The euro/dollar pair edged higher as the USDX dropped again in the short term. The US data could give us a clear direction today and fresh signals. The US will publish the Retail Sales, Core Retails Sales, Industrial Production, Capacity Utilization Rate, Industrial Production, and the Business Inventories reports. Better than expected figures could support the USDX and the EUR/USD pair may rise.

Unfortunately, negative data from the US could weaken the dollar. EUR/USD is likely to jump higher if it comes true. The pair is trading within a resistance area, an upside breakout will signal a larger increase in the weeks to come, while another rejection from here will bring a leg lower.

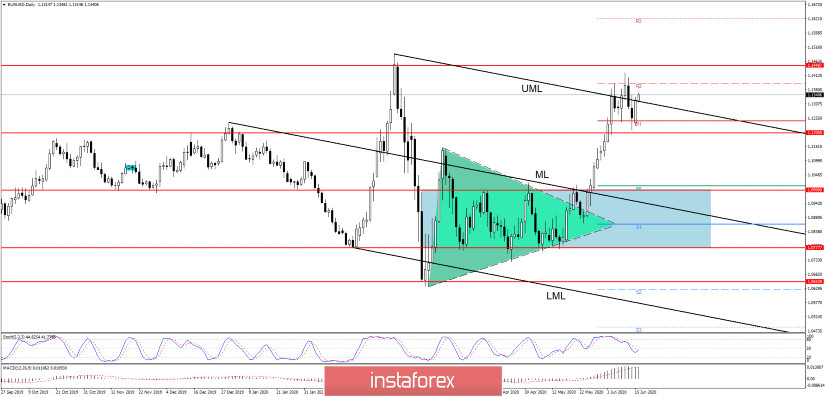

EUR/USD has decreased a little in the short term, but it has found strong support on the R1 (1.1243) level and now it has climbed above the upper median line (UML) again. Still, it is premature to talk about a further increase as long as the price is traded below the R2 (1.1383) level.

Better than expected data from the US could force EUR/USD to register another false breakout above the upper median line (UML) and to signal a bearish momentum. I believe that only a valid breakout above the R2 (1.1383) and another higher high will validate a further upside movement.

- EUR/USD Trading Tips

EUR/USD will climb way higher if the price makes a valid breakout (close and fix) above the R2 (1.1383) level. If the pair continues to lift up, it may close above the 1.1422 level. This potential scenario will suggest buying with a first potential target at the R3 (1.1622) level, the Stop Loss could be hidden below the former low at 1.1212 level.

The pair could drop if it fails to stabilize above the upper median line (UML) and if it makes a valid breakdown below the R1 (1.1243). The pair will decline below the 1.1200 level, the major downside target remains at the 1.1 level.