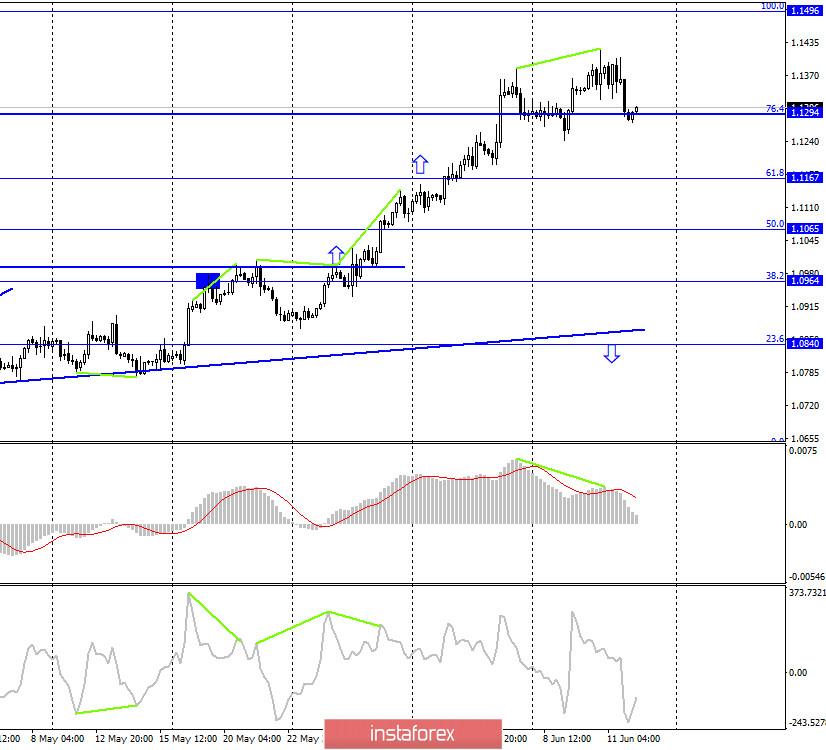

EUR/USD – 1H.

Hello, traders! On June 11, the euro/dollar pair performed another reversal in favor of the US currency on the hourly chart and another close under the upward trend corridor. Thus, there are again certain reasons to expect a change in the mood of traders to "bearish". However, the pair updated the previous local peak and did not update the previous local low. Thus, yesterday's drop in quotes may be just a pullback. Yesterday in terms of information background was again more boring than ever. For traders now, there are only general topics that are quite interesting but do not have a particularly strong impact on their mood. There were no economic reports in the European Union and the US yesterday. The main topic now is counting the political ratings of Donald Trump and Joseph Biden, preparing for the election campaigns of all candidates, since the presidential elections will be held this fall. And Trump is still losing out on popular support. There is no new information about the confrontation between China and America.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair, after the formation of a bearish divergence in the MACD indicator, performed a reversal in favor of the US dollar and fell to the corrective level of 76.4% (1.1294). However, it was not possible to perform pinning under this level. Thus, the rebound of the pair's exchange rate on June 12 from this Fibo level will work in favor of the European currency and resume growth in the direction of the corrective level of 100.0% (1.1496). Fixing at 1.1294 on the second attempt will increase the chances of a further fall towards the next corrective level of 61.8% (1.1167).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair rebounded from the corrective level of 161.8% (1.1405). Thus, traders can expect a fall to the Fibo level of 127.2% (1.1261).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). Given the growth of the euro currency in recent days, this goal can be "taken" in the next week.

Overview of fundamentals:

On June 11, there were no interesting news or economic reports in the European Union. In America, a report on applications for unemployment benefits was released, which did not particularly interest traders.

News calendar for the United States and the European Union:

EU - change in industrial production (09:00 GMT).

US - consumer sentiment index from the University of Michigan (14:00 GMT).

On June 12, the news calendar in the United States and the European Union is almost empty again. The report on industrial production in the EU, although predicting a serious reduction, is unlikely to affect the movement of the pair. The same applies to the American report.

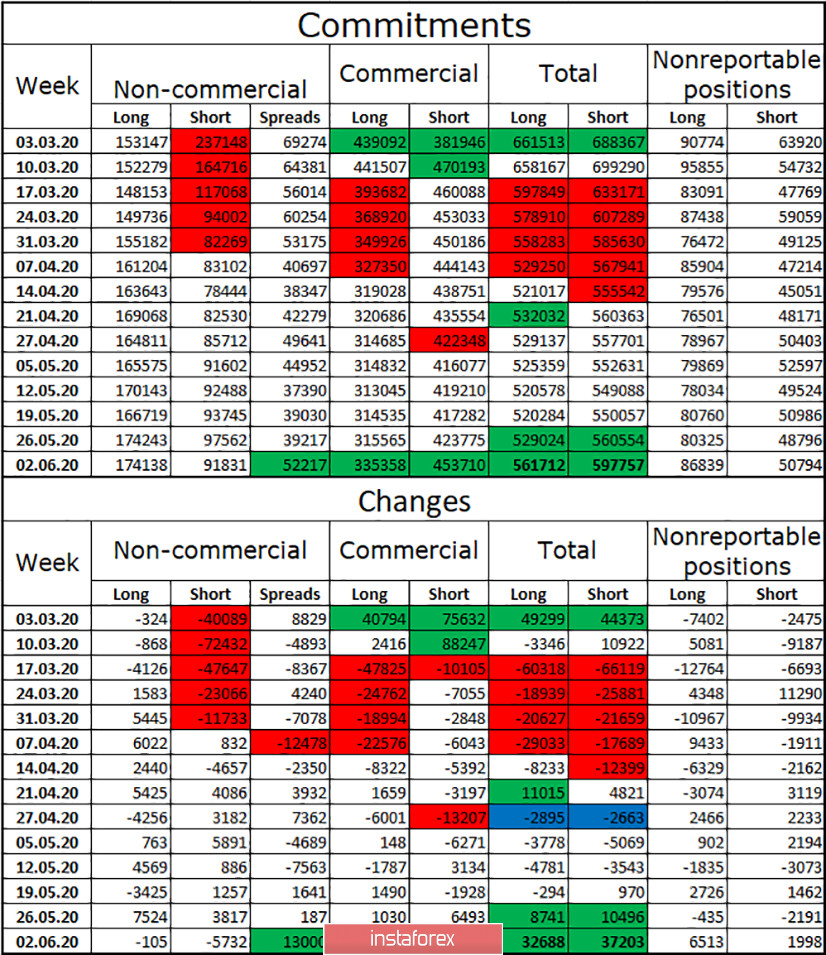

COT (Commitments of Traders) report:

Over the past week, the European currency has shown very strong growth, so traders reasonably expected a high increase in the number of long positions in general and in the "Non-commercial" group. However, in practice, it turned out the opposite. According to a new COT report, a group of speculators strenuously got rid of short-contracts during the reporting week, which led to exactly the same effect as the build-up of long-contracts. Thus, the difference between the number of long and short contracts in the hands of large speculators for the reporting week has increased, which is perfectly compared with what is happening in the currency market. I also note the increased activity of major players, as the total number of open contracts increased in 1 week by as much as 70 thousand. This week, the situation does not change at all, the euro currency is still in demand.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1167, if the close is made under the level of 1.1294 on the 4-hour chart. I recommend opening new purchases of the pair with the goal of 1.1405, if the rebound from the corrective level of 76.4% is made on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.