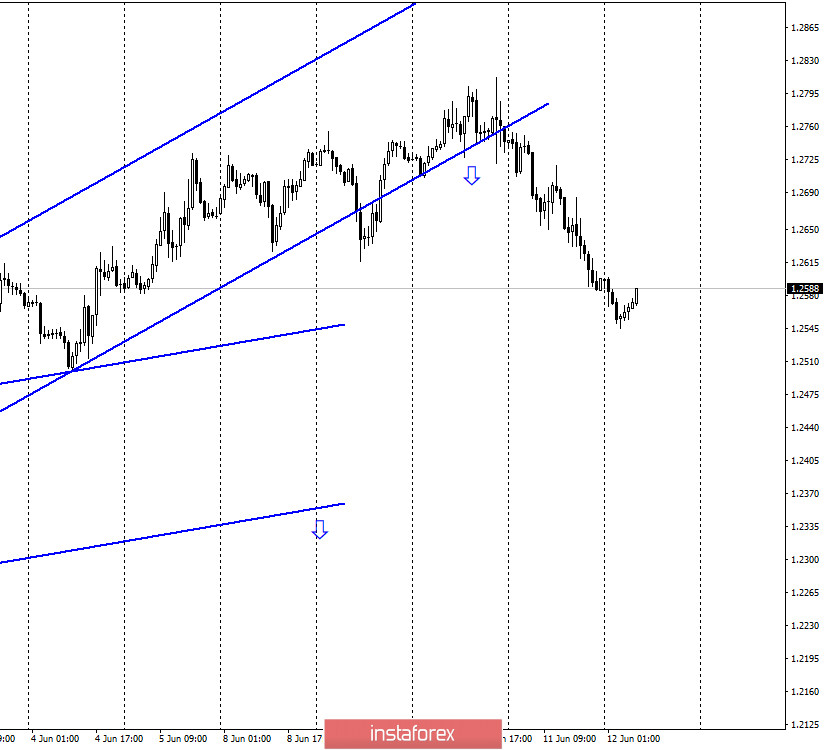

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues the process of falling after it closed for the second time under the upward trend corridor. Thus, the mood of traders still changed to "bearish" and the information background has nothing to do with this. If only because yesterday there was no background in either the US or the UK. There had been no interesting news from Britain for a long time. Boris Johnson is silent and all the news about the progress of negotiations with the European Union is reduced to another failure. There are no economic statistics. Only today, a few reports will dilute the boring routine of the British. In America, the situation is just as bleak. Topics that made traders actively trade a week ago are now forgotten and no one is interested in them. Well, the pound/dollar pair itself moves absolutely out of all correspondence with the information background.

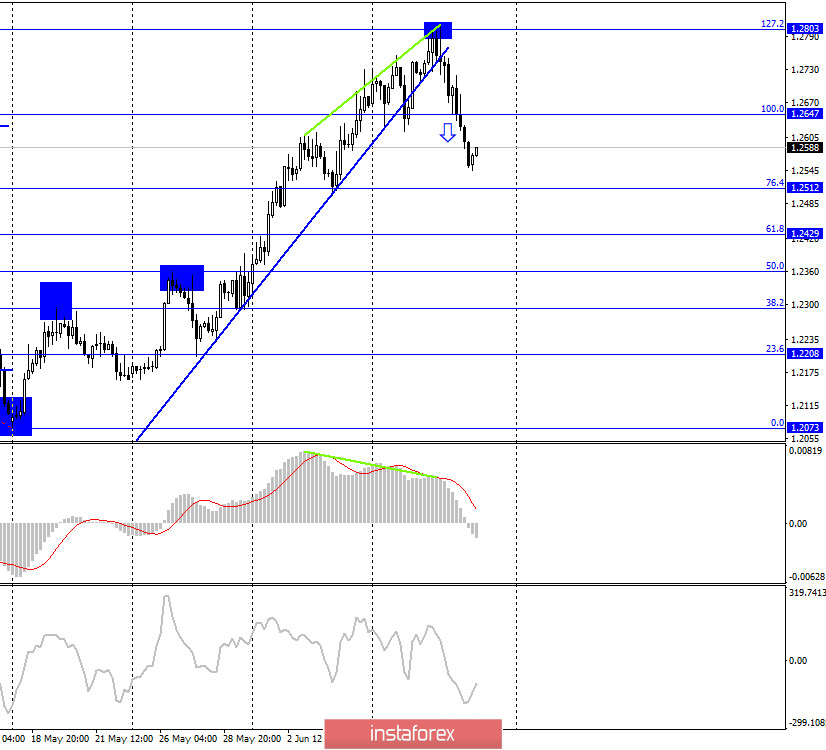

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair, after fixing under the Fibo level of 100.0% (1.2647), continues the process of falling in the direction of the next corrective level of 76.4% (1.2512). The rebound of quotes from the corrective level of 76.4% will allow traders to expect a reversal in favor of the British dollar and a resumption of growth in the direction of the level of 1.2647. Closing the pair's rate at 1.2512 will significantly increase the chances of continuing the fall, and a new grid of Fibo levels will be built. New emerging divergences are not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes made a consolidation under the corrective level of 61.8% (1.2711), which now allows us to count on a further fall. The sales signal on the 4-hour chart (rebound from the level of 1.2803) was stronger.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

There were again no interesting economic reports or news in the UK on Thursday. In America, there was one report on applications for unemployment benefits, which did not affect the mood of traders.

The economic calendar for the US and the UK:

UK - change in GDP (06:00 GMT).

UK - change in industrial production (06:00 GMT).

On June 12, the UK released reports on GDP (-20.4% in April) and industrial production (-19.3% y/y in April). It is easy to guess that such figures could not cause new purchases of the British.

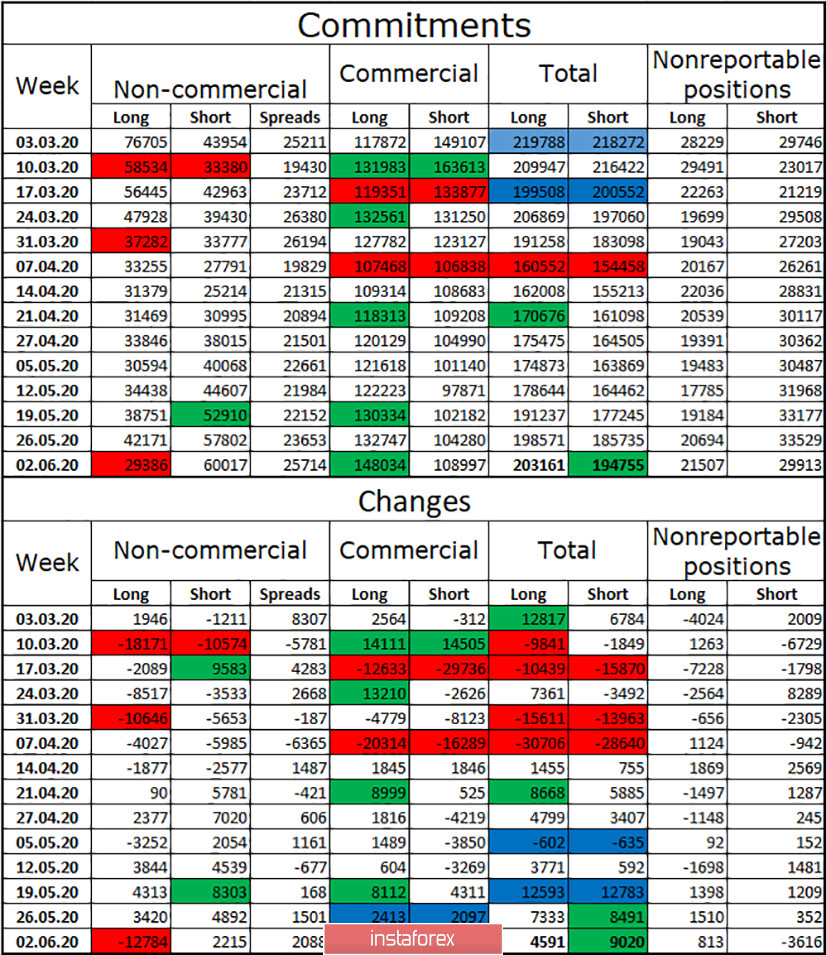

COT (Commitments of Traders) report:

Last Friday, a new COT report was released that showed a strong reduction in long-term contracts among the "Non-commercial" group. This means that major market players who earn money by changing the exchange rate got rid of purchases of the British during the reporting week. And yet it is the pound who has shown growth recently. Thus, the mood of major speculators does not coincide with the general mood of traders for the pound/dollar pair. It could be assumed that the total number of long contracts is the case, which could have grown significantly due to the "Commercial" or "Non-reportable" groups, but the total number of long contracts decreased during the reporting week. Thus, there was a paradoxical situation: traders sold the pound, but it eventually rose. Perhaps traders sold off the US dollar in even greater volumes? For most of the current week, the British dollar also grew and the fall began only at the end of the week. However, the last days of the week will not be included in the COT report.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with a target of 1.2512, as it was fixed below the level of 100.0% on the 4-hour chart. I recommend opening new purchases of the pair with the goal of 1.2803 while fixing above the level of 1.2647.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.