The USD index soared yesterday, almost reaching the borders of the 97th figure. The demand for the currency arose, due to a sharp decline in the stock market, in which all three key indices, the Dow Jones, S&P and NASDAQ, showed terrible figures yesterday. Towards the end of the American session on Thursday, the Dow Jones index fell by 6.9% (to 25128.17 points), while the NASDAQ index dropped by 5.27% (up to 9692.43 points). The S&P 500 index, meanwhile, decreased by 5.89% (up to 3002.10 points). Explaining the cause of such contractions are a bit difficult since the fundamental factors are contradicting each other: on the one hand, concerns about a second wave of coronavirus in the US has returned to the market; on the other, top officials of the state have promptly reassured the public that a repeated outbreak will not occur, and promised that the country's economy will not be closed again.

Nevertheless, investors succumbed to panic and uncertainty, provoking a domino effect. The stock market went down, and the safe dollar, on the contrary, went up, reflecting general sentiment in the foreign exchange market. In addition, the dollar was supported by the statements of US Treasury Secretary Steven Mnuchin yesterday, who announced a new package of financial assistance from the state.

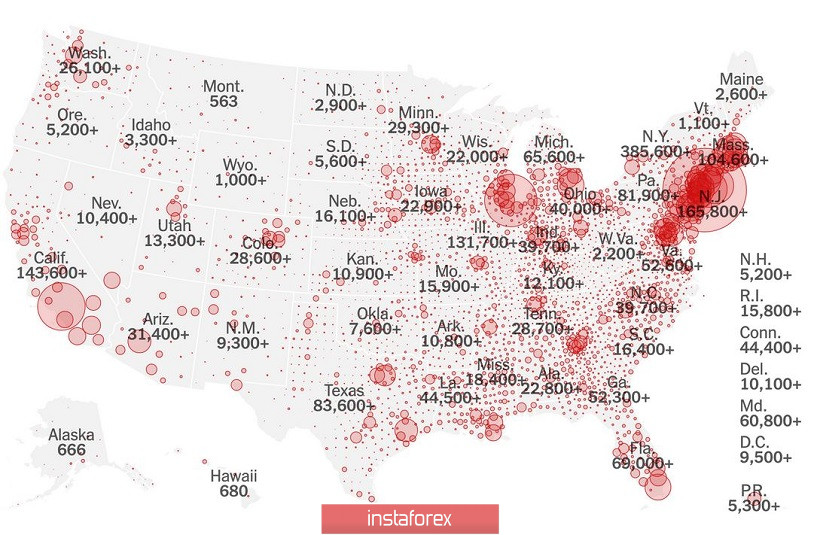

The growth of the dollar is somewhat unreasonable in my opinion. To be more precise, the factors that pushed the dollar quotes up look very unsteady, and in some cases, are clearly strained. The demand for safe-haven assets was due to concerns about a second wave of coronavirus in the US, which were associated with the fact that the number of infected in the country has already exceeded two-million. Moreover, the daily increase increased to 21 thousand new cases. Such figures are very alarming, but if we compare them with the indicators of the previous month, we will see that the daily increase back then was 25-30 thousand. Thus, assuming that a second wave will occur is quite wrong, at least from a mathematical point of view. The direct cause of such panic was the increasing number of infections in Texas and California, where huge jumps in the number of cases were recorded. However, the overall situation across the country remains "even", as coronavirus cases in 30 states have either remained the same or decreased, while in 20 states have increased.

With regards to the coronavirus situation in Texas and California, the increase in the number of infections has unnerved the markets, specifically the stock market. Shares of airlines, non-food retailers and cruise operators have plummeted, even though the demand for these sectors have increased over the past few weeks. The decline increased interest in traditional protective instruments, as well as on treasuries and demand for the US dollar.

The market once again focused on the increase of coronavirus cases in the United States, but if in the near future the growth does not come out of the general track of the previous statistics, this fundamental factor will quickly come to naught. The market is clearly ahead of the curve by making hasty conclusions based on local Covid-19 outbreaks in two states. In addition, US Vice President Mike Pence said that the recent protests in the US did not provoke a second wave of the pandemic, and if the statistics of the coming days confirm these, the dollar will lose another trump card for its growth.

As for the EUR/USD pair, the situation, by and large, has not changed. The quotes have still undergone a downward correction, but on the daily chart is still between the middle and upper lines of the Bollinger Bands indicator, as well as above all the lines of the Ichimoku indicator, which still shows a bullish signal. This suggests that the pair still has a bullish mood, and may go up at least to the first resistance level at 1.1450 (the upper line of the Bollinger Bands on the D1 chart).