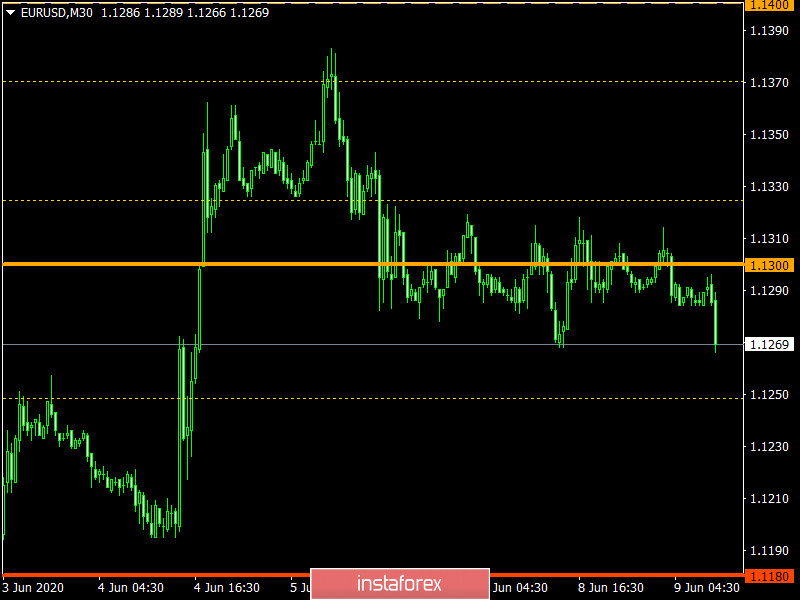

After a rapid inertial course, the EUR/USD currency pair found variable resistance in the region of 1.1380, where there was a slowdown and, as a fact, the initial pullback to the direction of 1.1270. Subsequent fluctuation was expressed in the accumulation process of 1.1270 / 1.1320. It can be assumed that if the price consolidates below the level of 1.1260, the downward mood will remain in the direction of the range 1.1200 - 1.1180.

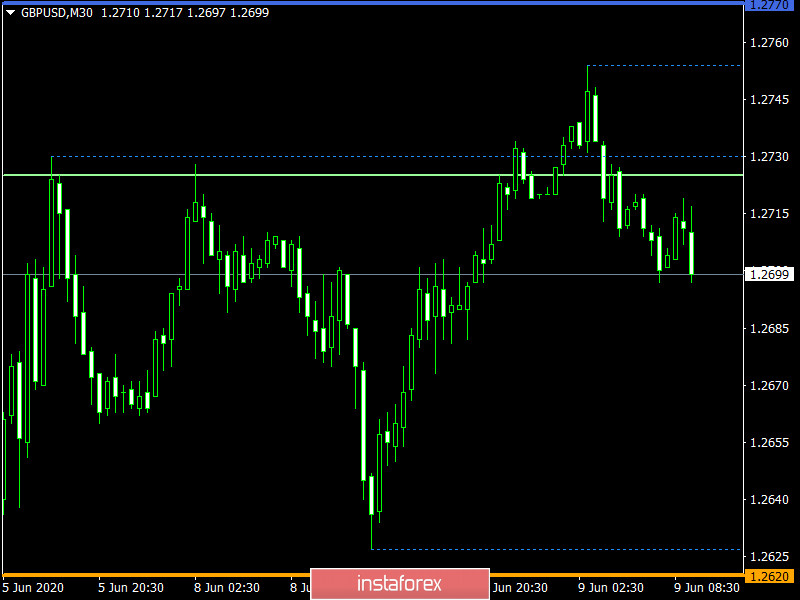

The GBP/USD currency pair managed to consolidate above the flat formation of 1.2150 // 1.2350 // 1.2620, focusing in the region of 1.2700. It can be assumed that focusing within the upper boundary of the previously passed flat will still remain on the market, with a variable fluctuation in the range of 1.2620 //1.2740.