Technical analysis recommendations for EUR/USD and GBP/USD on June 16

Economic calendar (Universal time)

06:00 Average Premium Income (UK)

06:00 Unemployment Rate (UK)

06:00 Change in the number of applications for unemployment benefits (UK)

06:00 Change in employment (UK)

06:00 Consumer Price Index (Eurozone)

9:00 ZEW Economic Sentiment Index in Germany

9:00 ZEW Economic Sentiment in the Eurozone

9:00 Salary Levels (Eurozone)

12:30 Retail Sales (USA)

13:15 Industrial output and industrial capacity factor (USA)

14:00 Speech by the head of the Fed

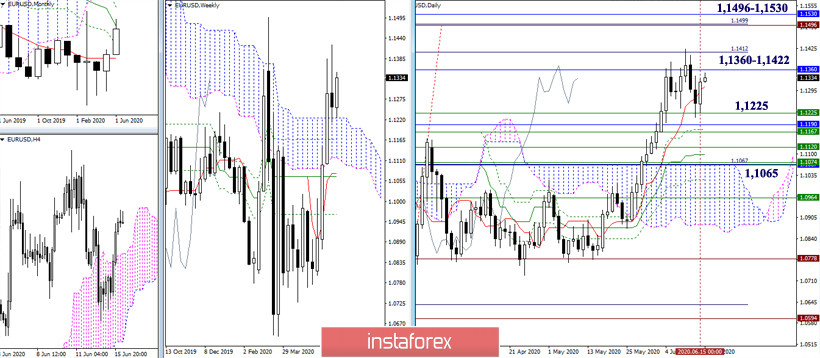

EUR / USD

Over the past day, the pair formed a fairly effective rebound from the met support zone, while returning the daily short-term trend. It is located at 1.1309 today, on the side of the players to increase. The restoration of the upward trend now complicates a series of resistance, led by the monthly Kijun (1.1360). Nevertheless, in case of updating the maximum of the last week (1.1422), the attention and interests of players to increase will be focused on testing important levels such as 1.1496 (maximum of the March high wave) - 1.1499 (100% working out of the daily target for the breakdown of the cloud) - 1.1530 (the final level of the monthly dead cross of Ichimoku). The support zone, which in this situation will restrain the development of bearish sentiment, is now quite wide and unites many strong levels of upper time intervals - 1.1225 - 1.1065 (weekly cloud + daily cloud + Ichimoku cross levels of daily, weekly, monthly timings), so the victory of players to the downside is unlikely in the near future.

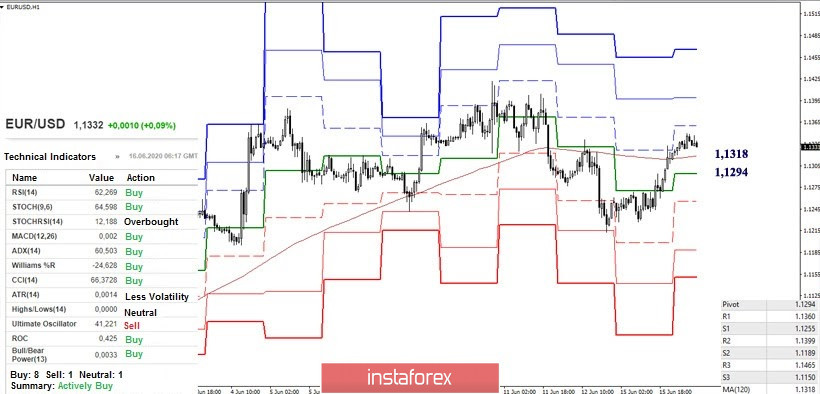

Yesterday, the upward players decided not only to develop a correctional upswing, but also significantly affect the further alignment of forces after breaking through the resistance of the central Pivot level. As a result, the pair regained a weekly long-term trend. The upward pivot points within the day are now the resistance of the classic pivot levels - 1.1360 - 1.1399 - 1.1465. Today, the key lower support is located at 1.1294 - 1.1318 (central Pivot-level of the day + weekly long-term trend). Working above these levels provides a bullish advantage in the lower halves, but being below will favor the opponent. The only thing is that, since the support and resistance of the higher halves are now closely located, there is a high probability of side movement, where key levels from H1 (1.1294 - 1.1318) can become a center of attraction.

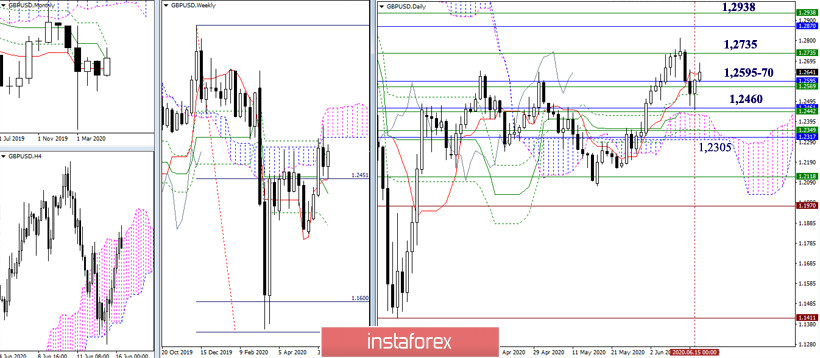

GBP / USD

The support met by the pound in the region of 1.2440-60 (daily Kijun + cloud + weekly cross + monthly Tenkan) did their job. The pair indicated a slowdown and formed a daily rebound from support levels. The issue of completing the correction and new bullish prospects now will depend on the result of interaction with a sufficiently strong and wide resistance zone 1.2735 - 1.2870 - 1.2938. Breaking the zone will allow players to go up to the bullish zone relative to the weekly cloud and eliminate the monthly dead cross. The levels of the monthly Kijun (1.2595), the weekly Fibo Kijun (1.2569) and the daily cross (1.2632 - 1.2530) can now exert attraction and restrain the development of the situation. The key supports for this section are combined within 1.2460 - 1.2305 (daily cloud and final boundaries of the daily cross + weekly cross + monthly levels).

In the lower halves, players to increase seek to gain a full-blown advantage, as a result of which there is a struggle for a weekly long-term trend. A consolidation above (1.2640) and reversal of the moving will allow us to consider plans to restore the upward trend (1.2812). The loss of moving can return the pair to support the central Pivot level (1.2552). A consolidation below the level of 1.2552 and all the player's achievements to increase indicated yesterday during rebound formation, and bearish landmarks within the day, in the form of supports of the classic pivot levels (1.2502 - 1.2402 - 1.2352), will become relevant again.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)