Hello, dear colleagues!

If we start with the results of yesterday's trading, then, despite the rather pessimistic rhetoric of the Chairman of the US Federal Reserve System (FRS) regarding the timing of stabilization of the US economy from the consequences of COVID-19, the dollar strengthened. Let me remind you that yesterday the head of the Federal Reserve, Jerome Powell, delivered a semi-annual report to the US Senate Banking Committee. These speeches are two days long, and the second part of Powell's speech is expected today. Yesterday, the head of the Federal Reserve noted the uncertainty of the timing of the recovery of the US economy after the COVID-19 pandemic. Powell also noted that the coronavirus has caused significant damage to economic activity, especially small businesses. However, according to the Fed Chairman, the latest macroeconomic data instill some optimism about the economic recovery and inflation growth towards the Fed's 2% target. In general, yesterday's speech by Powell contained more cautious and negative notes than caused demand for the US dollar as a protective asset.

Before that, good reports on retail sales and industrial production on an annual basis also supported the US currency. It is also worth noting that data on the housing market and inventory in warehouses exceeded the forecasts of economists and were in the green zone.

Today, at 17:00 (London time), the second part of Jerome Powell's speech before the Senate Banking Committee will be held, and before that, at 13:30 (London time), data on the construction and laying of new homes in the United States will be published.

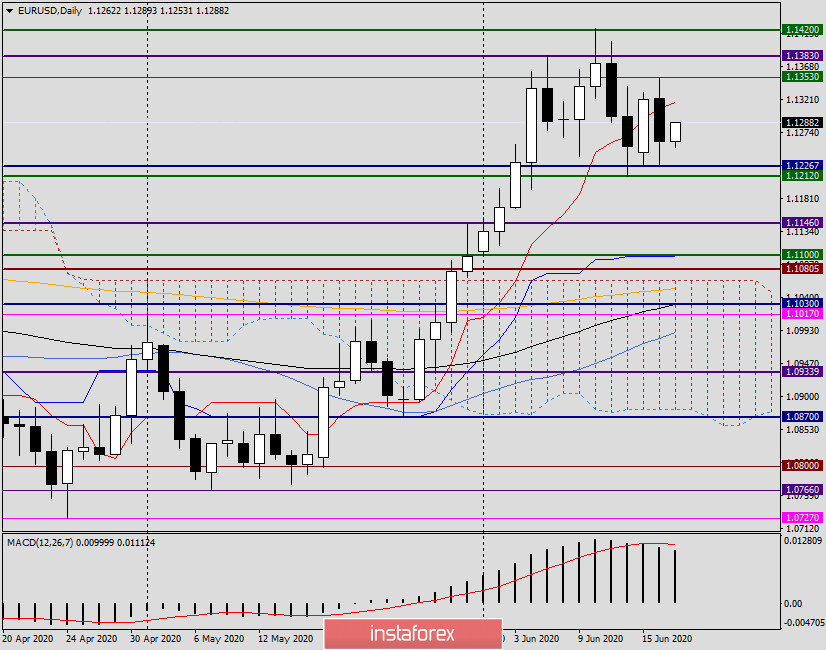

Daily

If we go to the technical part of the review, there is uncertainty among investors. This is obvious. After the growth on Monday, yesterday we saw the reverse dynamics, and today at the moment of writing, the pair is slightly strengthening.

Another interesting technical point is the barrage around the Tenkan line of the Ichimoku indicator. The price can not be fixed above or below this line, which does not give an idea about the further direction of the EUR/USD exchange rate.

On the daily timeframe, the possible growth targets will be 1.1317 (Tenkan), 1.1353 (yesterday's highs). Only the census of the maximum trading values on May 16 will give grounds to expect growth to a strong technical level of 1.1380. A break of this mark will open the way to the equally significant mark of 1.1420, where the further direction of the main currency pair of the Forex market will be decided.

The descending scenario will get a chance to be implemented after updating the minimum trading values of the last two days, as well as the breakdown of support at 1.1212. Only then will it become clear that it is the bears who run the market. At the moment, the probability of positioning in both directions remains. Let's look for options for opening positions on lower time frames.

H1

On the hourly chart, the pair is trading near the cluster of moving averages used: 200 EMA, 50 MA, 89 EMA. If the quote can rise above 1.1300 and consolidate above this important mark, we should expect a continuation of the rise towards yesterday's highs of 1.1353.

If the reversal patterns of Japanese candlesticks appear in the area of 1.1290-1.1308, it is time to count on the subsequent decline of EUR/USD and try selling the pair.

As for purchases, it is better to open them at more attractive low prices, that is, after the rollbacks down. It seems that a decline to the support area of 1.1230-1.1215 and the appearance of growth signals there will be a good reason to open long positions on the euro/dollar.

It is difficult to offer something more specific. The market is rushing in search of direction, and so far it remains in question.

Good luck!