The Australian dollar still reached its intermediate price peak: the level of 0.70 for many months served as a reliable support level: the bears permanently tried to go below this target for several months in the first half of last year, but returned each time. In the second half of 2019, the situation became mirror-like - the level of 0.7000 became a kind of price outpost, acting as a resistance level. The bulls of AUD/USD tried to attack the 70th figure more than ten times, but the price still fell under the "round" mark in the end. In other words, this target has a special, symbolic meaning for the indicated currency.

Against this background, it is not at all surprising that the AUD was unable to impulse to break through this level and consolidate in his own price area. The buyers of the AUD/USD pair have been trying to break through the level of 0.7000 since Friday, but it failed thrice. Now, external circumstances interfere: if the Australian dollar was forced to retreat due to strong Nonfarms at the end of last week, then the focus was on Australian-Chinese relations this week, which so far is disappointing.

It can be recalled that the conflict between Canberra and Beijing arose at the beginning of last month, when Australia called for an independent investigation into the causes of the spread of coronavirus. This proposal was supported by more than 120 countries. However, the Australian initiative was taken "with hostility" by the Chinese side. Beijing accused Australia of a "political attack" on the PRC, although neither China nor Wuhan was mentioned in the proposal for an investigation.

However, China was mentioned by the Americans: last month, a bill was introduced in the US Senate that allowed President Donald Trump to impose sanctions on China for refusing to cooperate in identifying the causes of the coronavirus pandemic. As a result, Beijing approved the investigation, but only after the pandemic. At the same time, relations between China and Australia remained strained, and this fact was reflected in trade relations. For example, China suspended imports of beef from Australia's four largest meat processing enterprises and sharply increased barley duties. In addition, the Chinese ambassador said Chinese consumers could boycott Australian products if Canberra continued to insist on an investigation.

The incident has not been used so far: just yesterday, Australian Minister of Commerce Simon Birmingham, who has been inviting China to negotiate trade frictions for several weeks, said Beijing was ignoring his requests. This statement by the Australian minister put pressure on the AUD/USD pair: The AUD was forced to leave the resistance level of 0.7000 once again, heading towards the middle of the 69th figure.

But, despite the "strategic retreat" of the AUD/USD bulls, purchases still have not lost their relevance, primarily in the context of the medium and long-term (as for the short-term, the opposite picture is here, but more on this later). The Aussie still hasn't developed its potential, especially against the backdrop of the opening of the Green continent economy and the expected growth of the Australian economy in the second half of the year.

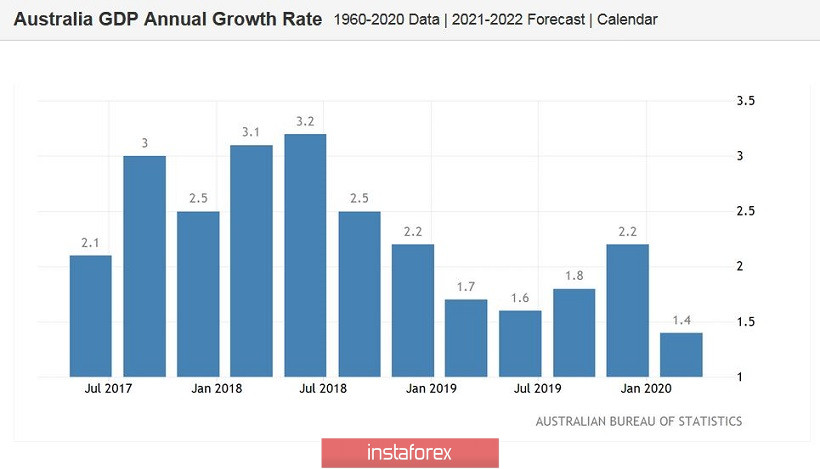

Let me remind you that according to the results of the June meeting of the RBA, the regulator was rather optimistic about the prospects for the recovery process. According to the head of the Central Bank, Philip Lowe, the "coronavirus strike" was weaker relative to earlier forecasts. The data published last week served as an additional confirmation of these words, despite the fact that they recorded a slowdown in GDP growth. Thus, the Australian economy in the first quarter slowed down to -0.3% in quarterly terms, while according to the general forecast, it was supposed to decline to -0.4%. On an annualized basis, the indicator came out at a predicted level, that is, at around 1.4%. Prior to this, the labor market and inflation indicators also appeared in the "green" zone.

All this suggests that the Australian economy will recover faster relative to earlier RBA forecasts. As for the Australia-China political conflict, it is believed that it will be temporary in view of the persistence of the Minister of Commerce of Australia to resolve it. Secondly, Beijing actually agreed to carry out the required investigation, so the parties do not have significant arguments to worsen the conflict.

The technical side of the issue is also on the upside. On the daily chart, the price is still between the middle and upper lines of the Bollinger Bands indicator, while the Ichimoku indicator still shows the bullish "Parade of Lines" signal. The goal of the upward movement in the medium-term is the "round" level of 0.7000. But to say that the pair has consolidated in the 70th figure will be possible only when the price breaks through the upper line of the Bollinger Bands indicator at D1, which corresponds to the level of 0.7050.

If we consider short-term prospects, then a further pullback inside the day to the base of the 69th figure is possible (that is, under the Bollinger Bands line on the 30-minute chart). However, in this case, any downward pullbacks should be used to open long positions to the above resistance level.