After the fall of the British pound at the end of the second week of June, there could be a feeling that investors have returned to reason. The serious damage of COVID-19 to the economy of the Foggy Albion and the impasse in the Brexit negotiations indicated that the GBP/USD pair should trade significantly lower. London has officially announced that it will not extend the transition period after December 31. British companies need to prepare for duties and checks at the border. Severing economic ties with the main trading partner will worsen the situation of an already poorly performing economy. In this regard, the growth of sterling to $ 1.28 looked like an anomaly. Does everything really fall into place or is there something we don't know?

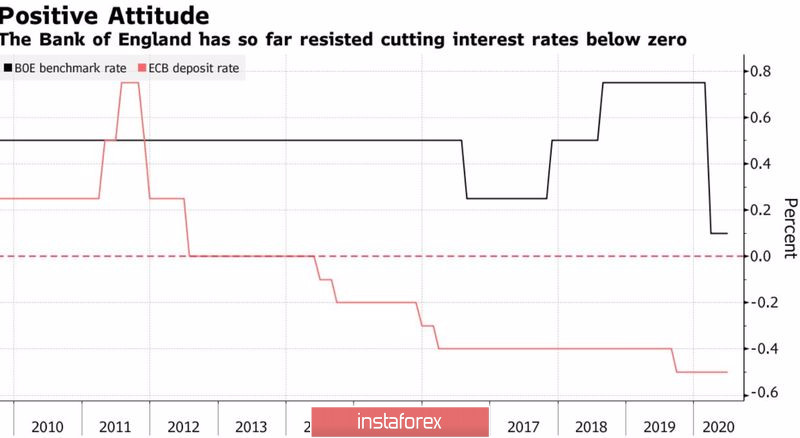

In February-April, the GDP of the Foggy Albion sank by 25.1%, which is three and a half times more than in the worst quarter of the previous global economic crisis in 2007-2009. April was absolutely the worst month in the history of accounting, the decline in its results exceeded the previous one, which took place in June 2002, an anti-record of 9 times. The weakness of the economy strengthens rumors about the introduction of negative interest rates by the Bank of England, following the example of the ECB. According to UBS Wealth Management, there is almost no chance of such an outcome at the BoE's June meeting, however, they will gradually grow. RBC Capital Markets believes that Andrew Bailey and his colleagues will lower borrowing costs below zero in November.

Dynamics of Bank of England and ECB rates

Instead of lowering rates, the Bank of England is likely to expand British QE by £100 billion, bringing the overall scale of the quantitative easing program to £745 billion. Nomura believes that it will be an additional £150 billion. Theoretically, an increase in asset purchases is a bearish factor for the national currency, but in a recession, we can expect a reverse reaction from the markets. Just remember how recently the EUR/USD pair was marked by a rapid rally in response to the expansion of European QE by €600 billion. Additional monetary stimulus during a pandemic is perceived as a good thing, it helps to smooth the decline. If at the same time retail sales in May show rapid growth, the "bulls" for GBP/USD will be able to correct the staggered positions.

In my opinion, the pound currently behaves as a risky asset. It is sensitive to the dynamics of the US stock market, and the contribution of the S&P 500 correction to the collapse of the analyzed pair at the end of the second week of June is more significant than London's reluctance to prolong the transition period or weak statistics on the GDP of the Foggy Albion. Investors are tired of the uncertainty, and the fact that Boris Johnson has limited the terms of negotiations to 6 months, allowed them to breathe a sigh of relief.

In my opinion, the pullback of the US stock indices will be short-lived, which allows us to adhere to the previous strategy of forming and increasing long positions for GBP/USD on declines. Longs that are open from the level of 1.2485 should be held.

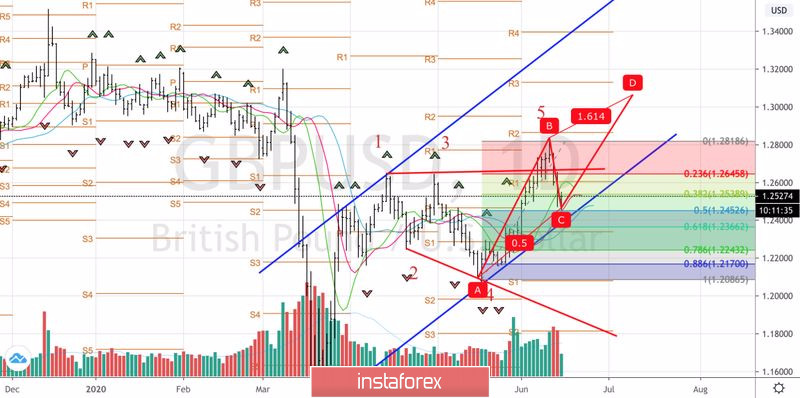

Technically, the "Expanding Wedge" pattern is relevant to the daily chart of the pair. The implementation of this will most likely lead to the continuation of the rally.

GBP/USD, the daily chart