To open long positions on EURUSD, you need:

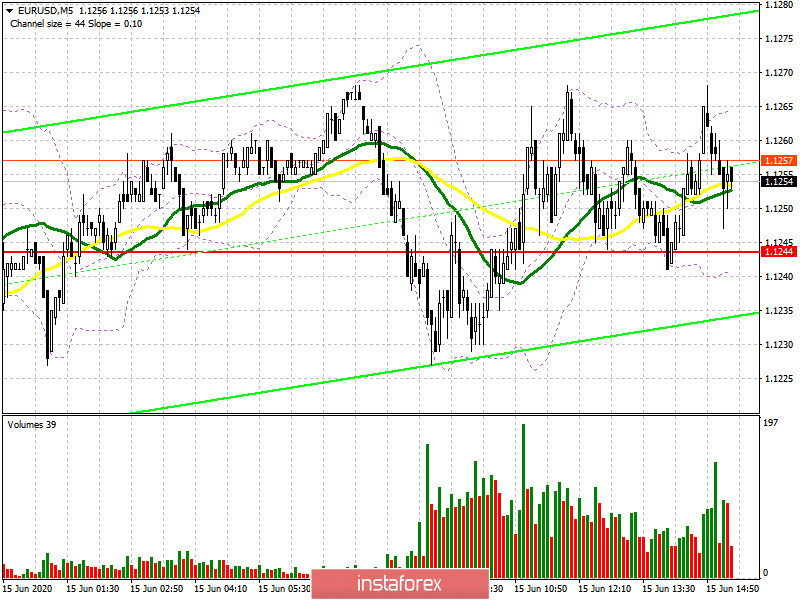

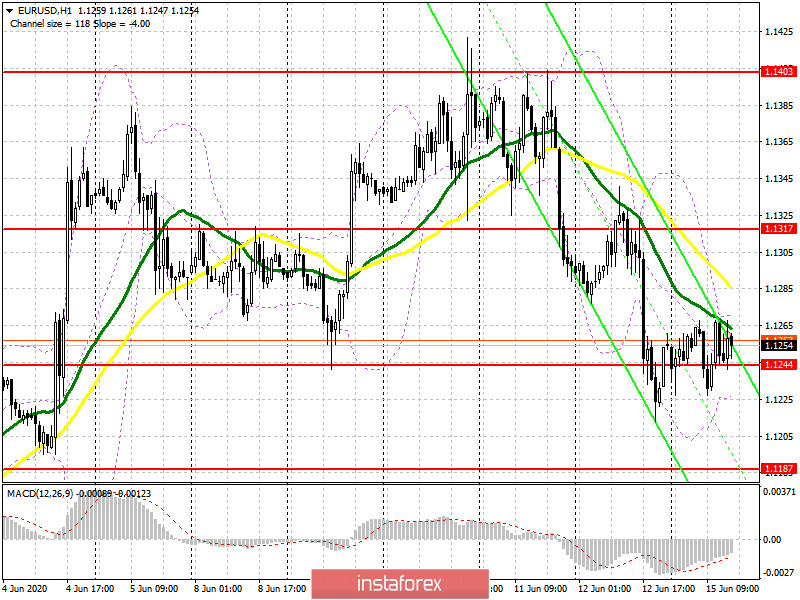

From a technical point of view, nothing has changed. If you look at the 5-minute chart, you are unlikely to see anything interesting that could indicate an entry into the market while the pair is trading around the level of 1.1244. I drew attention to the rather high probability of such an event in my morning forecast. Buyers managed to protect the support of 1.1244, and as long as the trade is above this level, you can expect growth within the day. A repeat test of this area will likely be a signal to open long positions in the expectation of an upward correction to the maximum area of 1.1317, where I recommend fixing the profits. If the pressure on the euro persists, and, most likely, today we will see a continuation of market loosening around the level of 1.1244 since important fundamental statistics are not published, then it is best to open long positions in EUR/USD only after updating the support of 1.1187 or immediately on a rebound from the larger minimum of 1.1119 in the calculation of correction of 30-40 points within the day.

To open short positions on EURUSD, you need:

The sellers still have no changes. Bears continue to put pressure on the euro, however, the morning attempt to break below 1.1244 was unsuccessful. The sellers' goal remains to return and fix EUR/USD below the level of 1.1244, which will increase pressure on the pair and lead to its further move down to the area of lows 1.1187 and 1.1119, where I recommend fixing the profits. This is especially possible due to the lack of important fundamental statistics at the beginning of this week. If the bulls are more active in their actions, and so far this is happening, then with an upward correction, it is best to open short positions after updating the resistance of 1.1317, but I recommend selling EUR/USD immediately for a rebound only from the local maximum of last week in the area of 1.1403, counting on a downward correction of 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted just below the 30 and 50 daily moving averages, which indicates that the market remains on the side of euro sellers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator at 1.1230 may increase pressure on the euro. Growth above the upper limit in the area of 1.1260 will lead to an upward correction of the pair.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20