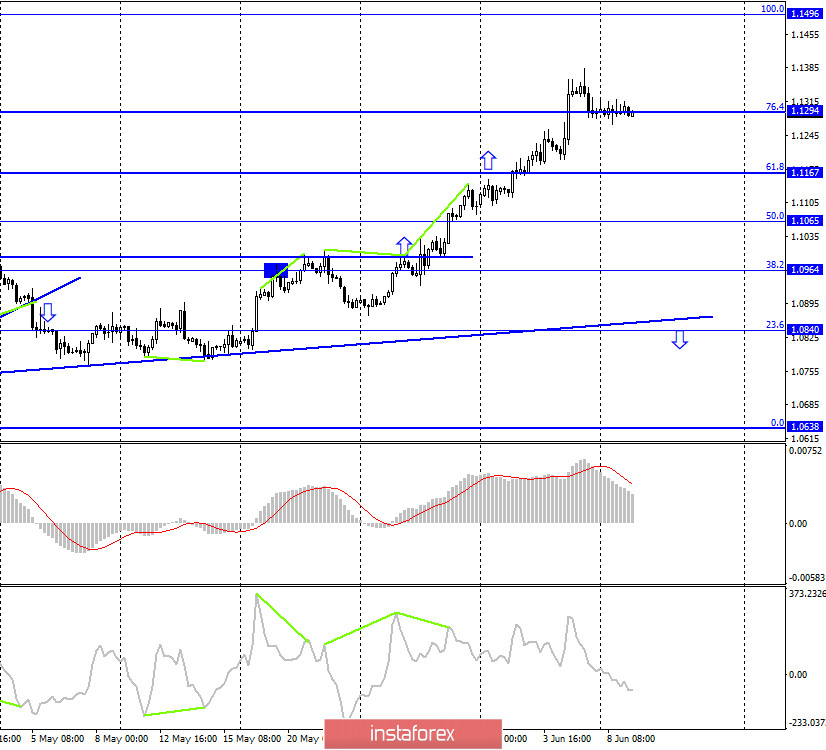

EUR/USD – 1H.

Hello, traders! The euro/dollar pair moved strictly sideways on the hourly chart on June 8, however, it still remained inside the upward trend corridor, which continues to define the current mood of traders as "bullish". Thus, the growth process of the pair can be resumed after the quotes rebound from the lower border of the trend corridor. There was no important news on Monday. No reports, no messages. The entire information background now revolves around expectations. Expectations of further actions by the Fed, expectations of further actions by China and the US in a personal confrontation, expectations of developments with large-scale rallies and protests in America. We cannot say that messages on these topics cause a strong reaction from traders every time. Last week, the euro currency just grew and did not pay attention to all the reports and news. Nevertheless, they still form a certain background that helps traders decide on a strategy. In the European Union, by the way, this week will also be a remarkable event – a meeting of the Eurogroup, which will again address the issue of financing the most problematic countries of the bloc. All previous attempts to agree on sources and amounts of funding have come to nothing.

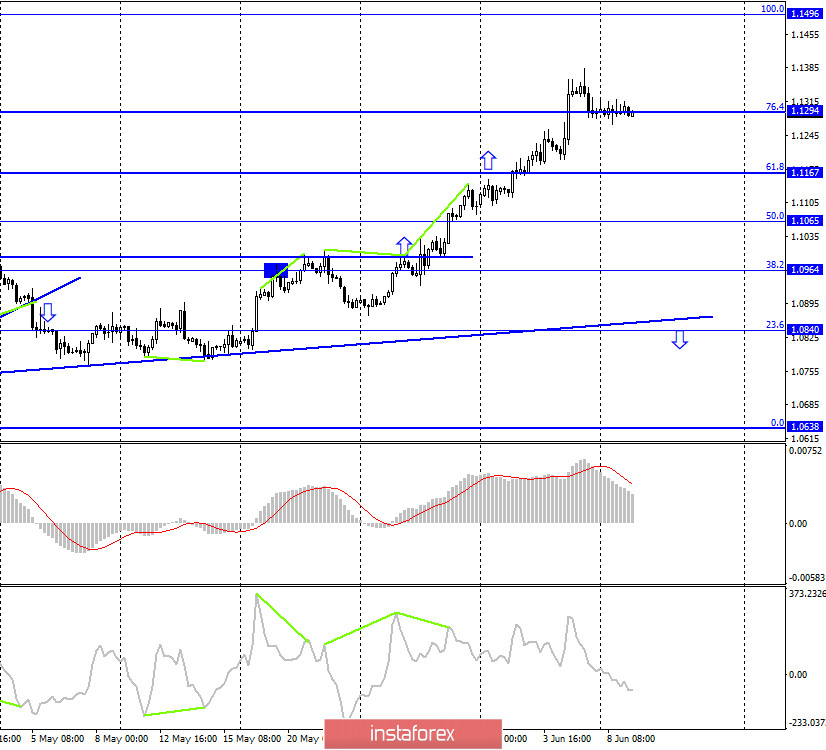

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair also performed a reversal in favor of the US dollar and returned to the corrective level of 76.4% (1.1294). There was no rebound of the pair's quotes from this level, however, there was no closing below it. Thus, it is recommended to look for the resumption of the growth process or its completion on the lower or senior chart. An upward trend corridor is the most suitable option for this. There are no pending divergences in any indicator.

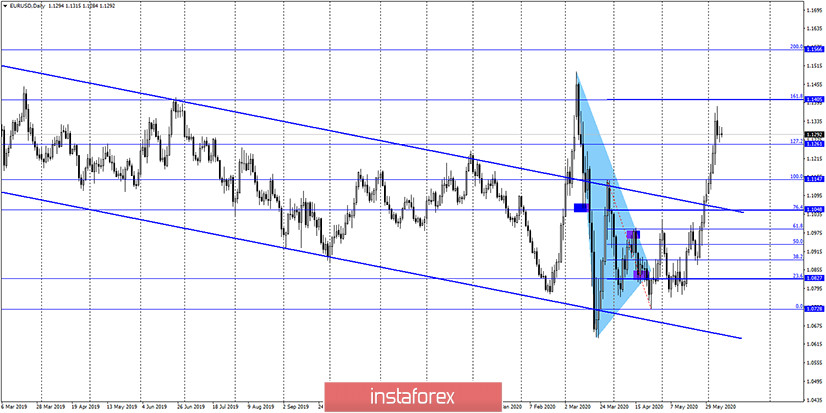

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation above the corrective level of 127.2% (1.1261). Therefore, the growth process can be continued towards the next level of 161.8% (1.1405).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). Given the growth of the euro currency in recent days, this goal can be "taken" in the next week.

Overview of fundamentals:

On June 8, there were no important reports and news in the European Union, as well as in America. Only the President of the European Central Bank, Christine Lagarde, spoke in the European Parliament but did not say anything new. She only stressed that by the end of 2020, the EU economy may lose about 8.7% of GDP, however, she already said this at the ECB meeting last week.

News calendar for the United States and the European Union:

EU - change in GDP (09:00 GMT).

On June 9, the calendar of events contains only the report on GDP in the Eurozone for the first quarter. The forecast is -3.8% compared to the previous quarter.

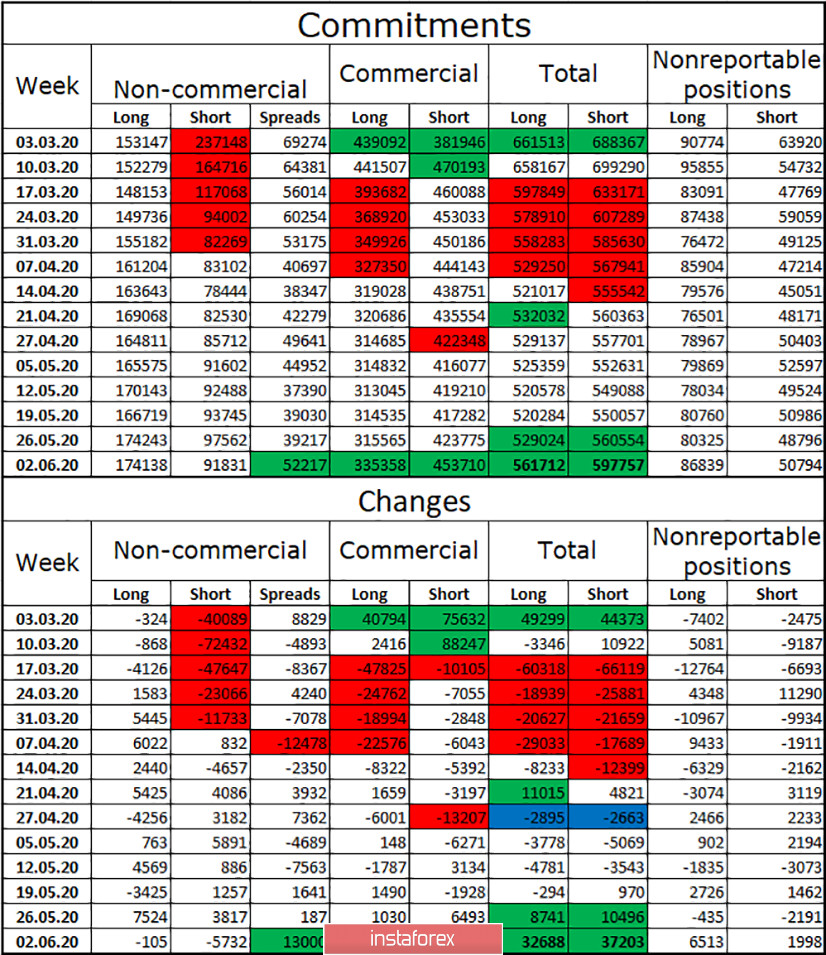

COT (Commitments of Traders) report:

Over the past week, the European currency has shown very strong growth, thus, traders reasonably expected a high increase in the number of long positions in general and in the "Non-commercial" group. However, in practice, it turned out the opposite. According to a new report from COT, a group of speculators strenuously got rid of short-contracts during the reporting week, which led to exactly the same effect as the build-up of long-contracts. Thus, the difference between the number of long and short contracts in the hands of major speculators for the reporting week has increased, which is perfectly compared with what is happening in the currency market. I also note the increased activity of major players, as the total number of open contracts increased in 1 week by as much as 70 thousand.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1167, if the upward corridor is fixed on the hourly chart. I recommend opening new purchases of the pair with the goal of 1.1496 in case of a rebound from the lower border of the same corridor. However, you should be careful! If the outright sideways movement continues today, all the signals will be false.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.