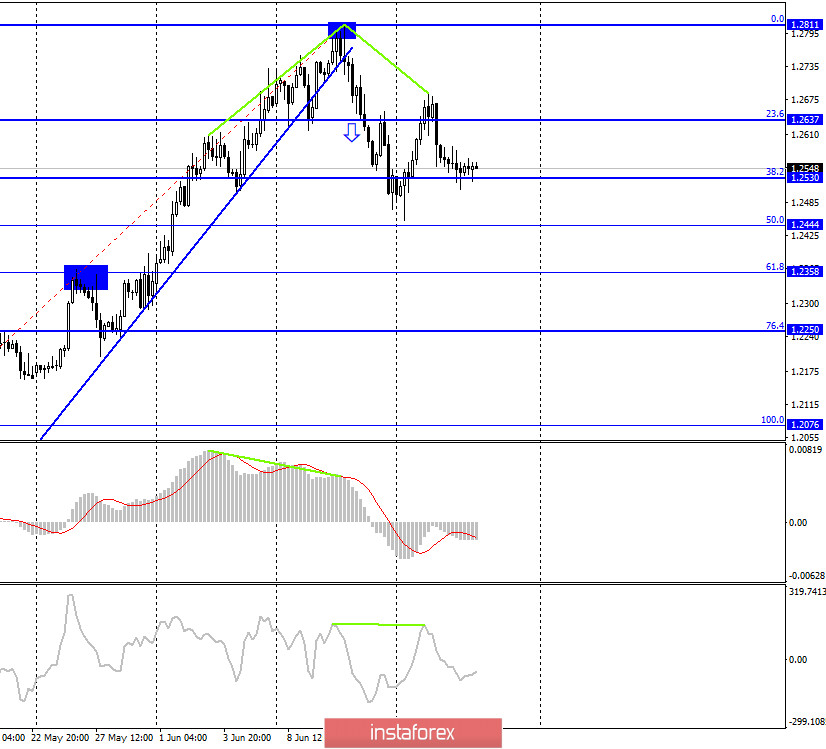

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues the process of falling within the downward trend corridor, which is more pronounced than for the euro-dollar pair. Thus, the mood of traders remains "bearish" for the British. There are also no interesting reports coming from the UK at the moment, which leads to a slight drop in the activity of traders. For example, yesterday the pound/dollar pair went a short distance, quite possibly since no information was received at all. And this applies to both the UK and the US. First, there is still no progress on the Brexit negotiations. Second - no new information on the skirmish with China, on the issue of Hong Kong and retaliatory sanctions. In general, traders are now on an information diet. Although the results of the Bank of England's meeting will be summed up today, during which a decision may be made to expand the volume of asset repurchases from 645 billion to 745 billion. This may help traders to start selling the pound again. Closing the pair above the trend corridor will increase the probability of resuming the growth process of the pair.

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair also performed a reversal in favor of the US dollar and fell to the corrective level of 38.2% (1.2530). Thus, the rebound of quotes from this Fibo level will allow traders to expect a reversal in favor of the British currency and a resumption of growth in the direction of the corrective level of 23.6% (1.2637). Closing the pair's exchange rate below the Fibo level of 38.2% will increase the probability of a further fall towards the next corrective level of 50.0% (1.2444). Today, the divergence is not observed in any indicator.

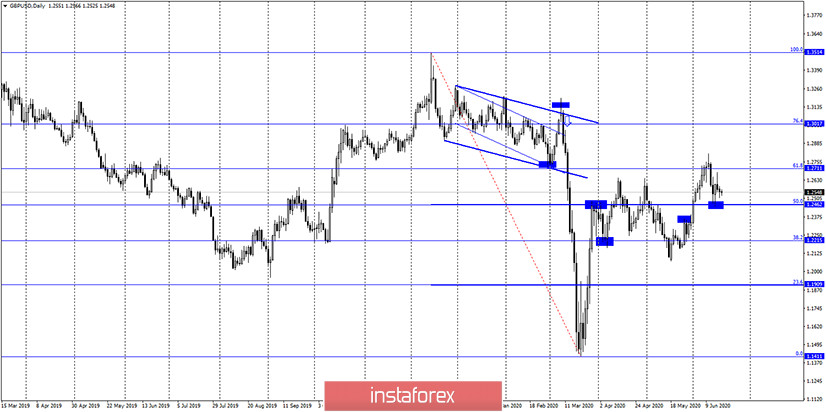

GBP/USD – Daily.

On the daily chart, the pair's quotes fell to the corrective level of 50.0% (1.2462) and rebounded from it. Thus, traders can now expect growth in the direction of the corrective level of 61.8% (1.2711). However, more important is the 4-hour chart, where growth is also possible and the "bearish" mood of traders remains.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Wednesday, the UK released a report on inflation, which fell from 0.8 y/y to 0.5% y/y. Thus, there were few reasons for traders to buy the British dollar yesterday. The mood of traders was not lifted by Jerome Powell, so the British dollar continued to fall for most of the day.

The economic calendar for the US and the UK:

UK - the decision on the main interest rate of the Bank of England (11:00 GMT).

UK - planned volume of asset purchases by the Bank of England (11:00 GMT).

UK - summary of monetary policy (11:00 GMT).

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On June 18, the results of the next meeting of the Bank of England will be published in the UK. This is the most important event of the day.

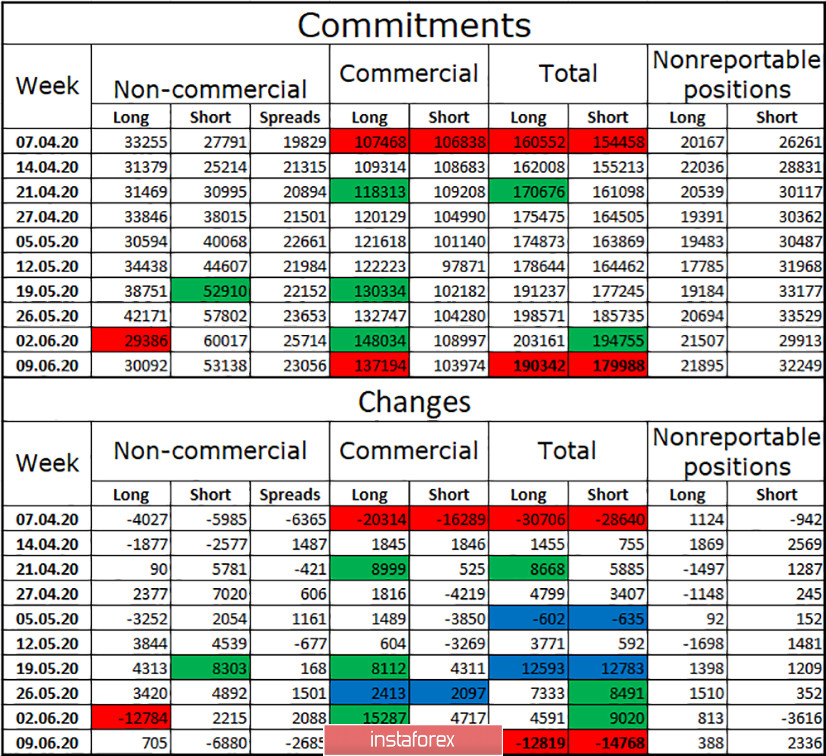

COT (Commitments of Traders) report:

Last Friday, a new COT report was released that showed a strong reduction in short contracts among the "Non-commercial" group. This same group of large traders opened 705 long contracts, but in total it turns out that they did not buy the British currency, but increased demand for it by reducing the number of sales of this currency. The "Commercial" group, which is less important, on the contrary, got rid of purchases of the pound, but at the same time getting rid of short contracts. In total, the number of long contracts and the number of short contracts decreased during the reporting week. The pound continues to enjoy very dubious and weak interest among major players. However, this still allows it to grow from time to time, as it has in the past two weeks. Given the fact that speculators did not increase purchases of the British currency, I do not believe that it will continue its growth.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goals of 1.2444 and 1.2358 if a new consolidation is made under the level of 38.2% (1.2530) on the 4-hour chart. I recommend opening purchases of the pair after closing above the trend corridor on the hourly chart with the goal of 1.2811.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.