Boris Johnson, who attributes his victory over the coronavirus, decided to add another achievement to his personal list of deeds. It is the one that even the ancient heroes could not handle. It is a question of absolutely incomprehensible fulfillment of election promises. However, at least one. This is an incredible amount, because so far no one has even been able to do this. So the British Prime Minister personally went to the next negotiations on the trade part of the divorce agreement with the European Union, after which he immediately said that the process that has not moved for many years has moved in the right direction. Yes, according to him, a trade deal can be signed in July. In fairness, it should be noted that the representatives of the European Union also did not hide their optimism and assured that the negotiation process had really moved from a dead point. Allegedly, both sides are ready to make some mutual concessions. And such good news quickly led to the growth of both the pound and the single European currency. The very prospect that all this epic story will finally end, and even safely, really inspires optimism and faith in a bright future. And against this background, no one, of course, is going to remember that such statements have been made repeatedly, and who is still there. And the current situation is no different, since there are no specifics. Only loud statements. And in general, where have you seen politicians fulfilling their election promises? After all, this contradicts not only common sense, but also the very laws of the universe. It won't do any good. This is what can trigger the collapse of the entire civilization. Thus, optimism may be very early and unjustified.

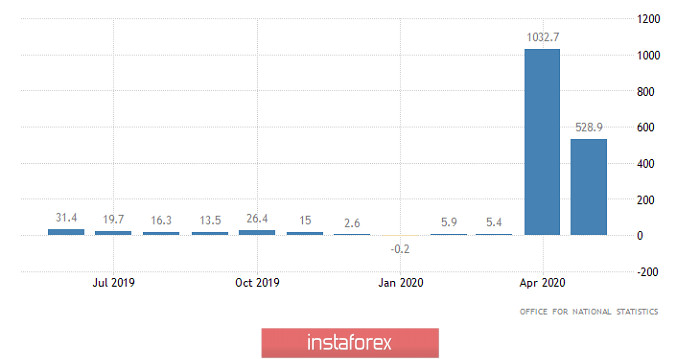

The strange things with Britain do not end there. The fact is that the morning began with the publication of data on the labor market, which caused nothing but surprise and confusion. They became the reason for the slowdown of the pound's growth and even led to its slight correction. The fact is that the unemployment rate has remained unchanged. The trick is that the number of applications for unemployment benefits declined from 1,032.7 thousand to 528.9 thousand. Of course, this is simply excellent and wonderful. But the thing is that it was forecasted to reduce the number of applications right up to 330.0 thousand. At the same time, the unemployment rate was supposed to grow from 3.9% to 4.4%. And this is at least. Generally, several forecasted its growth to 4.7%. And then it turns out that the reduction in the number of applications was much more modest, but the unemployment rate surprisingly remained unchanged, which is only at first glance. A closer look is still more wonderful. After all, we have applications for May and the unemployment rate for April. So, just in April, there was an absolute record for the number of applications for unemployment benefits. It turns out that no matter how many people apply for benefits, the unemployment rate itself is stable. Honestly, this really contradicts the elementary laws of formal logic. Yes, there is logic. Even the laws of mathematics are violated in all respects and so there is nothing strange that investors have experienced a sense of slight surprise once again at the sight of British labor market statistics. Moreover, besides the obvious assumptions regarding the artistic talents of the draftsmen from the United Kingdom Office of National Statistics, salary data, whose rates have slowed somewhat more than expected, are clearly worrying. So, if you look at salaries considering bonuses, and these are overtime, then their growth rate slowed down from 2.4% to 1.0%. Net salaries slowed down the growth rate from 2.7% to 1.7%.

Change in the number of applications for unemployment benefits (UK):

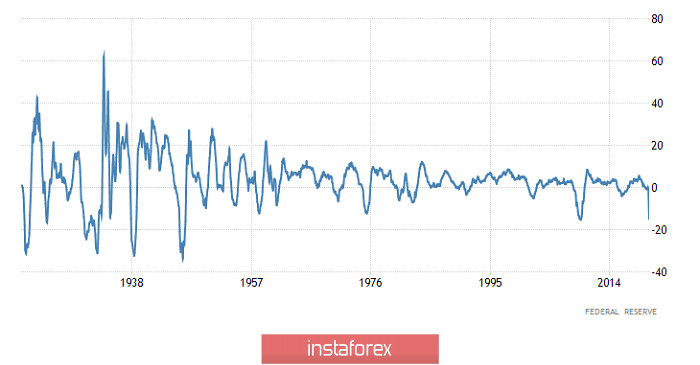

Nevertheless, the pound probably should not greatly grief. Look at the single European currency, which continues to grow slightly. And the reason for its growth is not that the Brussels bureaucrats suddenly began to say that it was only London that made concessions, and that the European Union remained in its position. No, the whole point is in today's American statistics, for which the market has already begun to prepare in advance. Like it or not, the rate of decline in retail sales in the United States may accelerate from -21.6% to -24.6%. That is, from record to absolutely record. However, we are talking about the main driving impulse of the US economy – consumer activity. Its best reflects just retail sales, especially trade accounts for about a fifth of the American economy. That is, we are talking about a decline in GDP of more than 4.0%. And this sphere itself drags other sectors of the economy deeper below. Indeed, in addition to retail sales, data on industrial production are also published, the decline of which should accelerate from -15.0% to -18.0%. So industry must break the local anti-record crisis of 2008-2009, and the current recession can only be compared with the post-war one. But then it was elementary due to the fact that suddenly there was no need for countless tanks, planes and ships, which the American industry stamped day and night. In other words, the current decline in industry really can only be compared with the Great Depression. And from this thought, positive emotions are somehow not added.

Industrial Production (United States):

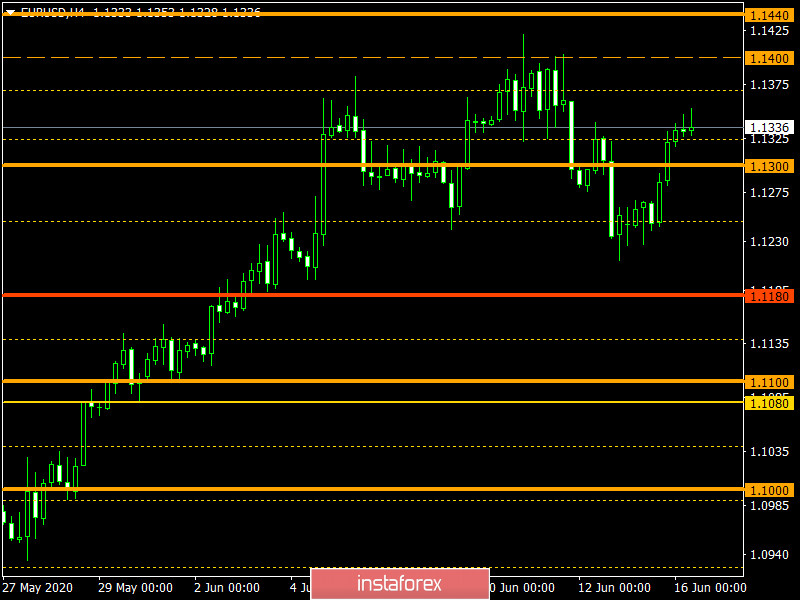

The euro/dollar currency pair decided to repeat the attempt of the past week, locally accelerating the long position, but this is all behind speculative interest. It can be assumed that amid rush and price consolidation above the level of 1.1360, the quote will continue to move in the direction of 1.1400, but with a minimal change in the external background. At the same time, a reverse surge in activity is not ruled out.

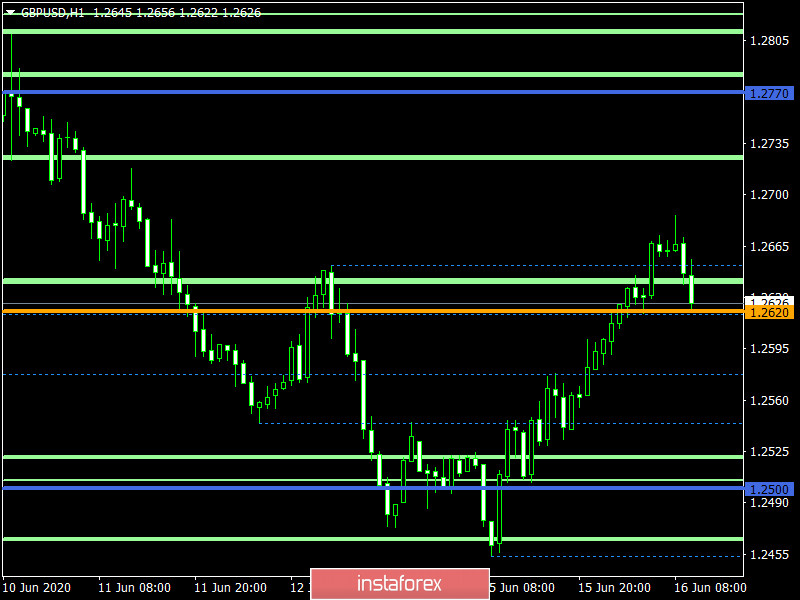

The pound/dollar currency pair managed to consolidate above the level of 1.2620 once again, signaling the recovery process of the previously set upward mood. A temporary fluctuation within 1.2620/1.2670 can be assumed, where the work will be built on local operations by the method of breakdown of established boundaries.