The euro-dollar today is trading in different directions. The European currency reacted positively to very good ZEW reports, while the greenback demonstrates sensitivity not only to statistics from the US, but also to the external fundamental background. The unexpected escalation of long-term, long-smoldering, geopolitical conflicts led to a surge in anti-risk sentiment, which was used by dollar bulls.

So, one of the centers of geopolitical tension was on the border of India and China. As a result of an armed skirmish, three Indian soldiers died - an officer and soldiers. This is the first death of the military in several decades of border confrontation between the two powers. Both countries possess nuclear weapons, therefore, all the world media have shown interest in the outbreak of conflict. In fact, the territorial conflict between India and China around the Ladakh region in the Himalayas has been smoldering since the beginning of the 60s - in 1962, a border war was fought between the countries for control over the region. In the 1990s, the parties agreed to de-escalate in the disputed region. Starting in 2017, the border conflict between the two nuclear powers resumed with renewed vigor because of Beijing's intention to build a new road in Ladakh. A number of units were pulled to the control line in May of this year, replacing the border between the two countries. This happened after the military of the two countries engaged in hand-to-hand combat in the area of the mountain border post. And yesterday, another skirmish escalated into an armed confrontation, which killed three people. Similar conflicts occur in many border areas in different parts of the world, but, given the fact that India and China are members of the "nuclear club", this incident also affected the mood of the foreign exchange market traders. According to the latest data, now the parties are trying to reduce the degree of incandescence, but the problem itself is unlikely to be resolved in the near future.

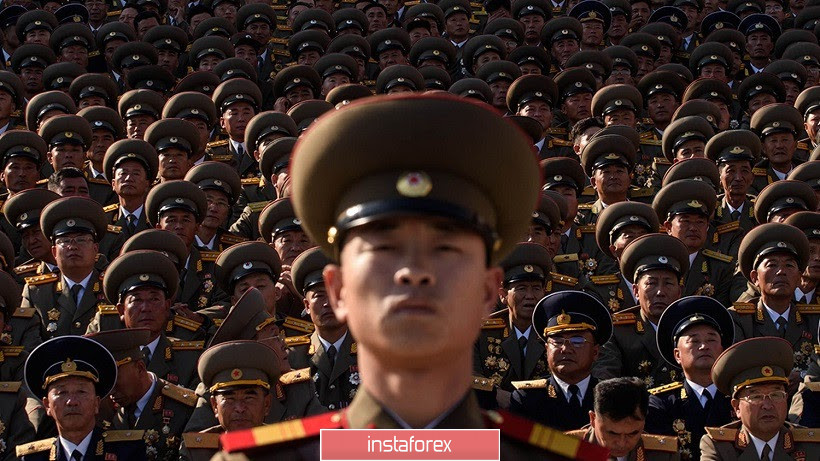

Another escalation of geopolitical conflict occurred on the Korean peninsula. The situation over there has been aggravating for several weeks. Pyongyang reacts extremely sharply to the distribution of campaign leaflets, which South Korean activists send over the border to the North in balloons. At the end of last week, the DPRK leader's sister, Kim Yo Jong, announced that her country was preparing a "new step in response to sending false leaflets." Then she called Seoul an enemy and stated that it was time to "confidently end relations with the South Korean authorities." Then, the DPRK unilaterally stopped communicating with its southern neighbor through all communication channels, including the military and the special line between the top leadership of the two countries. But today, the North Korean authorities have undermined the Office of inter-Korean communications in the city of Kaesong, after which South Korea brought the troops on high alert. North Korea, in turn, once again threatened military action against the southerners.

It is worth noting that if the Indian-Chinese conflict is most likely to be resolved (or rather, to return it to the "smoldering" stage), then the situation on the Korean peninsula is on increasing amplitude. Therefore, it is not surprising that today's events provoked a surge in anti-risk sentiment in the foreign exchange market and increased demand for the dollar, which continues to enjoy the status of a protective asset.

The dollar also received indirect support from the Bloomberg news agency: according to their data, the US government plans to allocate a trillion dollars for infrastructure restoration activities - the US Department of Transportation plans to spend this money on bridges and roads, as well as providing Americans with 5G Internet. But for now, these are just plans: according to journalists, the White House is now exploring various options for allocating funds. For example, this amount can be included in the next package of measures to provide assistance in a pandemic, or a separate bill can be developed for it.

Thus, the US currency today received plenty of reasons for strengthening - the greenback dominated in all dollar pairs in the second half of Tuesday. Speaking directly about the EUR/USD pair, here we observe a wide-range flat. Today's strengthening of the dollar did not help the bears to reverse the trend, despite an impressive downward momentum. Despite a surge in anti-risk sentiment, the US currency could not go below the 1.1250 mark (Tenkan-sen line on the daily chart), while the pair has been trading for the third day in a row in the range of 1.1250-1.1350.

Apparently, traders are in no hurry to open large sales positions on the eve of the summit of the EU leader, which will be held this Friday. The online meeting will discuss the European Commission's anti-crisis plan, which is worth 750 billion, so this event's importance for the euro can hardly be overestimated.

Given such an ambiguous fundamental background, as well as the fact that the bears could not overcome the lower limit of the above range, at the moment, we can consider purchases from current positions with a growth target at around 1.1350. The influence of the Sino-Indian conflict has already waned, while Korean events have a short-term impact on the market: if the DPRK does not realize its threats regarding a military invasion of the demilitarized zone, then tomorrow traders will switch to other fundamental factors.