Technical analysis recommendations for EUR / USD and GBP / USD on June 18

Economic calendar (Universal time)

8:00 ECB Monthly Report

9:30 Target operations of long-term refinancing of the ECB

11:00 Bank of England Interest Rate Decision

11:00 Bank of England QE Total

11:00 Minutes of the meeting of the Bank of England Monetary Policy Committee

12:30 The index of industrial activity from the Federal Reserve Bank of Philadelphia

12:30 Philadelphia Federal Reserve Employment Index

12:30 Number of applications for unemployment benefits

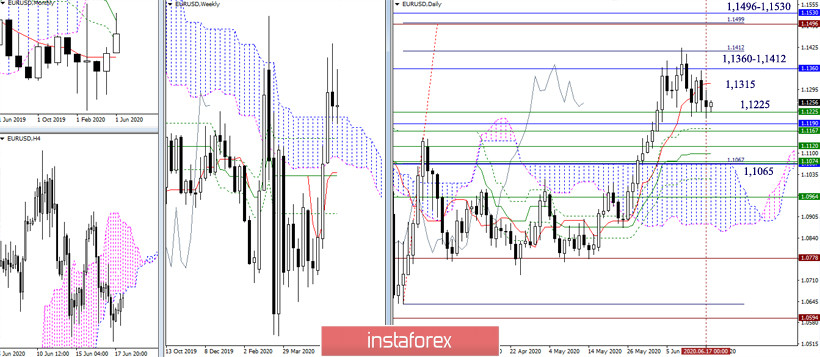

EUR / USD

The pair continues to work on a downward correction scale, which has not yet been developed due to the presence of a sufficiently strong and wide support zone. Support is now at significant levels of the Ichimoku indicator from various time intervals, concentrated in the region of 1.1225 - 1.1065. Each of the levels could separately serve as the reason for the completion of the daily correction, so there is a small probability that players to decline in the current situation will be able to change the trend that has taken shape the other day and which has emerged in the upper halves. The nearest resistances maintain their location and value at 1.1315 (daily Tenkan) - 1.1360 - 1.1412 (monthly Kijun + last week's maximum) and 1.1496 - 1.

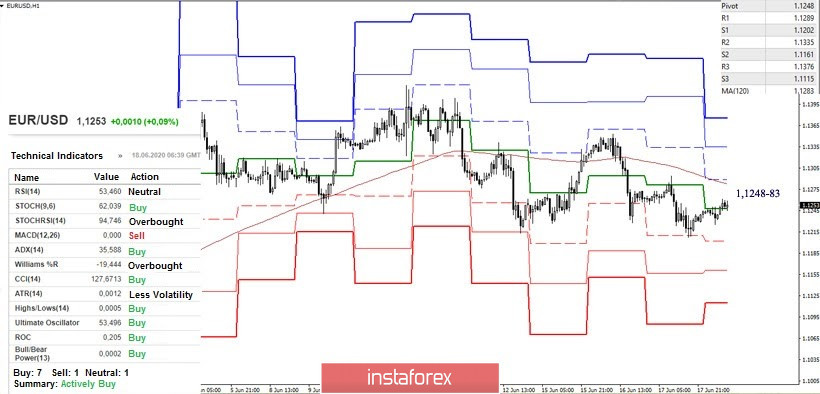

In the lower halves, the main advantage on the side of the players is to lower, although we still do not see significant performance from them. Support within the day in the form of classic pivot levels today can be noted at 1.1202 - 1.1161 - 1.1115. At the moment, on H1, the pair is in the zone of upward correction again and is testing key resistance located in the area of 1.1248-83 (central Pivot level + weekly long-term trend). Consolidating higher and reversing the moving will strengthen the bullish moods. In this case, the task of the players to increase will be to break through the nearest resistance and restore the daily trend (1.1422).

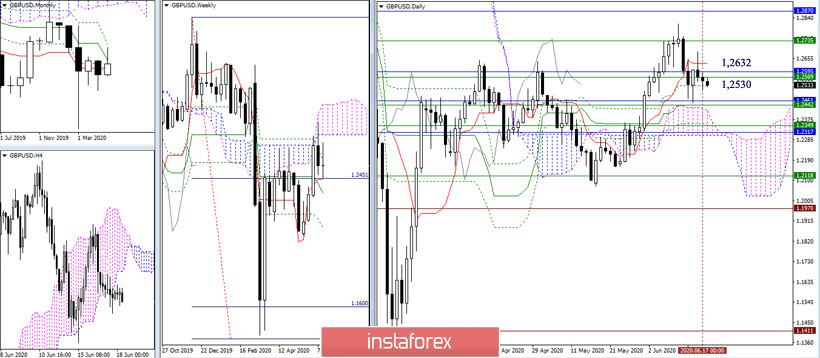

GBP / USD

The uncertainty that was predicted at the beginning of the week does not allow the pound to achieve results in any of their directions. As a result of yesterday, the pair remained in the zone of attraction of levels: 1.2632 - 1.2595 -1.2569 -1.2530 (daily cross + monthly Kijun + weekly Fibo Kijun) again. In this situation, the conclusions and expectations voiced earlier retain their relevance. The support remains in place 1.2460 - 40 (weekly and monthly Tenkan + daily Kijun + upper cloud border) and 1.2305 - 50 (lower boundary of the daily cloud + weekly Kijun + monthly Fibo Kijun). On the other hand, the nearest resistances are located at 1.2735 - 1.2812 - 1.2870 (lower border of the weekly cloud + monthly Fibo Kijun + maximum extreme).

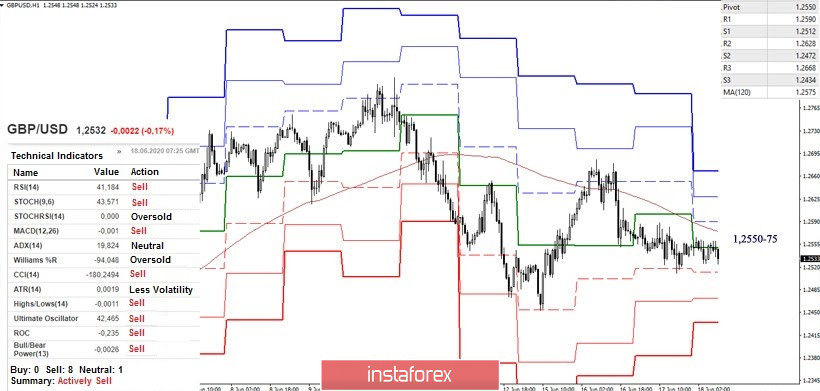

On lower time frames, the advantage due to the analyzed technical instruments now belongs to the players to decline. The downward trends within the day are the support of the classic Pivot levels 1.2512 - 1.2472 -1.2434. The key resistances (weekly long-term trend and central Pivot level) today are joining forces at 1.2550-75. Price consolidation above will allow players to raise their thoughts on breaking through the attraction and resistance of the levels of upper halves (1.2595 - 1.2632).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)