To open long positions on GBPUSD, you need:

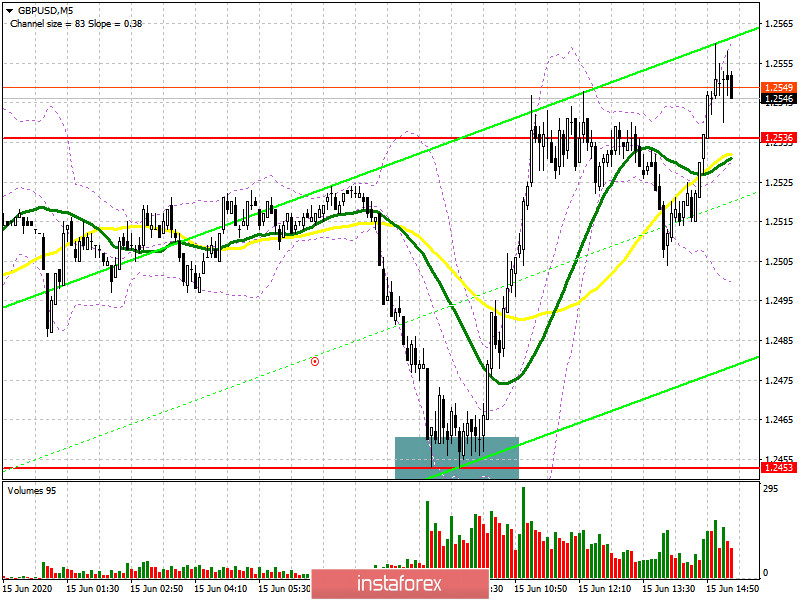

In the first half of the day, I paid attention to the probability of purchases around the support level of 1.2453, which happened. If you look closely at the 5-minute chart, you will see how the pressure on the pound has sharply decreased in the area of 1.2453, and how unsuccessful tests have led to the closing of a number of short positions by large players and to a quick upward correction of the pound to the opening area of the day. Now, the bulls are fighting for the resistance of 1.2536. Fixing above this level will be an additional signal to open long positions in the expectation of continuing the upward trend to the maximum area of 1.2620, where I recommend fixing the profits. However, to do this, you still need to deal with the moving averages. In the scenario of a return of GBP/USD back to the level of 1.2536 in the afternoon, it is best to postpone long positions to the test of the minimum of 1.2453 or buy immediately on the rebound from the larger support of 1.2376 in the calculation of correction of 30-40 points within the day.

To open short positions on GBPUSD, you need:

Sellers are not in a hurry to return to the market after the morning attempt to break below the support of 1.2453. At the moment, the key task is to protect the resistance of 1.2536 and return the pair to this level, which will be a new signal to open short positions in the pound with a repeated attempt to reduce and break the minimum of 1.2453. The longer-term goal of sellers remains the area of 1.2376, where I recommend fixing the profits. If the bulls manage to form an upward correction on the background of news on trade negotiations between Prime Minister Boris Johnson and EU representatives, it is best to return to short positions on the rebound from the resistance of 1.2620 in the expectation of correction of 30-40 points by the close of the day.

Signals of indicators:

Moving averages

Trading is below the 30 and 50 daily averages, which indicates that the pressure is still there.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

Breaking the upper limit of the indicator in the area of 1.2430 may lead to a new wave of growth of the British pound.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20