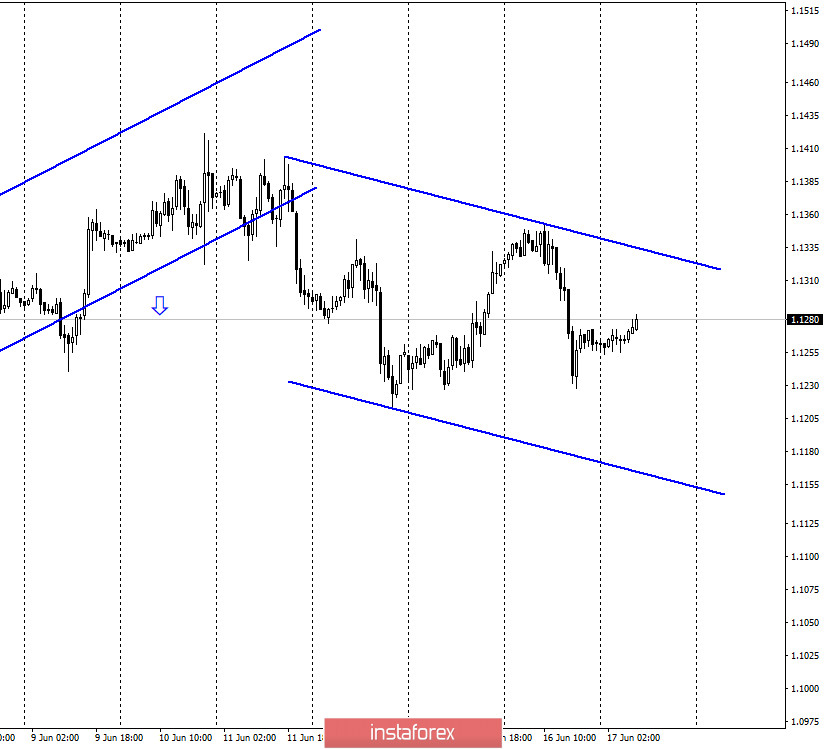

EUR/USD – 1H.

Hello, traders! The euro/dollar pair performed a reversal in favor of the US currency on the hourly chart on June 16 and resumed the process of falling. Thus, this allowed me to build a less inclined downward trend corridor, which characterizes the current mood of traders as "moderately bearish". Among the most interesting events of the past day, of course, should be the speech of Fed Chairman Jerome Powell before the Banking Committee of the US Congress. Many traders were waiting for this event, as it could bring back the desire to buy the dollar. Powell was indeed optimistic about some of the points in his speech. For example, he suggested that the "bottom" of the crisis has already passed and the recovery is now beginning, drawing attention to the latest reports on Nonfarm Payrolls and unemployment. At the same time, Powell noted that without a complete victory over the coronavirus, the economy will not be able to fully recover. Powell also said that the Fed is still not considering the option of introducing negative rates, but believes that more fiscal measures are needed to support the economy.

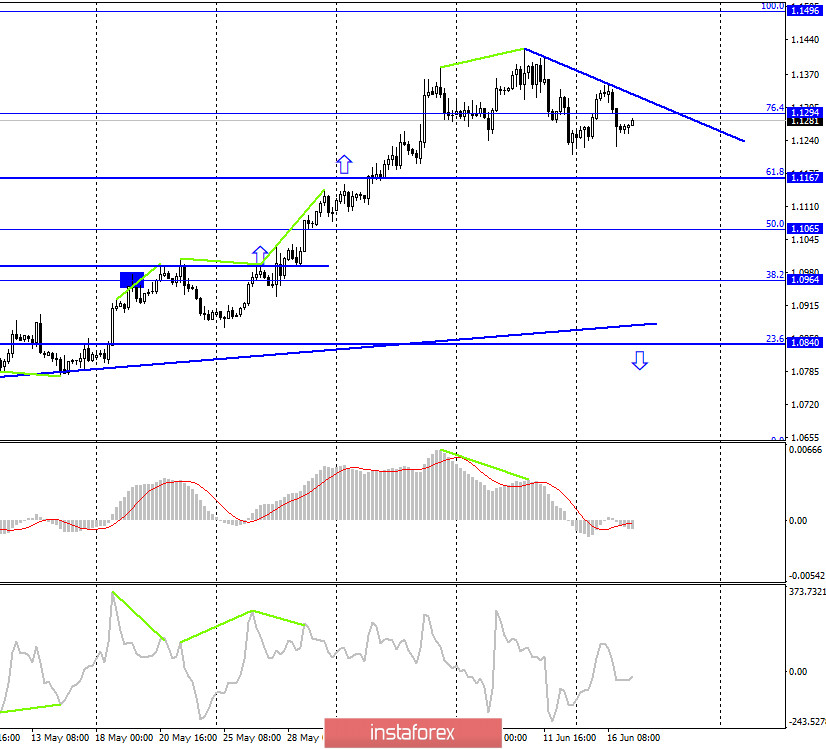

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair also performed a reversal in favor of the US currency and resumed the process of falling. The pair's quotes again closed at the corrective level of 76.4% (1.1294), which increases the probability of a further decline in the direction of the corrective level of 61.8% (1.1167). I also built a downward trend line, fixing the pair's rate above which will allow traders to count on new growth in the direction of the Fibo level of 100.0% (1.1496). Today, the divergence is not observed in any indicator.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair rebounded from the corrective level of 161.8% (1.1405) and fell to the Fibo level of 127.2% (1.1261). However, there was no closure below this level. Therefore, the further fall in the direction of the next corrective level of 100.0% (1.1147) is still questionable.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is postponed.

Overview of fundamentals:

On June 16, the EU did not have any important reports or events. But in the US, there were reports on retail trade (+17.7% in May), and industrial production (+1.4% in May). The first one turned out to be significantly better than traders' expectations, while the second one was worse.

News calendar for the United States and the European Union:

EU - consumer price index (09:00 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (16:00 GMT).

On June 17, the EU news calendar contains the consumer price index, which is likely to continue to decline. And in the US, there will be a second speech by Jerome Powell in the US Congress, which may be no less interesting than the first.

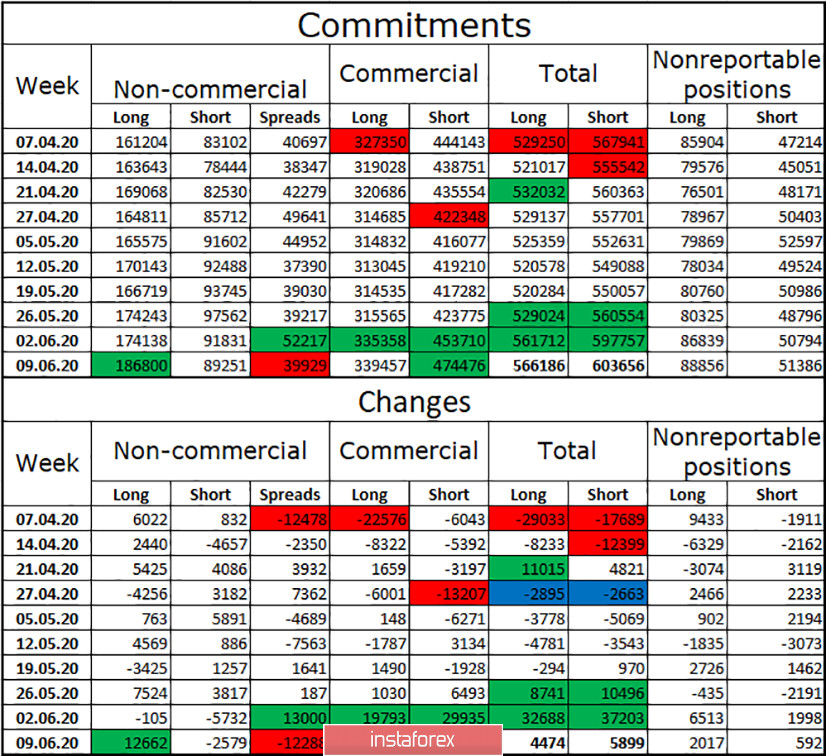

COT (Commitments of Traders) report:

The latest COT report showed very interesting changes in the mood of large traders. For example, the "Non-commercial" group has increased the number of long contracts by 12,500, while not forgetting to get rid of short contracts. Since it is believed that this group is driving the currency market, nothing is surprising in the growth of the European currency, according to this report. Hedgers very logically recruited opposite contracts, since this is the essence of their activity (+20766 short contracts). Thus, over the past two weeks, the euro currency has lost 8 thousand short contracts and gained 12,500 long contracts. The most interesting thing is whether this mood will continue among traders, which will allow the euro currency to continue the growth process. Recent days show that bull traders are fed up with buying the euro currency.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1167, as a new close was made under the level of 1.1294 on the 4-hour chart. Purchases of the pair can be opened when closing above the ascending corridor on the hourly chart or above the trend line on the 4-hour chart with a goal of 1.1496.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.