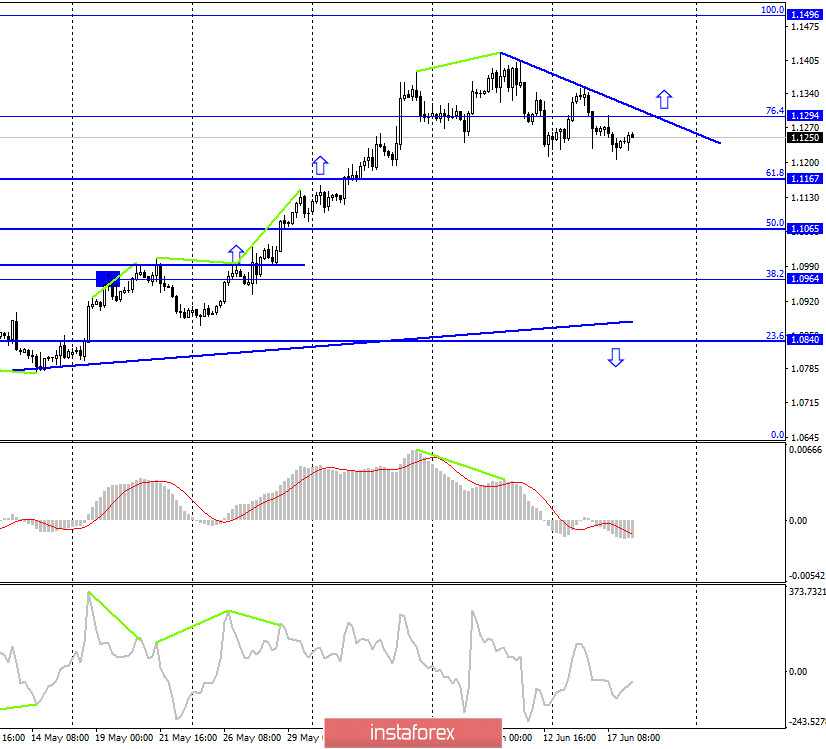

EUR/USD – 1H.

Hello, traders! The euro/dollar pair continues its unintelligible movement inside the downward trend corridor on the hourly chart on June 17. Thus, in general, we can say that the mood of traders remains "bearish". Only the closing of the pair's rate above the corridor will allow traders to count on the more or less strong growth of the pair. Yesterday, the Fed Chairman made another speech to the US Congress. However, this time nothing was interesting in Powell's speech since it completely duplicated the speech the day before. Thus, the previous speech of Powell was not supplemented with new information and in general remains quite contradictory, as there was a lot of optimism, but also a lot of pessimism in Jerome's words. The markets calmed down very quickly about this. There was no further news yesterday. Many topics that traders were very concerned about are now on pause. No information has been received from Hong Kong or China in the past week. It seems that Beijing and Washington have signed a truce or, on the contrary, are preparing for new attacks on each other.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair also performed a reversal in favor of the US currency and continued the process of falling. The pair's quotes again closed under the corrective level of 76.4% (1.1294), which increases the chances of continuing the fall in the direction of the next Fibo level of 61.8% (1.1167). The downward trend line also indicates a "bearish mood" of traders. Closing the pair's exchange rate above it will work in favor of the European currency and resume growth in the direction of the corrective level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed a fall to the Fibo level of 127.2% (1.1261) and closed under it with great difficulty. Thus, now the fall in quotes can be continued in the direction of the next corrective level of 100.0% (1.1147), which corresponds to the indications of the younger charts.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is postponed.

Overview of fundamentals:

On June 17, the European Union released the consumer price index for May, which fell to 0.1% y/y. There was also a speech by Jerome Powell in Congress, however, no new information was given.

News calendar for the United States and the European Union:

US - number of initial and repeated applications for unemployment benefits (12:30 GMT).

On June 18, the EU news calendar was empty again. And in the US, a new report on applications for unemployment benefits will be released, which traders have recently stopped paying attention to. Thus, the information background for the euro/dollar pair will be almost absent today.

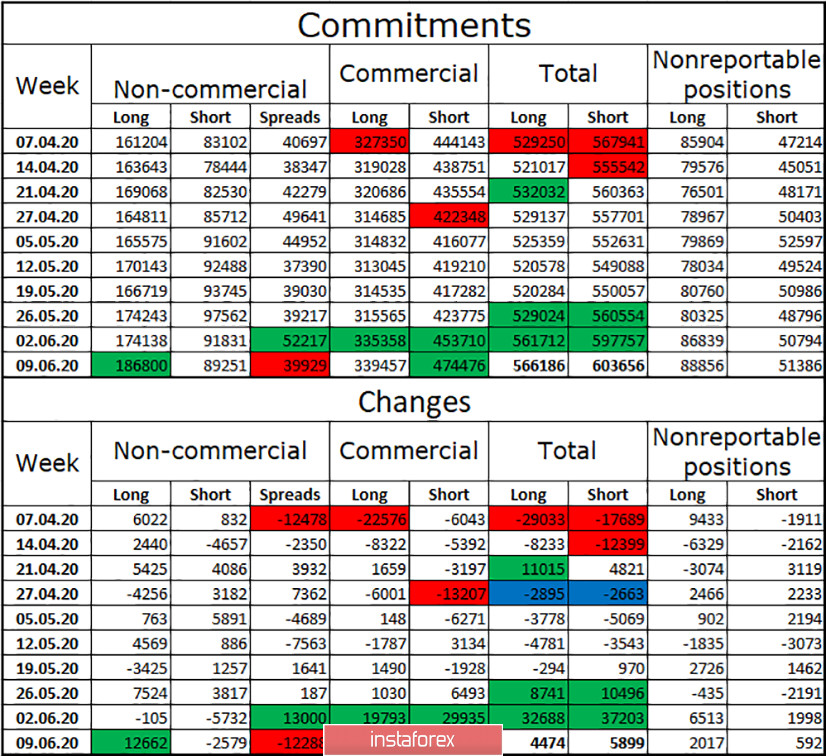

COT (Commitments of Traders) report:

The latest COT report showed very interesting changes in the mood of large traders. For example, the "Non-commercial" group has increased the number of Long-contracts by 12,500, while not forgetting to get rid of short-contracts. Since it is believed that this group drives the currency market, nothing is surprising in the growth of the European currency, according to this report. Hedgers very logically recruited opposite contracts, since this is the essence of their activity (+20766 short contracts). Thus, over the past two weeks, the euro currency has lost 8 thousand short contracts and gained 12,500 long contracts. The most interesting thing is whether this mood will remain among traders, which will allow the euro currency to continue the growth process? Recent days show that bull traders are fed up with buying the euro currency.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1167, as a new close was made under the level of 1.1294 on the 4-hour chart. Purchases of the pair can be opened when closing above the ascending corridor on the hourly chart or above the trend line on the 4-hour chart with a goal of 1.1496.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.