Just yesterday, it seemed that everyone would publish the next macroeconomic data, which would finally remove all doubts regarding the fairness of comparing the current crisis with the Great Depression. However, something went wrong. Instead of long lines at pharmacies for sedatives, we saw the disappearance of champagne from the shelves of liquor stores. There is even a suspicion that the current crisis will be no worse than 2008 in the end. But the whole trick is that it concerns only the United States, which was the reason for the strengthening of the dollar. Nevertheless, it is too early to draw conclusions and it is better to remain vigilant.

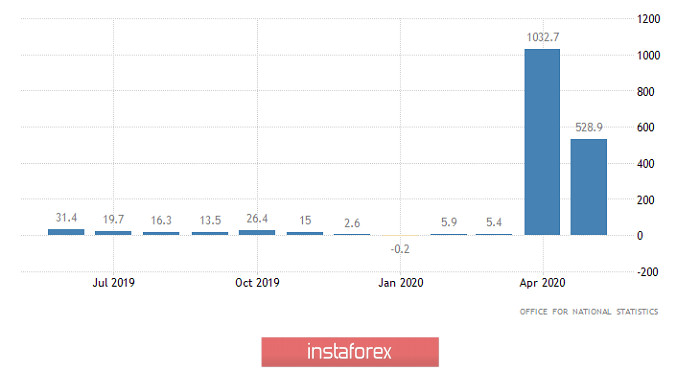

At the same time, there were some tricks in Great Britain, because of which one is more and more convinced that "Alice in Wonderland" is not a fairy tale, but a mean statement of English reality. The April data on applications for unemployment benefits were revised upwards, and they turned out to be not 856.5 thousand, but already 1,032.7 thousand. That is, it is not just a record high value. Indeed, it exceeded the mark of one million for the first time in the history of this indicator. However, it usually fluctuates around zero. That is, the number of applications for benefits remains virtually unchanged from month to month, and any change was perceived as something extraordinary. Here, immediately more than a million. But the funniest thing about all this is that, despite such a fantastic increase in the number of applications, the unemployment rate itself remained unchanged. And this simply contradicts even common sense, not to mention the laws of mathematics. So, this can only happen if someone's ridiculous mistake has crept in, and soon the unemployment data will be revised for the worse. However, there is still a possibility that the statistical office was fond of embellishing, or rather usual drawing of macroeconomic indicators. Both options do not inspire optimism, especially the second. So it is not surprising that investors began to get rid of the pound quickly. Moreover, the number of these same applications for benefits increased by another 528.9 thousand although an increase of 330,0 thousand was predicted. Thus, the unemployment rate clearly cannot remain unchanged. It should spike up.

Change in the number of applications for unemployment benefits (UK):

Amid the strangeness in Britain, the US statistics looked simply amazing although they approached it with alarm and apprehension. Say what you like, but all the forecasts indicated only one thing - this is the beginning of a new Great Depression. But nothing happened. First, we reviewed the previous value of retail sales, and for the better. So instead of -21.6%, their decline rate was -19.9%. Of course, the difference is small, but still nice. But the biggest surprise was that instead of accelerating to -24.6%, the decline slowed to -6.1%. Also, it turns out that the decline in consumer activity, namely it is reflected in the dynamics of retail sales, is not so terrifying even if it was worse than the crisis of 2008-2009. Although the previous result was reviewed for the worse, from -15.0% to -16.2%. But still, the pace of decline in industrial production slowed down to -15.3%. Although it is clear that without a review of previous results, there would be no slowdown. Nevertheless, an acceleration of the decline was predicted to -18.0%. Of course, the decline in industry is about the same as during the crisis of 2008-2009. But no more. Which pleases. After all, they feared just that.

Retail Sales (United States):

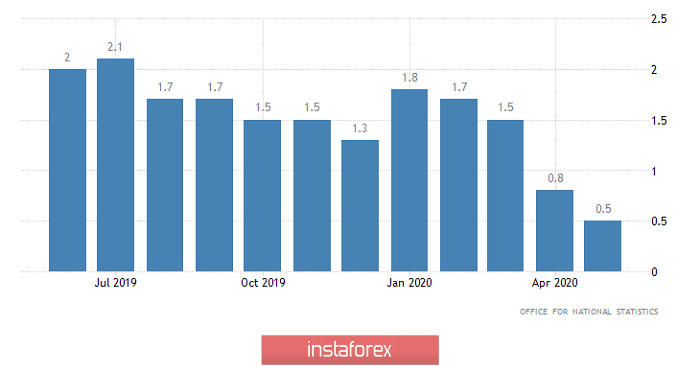

The UK has already managed to report on its macroeconomic statistics. As expected, inflation slowed down from 0.8% to 0.5%. This fully coincides with all forecasts and finally removes all doubts regarding what will be the outcome of tomorrow's meeting of the Board of the Bank of England. Yes, the British regulator will expand the quantitative easing program. Although the topic has been recently debated that the Bank of England has some margin for action in terms of interest rates. Naturally, this is a hint at the possibility of lowering the Bank of England refinancing rate. But for now, this is just rumor and speculation. There have been no statements on this issue from representatives of the Bank of England.

Inflation (UK):

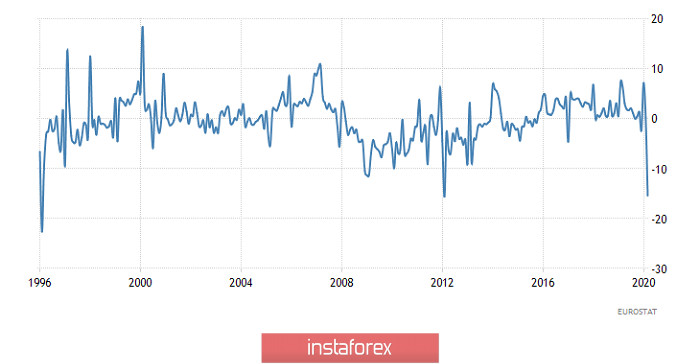

Inflation will be published in Europe today. However, the fact of its decline from 0.3% to 0.1% will not produce any particular effect. All this has long been considered by the market, exactly at the time of publication of the preliminary assessment. And what can we say here, when a number of European countries have already faced full-fledged deflation and no one is under any illusions that the entire Eurozone will inevitably slide into deflation. The only question is how long and how deep it will be. Of course, optimism does not add. But in Europe, data on the construction industry is still being published today, which should decline by another 34.2%. The picture looks quite depressing combined with a decline of 15.4% in the previous month. So there is really nowhere for the single European currency to grow, although it is unlikely to fall at least until the opening of the American session. Anyway, the data on construction in Europe do not belong to the category of such significance.

Scope of construction (Europe):

At the same time, we get the feeling that today is such a strange day since statistics on this issue are also published in the United States. However, the forecasts here are purely positive. After a rather impressive decline of 30.2%, the volume of construction of new houses should grow by 17.8%, particularly from 891 thousand to 1,050 thousand. In addition, the number of construction permits issued, which declined by 21.4% last month, may increase by 12.4%. That is, if 1,066 thousand permits were issued in April, then there should be 1,198 thousand in May. At the same time, the state of the American construction industry has a slightly greater weight than the European one. Thus, the dollar has every reason to rise following the forecasts.

New Home Construction (United States):

So, based on the available forecasts on macroeconomic statistics, the single European currency may decline to the level of 1.1200.

The pound may decline to the level of 1.2500 due to the same exact reasons.