"Neither fish nor fowl"

Hello!

Yesterday's market sentiment was driven by new cases of COVID-19 in Beijing and in several US states. Also, investors focused on the second part of the monetary policy report by Fed Chairman Jerome Powell. In particular, the head of the Fed confirmed that the rates will remain at current low levels until the US economy recovers from the coronavirus impact. The Fed's Chair considers it unreasonable to introduce negative interest rates at the moment. But the support of small businesses and the unemployed remains the priority. In addition, Powell confirmed that the regulator will continue to purchase corporate debt securities. In general, there was nothing particularly new in Jerome Powell's speech.

Yesterday's eurozone inflation data for May, as expected, showed a slowdown. This was a direct result of restrictive measures introduced to curb the COVID-19 pandemic. On a monthly basis, inflation in the eurozone dropped to -0.1% and increased by 0.1% year-on-year.

If we talk about COVID-19, it is too early to say that coronavirus has been defeated, even though restrictions in many countries have been lifted. For instance, new virus outbreaks in Beijing prove that the worst is yet to come. Moreover, some virologists believe that the new type of COVID-19 may be much more dangerous than the previous one. In the meantime, cafes and restaurants, as well as other small businesses, are reopening in many countries, with some safety measures being observed.

In general, the situation in the world is very unstable. After quarantine restrictions and self-isolation, countries began to revive but in an unexpected way. The murder of the African-American by the police in Minnesota sparked a wave of protests, demonstrations, and riots in support of the black population. It also led to the demolition of the monuments of the founding fathers who are now considered colonizers and enslavers.

In addition, the relations between South and North Korea have seriously deteriorated, and all agreements have been forgotten. Earlier, US President Donald Trump addressed the Korean conflict, making loud statements, but practically did nothing. Washington's attempts to influence Pyongyang revealed the weakness of the White House administration policy. North Korea advised the United States to deal with their own problems instead of interfering into other countries' affairs. Now let's move on to the technical analysis of the main currency pair.

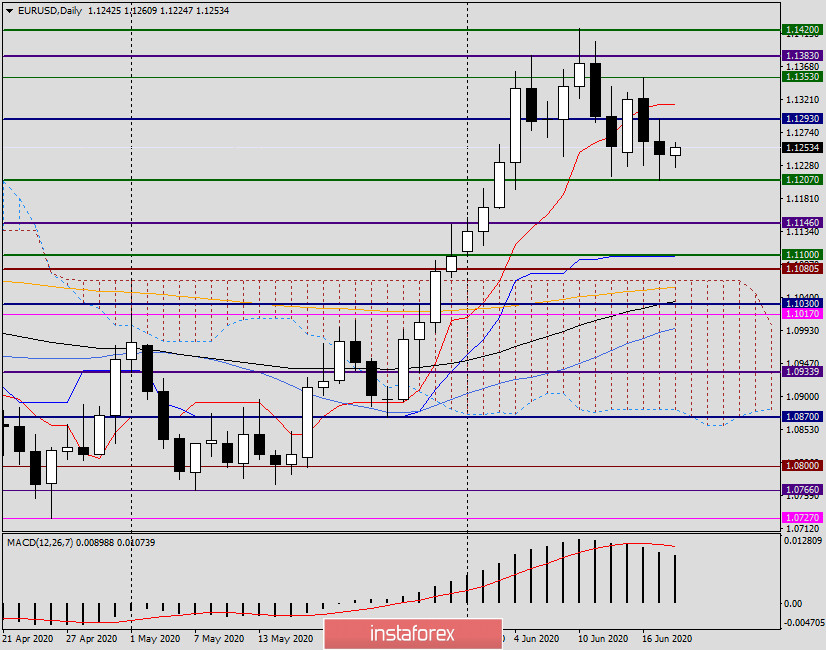

Daily chart

On the daily chart, the situation with the EUR/USD is no less complicated. Yesterday's attempts to continue growth have failed. The pair faced resistance at the level of 1.1293 and then pulled back to the downside and tried to break through the support level at 1.1212. However, the pair did not complete the breakthrough. Instead, it tested the low of 1.1207 and rebounded after that. As a result, the pair finished the trade on June 17 at the level of 1.1243. As the saying goes: "Neither fish nor fowl."

To resume the upward trend, the price needs to settle above 1.1300 and break through the Tenkan line of the Ichimoku indicator which is located at 1.1314. And this is just the beginning.

As for the bears, they need to settle firmly below the key level of 1.1200 to continue their trend. As we can see, both the bulls and the bears did not succeed.

Today I will outline the nearest and most important levels of resistance and support.

The level of resistance is seen at 1.1293 (yesterday's high), 1.1314 (Tenkan line) and 1.1353 (highs from June 16). The support level is set in the area of 1.1210-1.1200. At the same time, I should note that in case of a true breakthrough of the 1.1200 level, the bearish trend in the pair will become much stronger.

Conclusion and trading recommendations for EUR/USD

As you can see, it is not clear yet which positions are better to open. Both buy and sell positions are possible but with closer targets. For those who prefer buying on the pullbacks, I'd recommend taking a closer look at the price range of 1.1215-1.1210. Those who trade on the levels' breakouts can try opening long positions after the price breaks through the level of 1.1300.

It is better to place short positions after the price climbs to the area of 1.1290-1.1300. Those of you who trade on the breakouts should sell after the price breaks through the key support level at 1.1200. That's probably all for today.

Good luck!