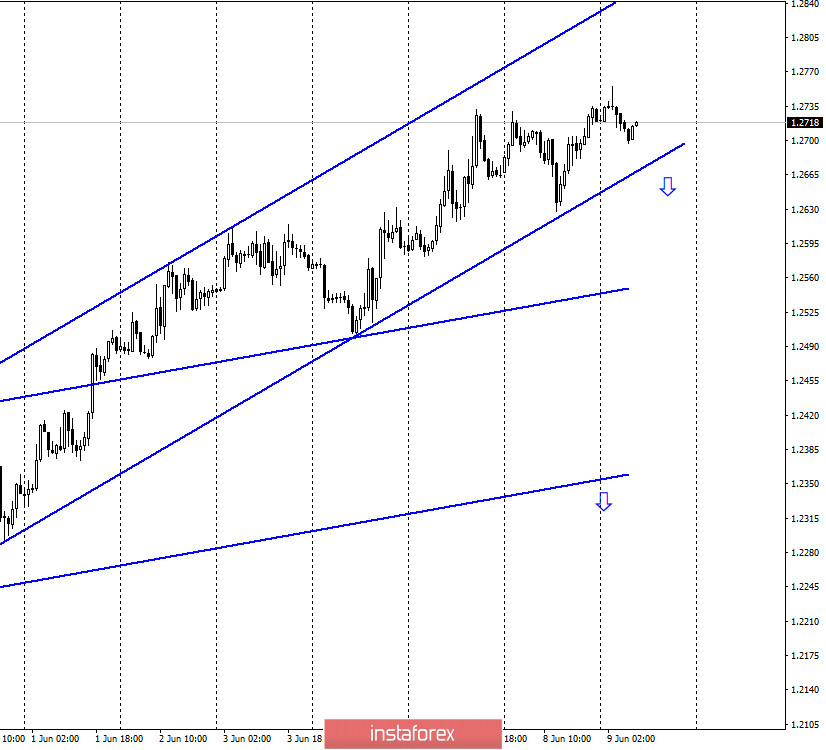

GBP/USD – 1H.

Hello, traders! As seen on the hourly chart, the pound/dollar pair continues to grow within the upward trend corridor. Thus, if the euro/dollar pair is going to leave this corridor, then the pound shows a serious desire to stay in it and continue growing. There was no important information from the UK on Monday. However, no important information has been received from the United Kingdom for a long time. The last thing you could pay attention to was another failure in the negotiations on the Brexit agreement. Now traders need to wait for the meeting of the head of the European Commission, Ursula von der Leyen, and British Prime Minister Boris Johnson. Perhaps they will be able to establish a negotiation process and come to something common. The Briton does not pay any attention to the failure in the negotiations between London and Brussels. Previously, traders were very much afraid of the uncertainty and foggy future of the UK. Now it seems that all this has become unimportant. There is not much news in America right now, most of it concerns Donald Trump, who in his usual manner continues to comment on everything that is happening in the country and in the world.

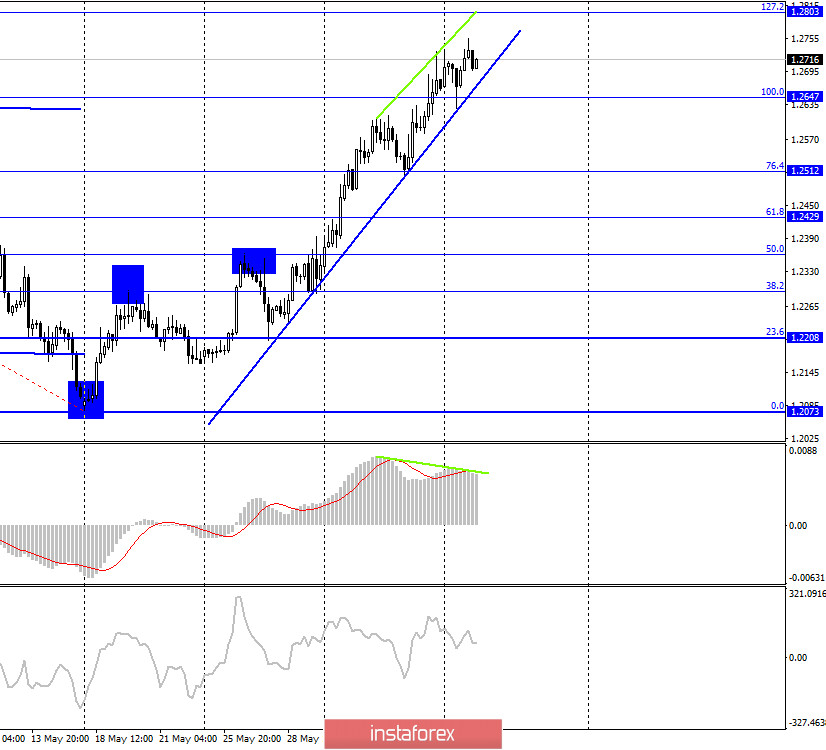

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair continues to grow in the direction of the corrective level of 127.2% (1.2803). The new upward trend line clearly shows the mood of traders – "bullish". The bearish divergence in the MACD indicator also continues to grow, which allows us to count on a reversal in favor of the US currency and a slight fall in the direction of the corrective level of 76.4% (1.2512).

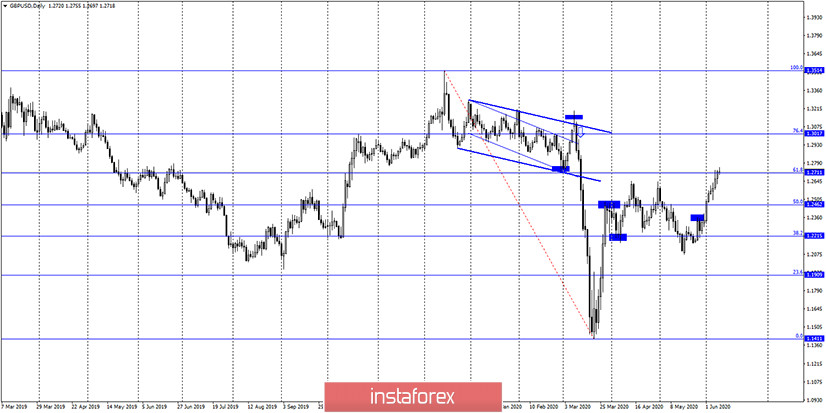

GBP/USD – Daily.

On the daily chart, the pair's quotes increased to the corrective level of 61.8% (1.2711). Thus, now traders need to understand whether there will be a rebound or a breakout of this level. In the first case, the fall will begin in the direction of the Fibo level of 50.0% (1.2462), in the second – the growth will continue in the direction of the corrective level of 76.4% (1.3017).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

There were no interesting economic reports or news in the UK and the US on Monday. Thus, the information background is currently absent, which does not prevent traders from continuing to buy the dollar.

The economic calendar for the US and the UK:

On June 9, the UK and America will again not have any important economic reports. Important news may come from the White House or the British government, but you can't be sure.

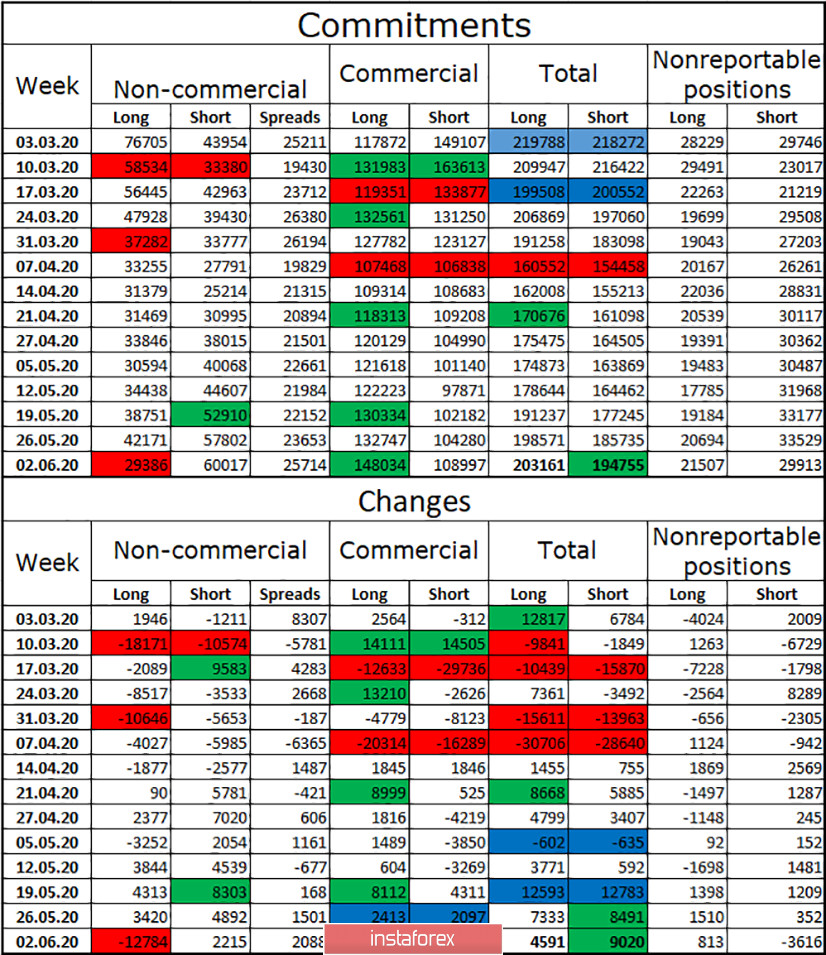

COT (Commitments of Traders) report:

Last Friday, a new COT report was released that showed a strong reduction in long-term contracts among the "Non-commercial" group. This means that major market players who earn money by changing the exchange rate got rid of purchases of the British during the reporting week. And yet it is the pound that has shown growth recently. Thus, the mood of major speculators does not coincide with the general mood of traders for the pound/dollar pair. It could be assumed that the total number of long contracts is the case, which could have grown significantly due to the "Commercial" or "Nonreportable" groups, but the total number of long contracts decreased during the reporting week. Thus, there was a paradoxical situation: traders sold the pound, but it eventually rose. Perhaps traders sold off the US dollar in even greater volumes?

Forecast for GBP/USD and recommendations to traders:

I recommend selling the British pound in the current conditions with the goals of 1.2512 and 1.2429 if the closing is performed under the trend line on the 4-hour chart and under the ascending corridor on the hourly chart. I recommend continuing to hold purchases of the pair with the goal of 1.2803 and the stop-loss level under the ascending corridor of the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.