If US stock indices are considered an indicator of global risk appetite, then the oil is a kind of indicator of the health of the world economy. In this regard, we should not be surprised at the rapid growth of these assets at a time when the world is on the verge of victory over COVID-19, and global GDP has a good chance to go on the path of a V-shaped recovery. The S&P 500 correction, driven by fears of a second wave of pandemics, was short-lived. As soon as the Fed announced details of its programs for lending to the corporate sector for about $ 1 trillion, stocks went up and extended a helping hand to Brent, which managed to return above the psychologically important mark of $ 40 per barrel.

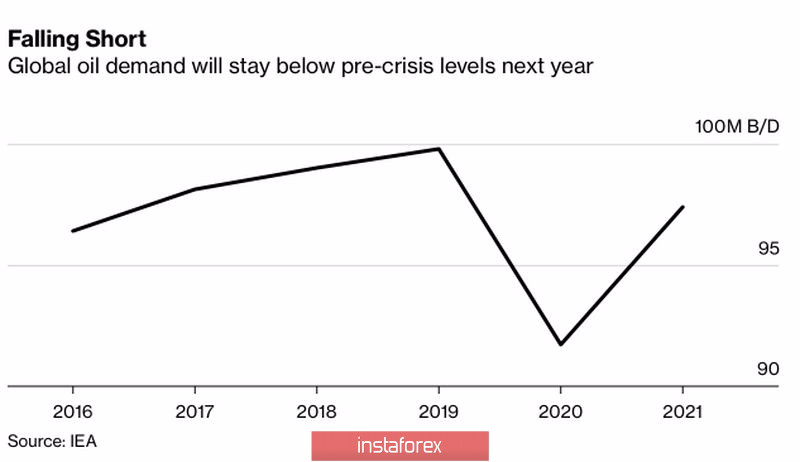

It would seem that black gold was supposed to scare the forecast of the International Energy Agency, which reported that after sagging by 8.1 million b/d in 2020, global demand will grow by 5.7 million b/d in 2021. The pre-crisis level of 100 million b/d is still 2.4 million b/d short, meaning that the indicator will only be able to recover in 2023. Not very good news for the "bulls" for Brent and WTI, who seriously expect that oil will be able to quickly recover. However, the IEA admitted its mistake and raised the demand forecast for the current year by 500 thousand b/d due to higher consumption during the pandemic than previously estimated. It is possible that the current estimate will be adjusted, especially if the return of the US and the global economy to the trend will go faster than currently expected.

Dynamics of global oil demand

Since oil is an indicator of the health of the global economy, it is not surprising that it is sensitive to the risks of the second wave of COVID-19 and the associated probability of repeated lockdown. According to the official Riyadh, the further dynamics of black gold will largely depend on whether the coronavirus strikes the world economy again or not. Saudi Arabia stressed the role of the OPEC+ agreement on production cuts in stabilizing the oil market and noted that in March, the level of $ 40 per barrel was only a dream. According to officials, restrictions on production will contribute to the continuation of the rally of Brent and WTI with the subsequent return of both grades to normal levels. Riyadh did not specify what the "normal level" means, but I believe that the average Brent price of $ 64 per barrel, which took place in 2019, will suit it quite well.

Oil is supported by forecasts from the US Energy Information Administration that US shale production will fall to a 2-year low of 7.63 million b/d in July, as well as a decline in Iraq's June exports by 8% or 300 thousand b/d. The figures show that Baghdad has made progress, but has not yet fully fulfilled its promises.

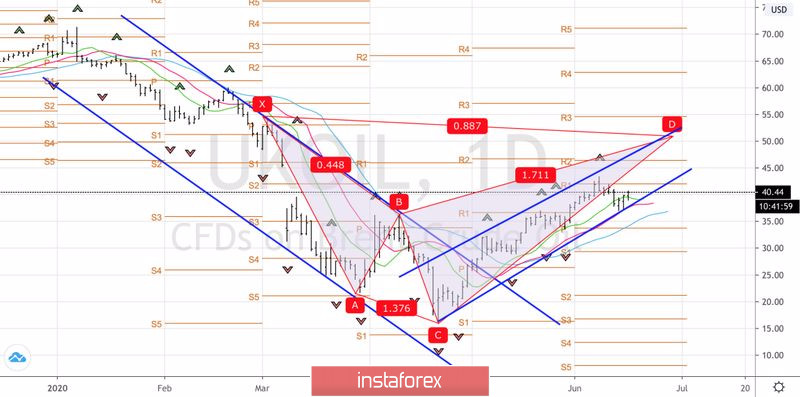

Thus, the improvement in the black gold market conditions allows us to adhere to the strategy of buying Brent on pullbacks. Longs formed according to my previous recommendations should be held from the level of $ 37.65 per barrel. The target is still the $ 51 mark, which is close to the 88.6% target for the "Shark" pattern

Brent, the daily chart