To open long positions on GBPUSD, you need:

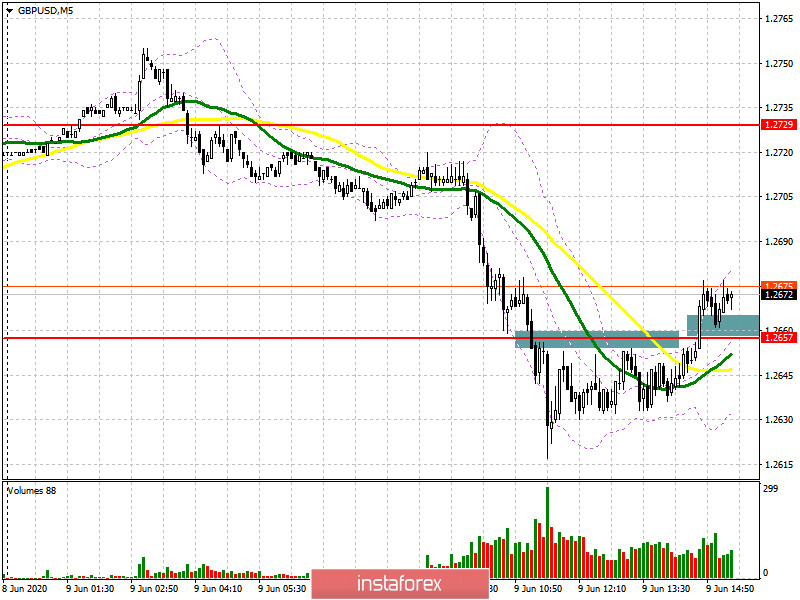

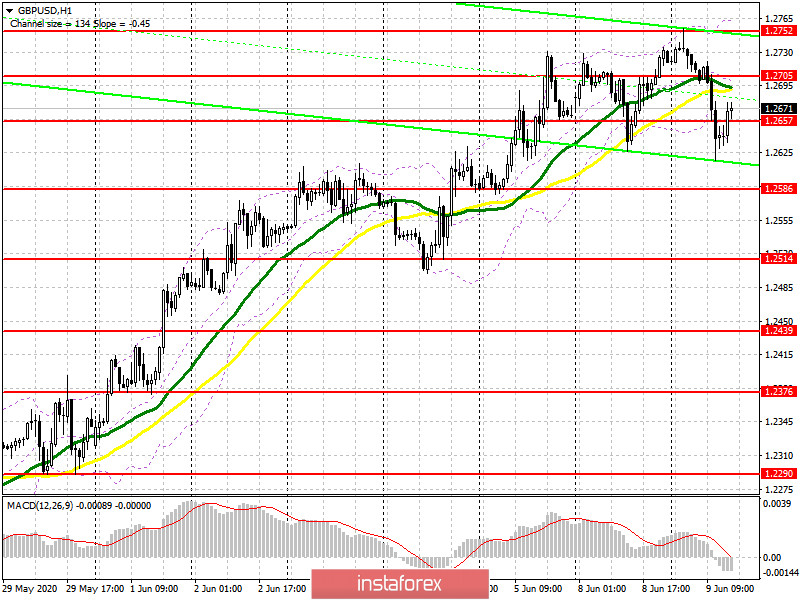

The pound's downward movement in the first half of the day seemed to allow the bears to take control of the market, however, there was no support from the big bears again, which may lead to a repeat of yesterday's scenario. If you look at the 5-minute chart, you will see how the bears fixed below the level of 1.2657 and tried to sell the pound several times, although to no avail. However, already now, closer to the North American session, buyers are trying to regain the level of 1.2657, and if they succeed, a clear buy signal may lead to a repeat of the situation of yesterday. As long as the trade is above the area of 1.2657, the demand for the pound will continue, and the bulls will expect to return to the area of the intermediate resistance of 1.2705. Only a break of this level will allow you to update this week's highs in the area of 1.2752, where I recommend fixing the profits. If the pressure on GBP/USD returns after the publication of macroeconomic statistics for the US, it is best to consider new long positions for a rebound from the larger minimum of 1.2586 or even purchases of the pound for a rebound from the support of 1.2514 in the expectation of correction of 30-40 points by the end of the day.

To open short positions on GBPUSD, you need:

If you remember my morning forecast, I paid attention to the reports that recorded a sharp reduction in long positions on the pound. During the reporting week, short non-commercial positions increased from the level of 61,449 to the level of 63,014, while long non-commercial positions decreased sharply from the level of 39,192 to the level of 26,970. As a result, the non-commercial net position turned even more negative and ended up at -36,044, against -22,257, which indicates a slowdown in short-term bullish momentum and the likely formation of a major downward correction by the middle of this month. Today's attempt of the bears to hold the area of 1.2657 did not lead to the continuation of the pair's downward correction movement. Now sellers are required to protect the resistance of 1.2705, the formation of a false breakout on which will be a signal to open short positions. Also, the bears can regain control of the level of 1.2657, which will increase pressure on the pair in the second half of the day and lead to its further decline to the support area of 1.2586. A longer-term goal will be a minimum of 1.2514, where I recommend fixing the profits. If the bulls cope with the task and achieve a breakout of the resistance of 1.2705, the last hope for sellers to build a downward correction will be this week's maximum in the area of 1.2752, from where you can open short positions immediately for a rebound.

Signals of indicators:

Moving averages

Trading is below the 30 and 50 daily averages, which indicates another attempt by bears to resume a downward correction.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Growth will be limited by the upper level of the indicator around 1.2755. A break in the lower border at 1.2650 will increase the pressure on the pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20