Good day, dear traders!

During the last trading week, the GBP/USD currency pair ended with a decline, losing 0.67%. In this article, the main attention will be paid to technical nuances, and we will start considering the charts with the results of the past five days.

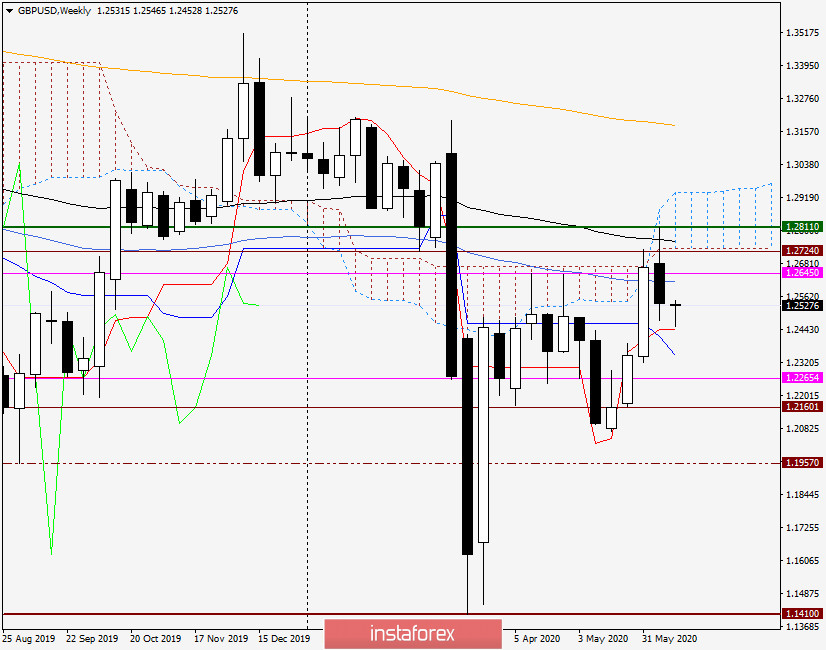

Weekly

As we can see, the pound bulls were determined to extend the three-week upward series, and at first, everything was fine. The pair rewrote the previous highs of 1.2730 and tested a strong technical level of 1.2800 for a break. However, after reaching 1.2811, the exchange rate turned to decline. On the technical side, this development was influenced by the 50 simple moving average, the cloud of the Ichimoku Indicator, and the 89 exponential moving average. These indicators, which are quite significant for the price, became the technical basis for its downward turn.

The candle, which appeared at the end of trading on June 8-12, can be described as a "shooting star". Now, in order for the "British" bulls to have a chance to continue the rate rise again, they must necessarily absorb the previous candle growth, and together with its long upper shadow. This means the closure of the weekly candle above 1.2811. Given all these resistances, the task is not easy.

However, it is not an easy task for bears to continue the downward scenario. They need to go down the Tenkan and Kijun lines of the Ichimoku indicator, with the mandatory fixing under them.

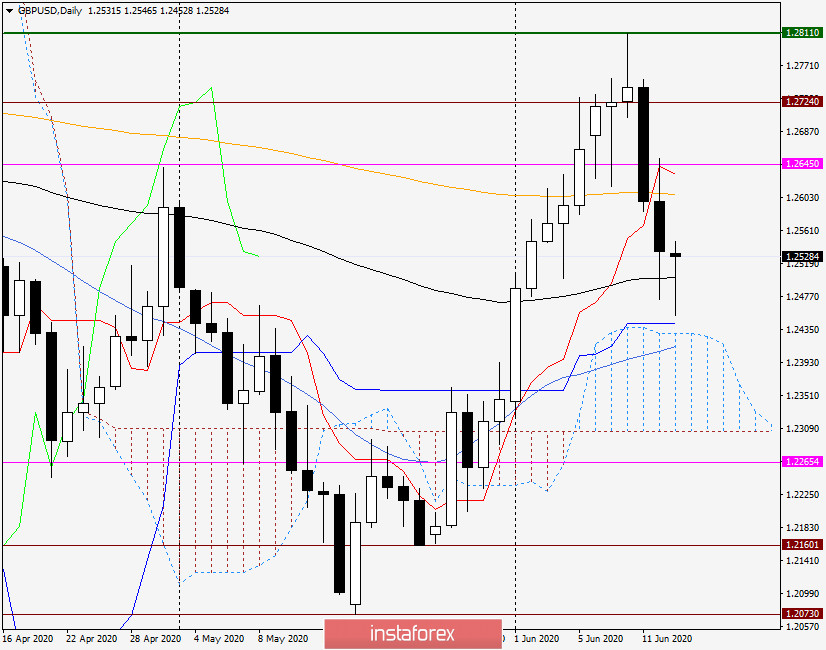

Daily

On the daily chart, you can note the reversal candle model "Tombstone" for June 10. It was after the formation of this candle that a strong fall in the British currency occurred.

Strong support is provided by the exponential moving average, which holds the course, sending it up every now and then. So at the time of writing, the pound was already falling to 1.2453 but then began to actively recover losses incurred earlier.

Currently, the GBP/USD is trading near the opening price of today's trading 1.2531. If the bulls have enough strength to continue the rise of the quote, the next target will be the important level of 1.2600, near which there is 200 EMA. The price zone of 1.2632-1.2652 is seen as the further goal of buyers.

If we consider the downward scenario, which is still a little more priority, the bears' targets for the pound will be the price area of 1.2440-1.2430, where the Kijun line is located and the upper border of the Ichimoku cloud passes. If the price goes into the cloud and gets fixed in it, the bearish sentiment for the pound will increase and the pair will be under even more selling pressure.

Since the situation is not completely clear, I will indicate trading recommendations in both directions. Buying aggressively and risky can be tried from the current prices (1.2538) with the nearest goal in the area of 1.2600-1.2640. Here, when the reversal candle models appear, you should think about opening short positions on the pound/dollar pair. Tomorrow we will return to the consideration of charts for GBP/USD and adjust (if necessary) trading ideas. In conclusion, I would like to draw your attention to the fact that the main event for the British pound this week will be the decision of the Bank of England on the main interest rate. This is also discussed in more detail in the following articles.

Have a nice day!