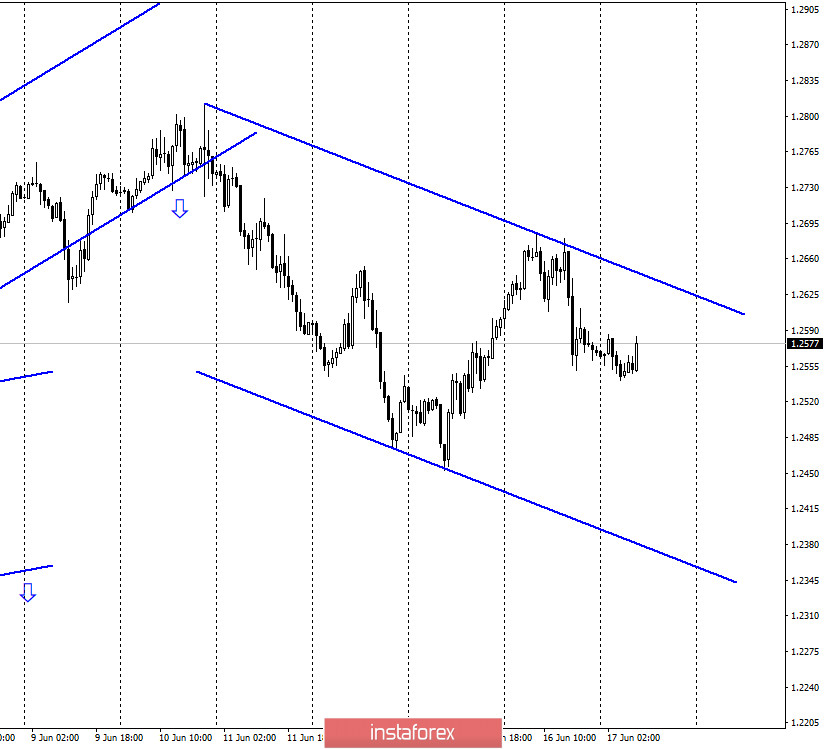

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair performed a reversal in favor of the US dollar and resumed the process of falling, and a new downward trend corridor was also built. Thus, demand for the US dollar now remains moderate or even weak, and the general mood of traders is "moderately bearish". Jerome Powell's speech in the US Congress yesterday also had a bearing on the pound/dollar pair, so the euro and the pound moved almost exactly the same way yesterday. In the UK itself, there were several interesting reports yesterday and no important events or news. Everything still revolves around Boris Johnson's personal talks with the leaders of the European Union. The British Prime Minister said that he expects the agreement to be signed by the end of July, however, it is unclear why Johnson is optimistic about this issue. There was no information about the concessions made by either side. Why did Johnson think that within the next month or a month and a half the parties would suddenly come to an agreement?

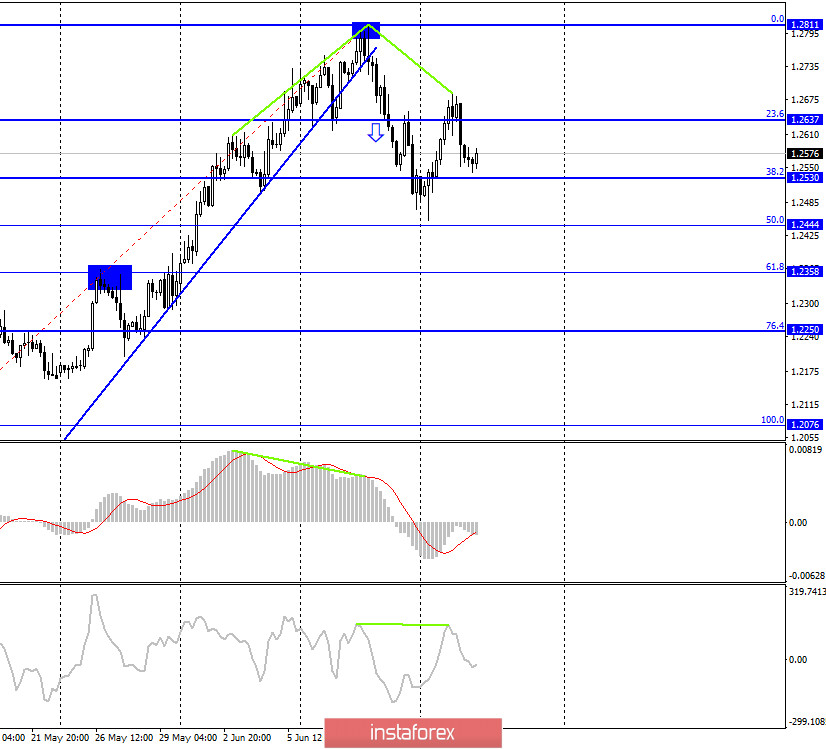

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair also performed a reversal in favor of the US dollar and returned to the corrective level of 38.2% (1.2530). Thus, the rebound of the pair's exchange rate from the Fibo level of 38.2% will work in favor of the British currency and resume growth in the direction of the corrective level of 23.6% (1.2637). Closing the pair's exchange rate below the Fibo level of 38.2% will increase the probability of a further fall towards the next corrective level of 50.0% (1.2444).

GBP/USD – Daily.

On the daily chart, the pair's quotes fell to the corrective level of 50.0% (1.2462) and rebounded from it. Thus, traders can now expect growth in the direction of the corrective level of 61.8% (1.2711), but more important is the 4-hour chart, where growth is also possible. However, the "bearish" mood of traders remains.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

News overview:

On Tuesday, the UK released reports on the unemployment rate, which unexpectedly did not increase for many, on applications for unemployment benefits, which showed + 300 thousand applications, and on wages, which rose slightly. In general, these statistics cannot be described as either positive or negative.

News calendar for the US and UK:

UK - consumer price index (06:00 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (16:00 GMT).

On June 17, the calendars of economic events in the UK and the US contain a relatively important consumer price index and a speech by Jerome Powell in the House of Representatives of the US Congress. I think the second event is more important.

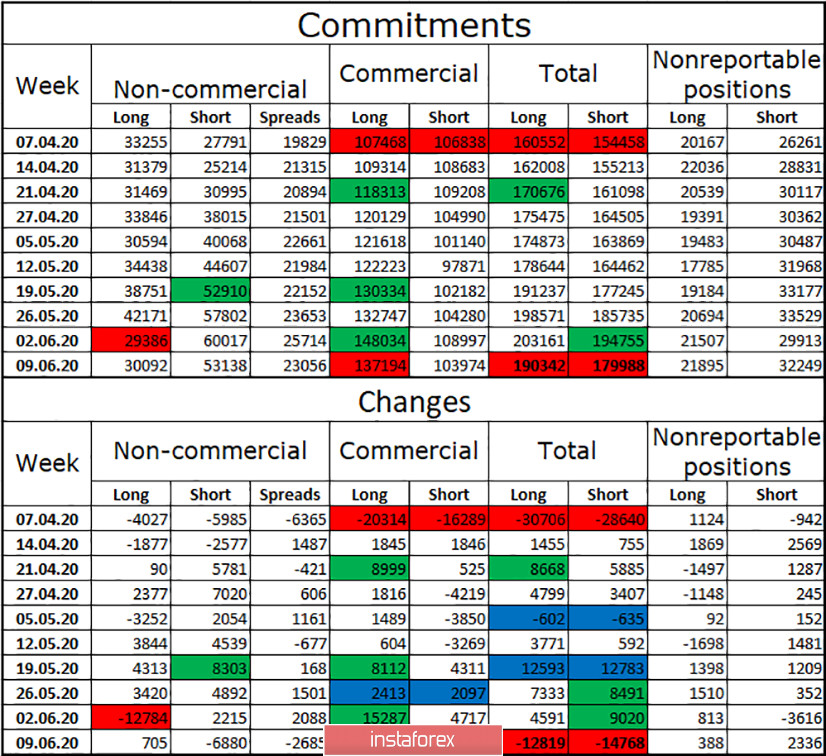

COT (Commitments of Traders) report:

Last Friday, a new COT report was released, which showed a strong reduction in short contracts among the "Non-commercial" group. This same group of large traders opened 705 long contracts, but in total it turns out that they did not buy the British currency, but increased demand for it by reducing the number of sales of this currency. The "Commercial" group, which is less important, on the contrary, got rid of purchases of the pound, but at the same time got rid of short contracts. In total, the number of long contracts and the number of short contracts decreased during the reporting week. The Briton continues to enjoy very dubious and weak interest among major players. However, this still allows it to grow from time to time, as it has in the past two weeks. Given the fact that speculators did not increase purchases of the British currency, I do not believe that it will continue its growth.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goals of 1.2444 and 1.2358, if a new consolidation is made under the level of 38.2% (1.2530) on the 4-hour chart. I recommend opening purchases of the pair after closing above the trend corridor on the hourly chart with the goal of 1.2811.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.