4-hour timeframe

Average volatility over the past five days: 119p (high).

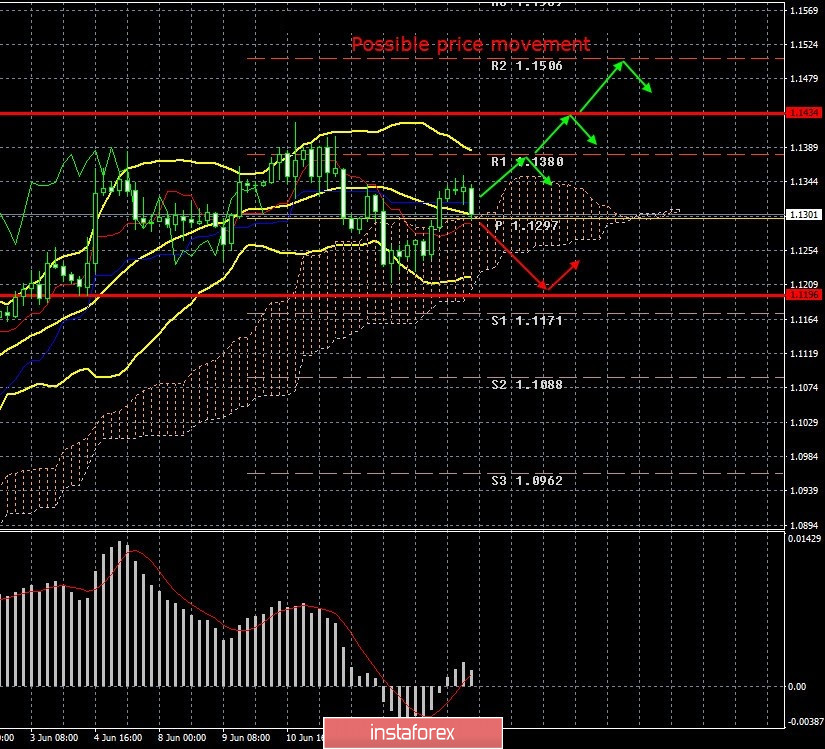

After the US dollar again began to fall in price across the entire spectrum of the market on Monday, today there was a downward movement again during the day. Thus, so far we are still inclined to the option that the pair will continue the corrective movement. Moreover, today quotes consolidated back below the critical Kijun-sen line, which therefore disconfirms the desire of the bulls to continue and continue to buy European currency. We have already said that, from our point of view, the euro has already risen in price quite a lot in recent days. Too strong for the set of fundamental and macroeconomic reasons that was at the disposal of traders. So now, in a way, it's time to repay the debts. On Monday, no important macroeconomic information regarding the European Union or the United States was published. There were no speeches by important officials or politicians. Nevertheless, in recent days, the pair's volatility has increased, which may even mean a certain panic in the foreign exchange market. Considering the groundless growth of the euro and the pound in recent weeks, as well as the growth of volatility, we can assume that there is not too much logic in the actions of traders. Nevertheless, we still recommend not trying to guess the pair's reversals, but trading strictly according to the trend, even if the foundation and macroeconomics speak of the futility of this option.

Trading on the EUR/USD pair took place in a completely calm manner on Tuesday, June 16. Nevertheless, the dollar at the time of writing the article has risen in price by more than 60 points, so there is definitely a trend within the day. Let's try to figure out whether there were reasons for the strengthening the US dollar today or whether the fall of the pair is a purely technical phenomenon. There were many macroeconomic statistics today, but most of them could hardly interest traders in the current conditions. Inflation in Germany was 0.6% year-on-year in annual terms, while the harmonized consumer price index (published by the official statistics office of the European Union) was 0.5% y/y. However, such low figures have not surprised anyone in the market for several months now, since falling inflation in the crisis (as well as hyperinflation) is a normal phenomenon. Studies were also published by the ZEW Institute on economic sentiment in Germany and the European Union in June. It turned out that most investors are optimistic about the future, as indicators have grown significantly. However, at the same time, the index of current economic conditions in Germany remains at a level "below the baseboard", which reflects the current deplorable state of the economy and the pace of its recovery after the coronavirus epidemic. By and large, all these statistics did not have much significance for traders. It can not be called positive or negative for the euro.

A report on retail sales for May was just released in the United States. The main indicator grew by 17.7%, the retail control group added 11%, and the indicator excluding car sales grew by 12.4%. All three indicators significantly exceeded forecast values and could cause increased demand for the dollar in the US trading session. Jerome Powell's speech in the US Congress is set for today and a lot will depend on the Federal Reserve chief's rhetoric. As with the ZEW Institute, it will be very difficult to expect any positive speech from Powell. The US economy has been hit hard by the coronavirus crisis, key indicators of its condition have fallen, and it is not known how long it will take to fully recover. It should also be understood that the whole world must recover from the epidemic at once. If, for example, the United States announces the resumption of air travel, but the airports in Europe and China continue to remain closed, then this will not help American airlines. If trips and flights are allowed around the world, but at the same time most people will be afraid of the coronavirus, the tourism sector will continue to remain in a deplorable state and will not be restored. Thus, we still believe that in order for the global economy and the economy of each individual country to begin to grow fully, a victory over the pandemic is needed. There are still no signs of a victory over the pandemic. People continue to become infected in the United States. The total number of cases is already more than two million. Europe seems to have managed to completely suspend the distribution of COVID-2019, but many other countries cannot boast of this, for example, Brazil, India or Russia. This means that communication with these countries will either be limited, or it will be closed altogether, and a virus without a vaccine or medicine can again spread to the recovered countries at any time. Thus, the second wave of the epidemic is not something hypothetical, it is a very real threat.

4-hour timeframe

Average volatility over the past five days: 146p (high).

The GBP/USD currency pair also sought to resume the downward movement on June 16, however, unlike the EUR/USD pair, it did not succeed. Thus, today's correlation between the two main pairs was weak. Given the fact that no important news and messages were received from the European Union today, this looks strange. It turns out that the US dollar has risen in price against the euro, but has not risen in price with the pound. Why? Is it because the pound received real support from market participants due to frank rumors about the possible signing of an agreement between London and Brussels in the near future? Recall that in the first years of Brexit, the British currency, if it grew, then only on such unsubstantiated rumors that regularly appeared in the press, the media and on television. After a few days it became clear that the rumors were still just rumors and the pound fell again. It seems that the same thing is happening with the British pound. The GBP/USD currency pair has consolidated above the critical Kijun-sen line, however, it is unlikely to be able to continue the upward movement. A more likely scenario is the euro consolidating below the critical line. However, the bears in the GBP/USD pair are extremely uncertain and are not yet ready for such a development. Perhaps they will help Powell?

Recommendations for EUR/USD:

For short positions:

The EUR/USD pair resumed its downward movement on the 4-hour timeframe. Thus, the targets for short positions are now levels 1.1196 and 1.1171, which are still advised to be considered in small lots due to the weakness of the current sell signal.

For long positions:

Buy orders can be opened but first you must consolidate the price above the critical line with the first objectives of 1.1380 and 1.1434. However, the implementation of this option is not expected in the near future - the pair has just declined.

Recommendations for GBP/USD:

For long positions:

The pound/dollar pair crossed the Kijun-sen line, but cannot continue to move up. Thus, formally, buy orders with targets of 1.2732 and 1.2946 are formally relevant now, however, we do not recommend considering longs yet, since we believe that the pound will resume its decline.

For short positions:

It is advised that sales of the GBP/USD pair be considered in small lots while aiming for a volatility level of 1.2440 not earlier than consolidating quotes below the Kijun-sen line.