An economic summit will be held today in the EU via video conference, at which, most likely, EU representatives will raise the issue of the assistance plan proposed by the European Commission, which involves raising € 750 billion euros in debt directly to financial markets. Such a factor slightly decreased the current pressure on the euro, as it is still unclear whether the program will be approved or not. If it is passed, demand for the euro will continue to lower, as it will strengthen the disputes of the northern EU and southern EU, even though the additional financing will help the eurozone economies recover more quickly from the pandemic crisis. In addition, the question of who will pay the debts remains a big concern to the people,

Approving the aforementioned plan will require rather difficult and compromise decisions, primarily with the northern EU countries, with which there are now the deepest disagreements. This is due to the reports that say approximately 40% of 500 billion can be used to save the economies of Italy and Spain, in which if implemented, can lead to quite serious questions about the size of the shares of grants and loans. The four countries who have opposed the earlier Franco-German agreement, Netherlands, Denmark, Austria and Sweden, also protested such a plan, as its approval will just increase the political risks within these countries, since taxpayers are to be the ones to pay off the debts taken to support the southern European countries.

If the meeting today does not result in specifics in this direction, the euro can strengthen its position in the short term by the end of the week.

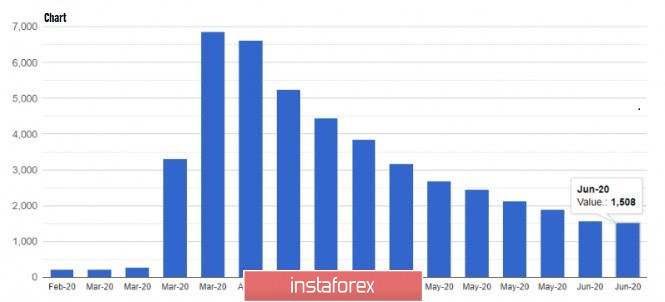

As for the macroeconomic reports published yesterday, a report by the US Department of Labor indicated that over the week of June 7-13, the number of initial applications for unemployment benefits fell by 58,000 to 1.5 million, which indicates the stabilization of the situation after the jump of figures in April. However, it also indicates that lay-offs increased at a fairly high rate, which persisted as the coronavirus pandemic remains in the United States. For secondary applications of unemployment benefits for the week from May 30 to June 6, the figure decreased by 62,000, to 20.54 million.

Fed representatives, including Fed Chairman Jerome Powell, repeatedly drew attention to the need to support the most vulnerable people who suffered during the pandemic. Thus, the US Congress is now considering another package of unemployment assistance, as well as the possibility of increasing unemployment benefits.

Meanwhile, data on the growth of the economic index, which indicates economic cycles in the US, supported the US dollar in the afternoon. The increase in activity after the mitigation of quarantine restrictions resulted in positivity on the index, in which according to the Conference Board, the leading indicators index in May 2020 increased by 2.8% compared with the previous month, amounting to 99.8 points. Economists expected the indicator to grow by only 2.4% in May.

Manufacturing activity in the area of Philadelphia Fed also pleased traders, as the report indicated an increase in the index in June this year. According to the data, the leading index of business activity in June this year finally to 27.5 points against -43.1 points in May, while economists expected the index to be -20 points.

With regards to Fed statements, Loretta Mester, head of the Cleveland Fed, said yesterday that it would require strong support from the authorities and a long time for the economy to recover. According to her, it would take at least two years for the economy to return to its pre-pandemic state, which is why new fiscal support measures are being developed.

As for the technical picture of the EUR / USD pair, demand for the euro could decrease sharply today, depending on the results of the upcoming EU summit. Bulls will work on a return to the resistance level of 1.1230, which will lead to a more confident increase in risky assets due to the demolition of stop orders of speculative sellers. Such a scenario could also lead to the update of highs at 1.1290. However, if pressure on the euro continues, the next support levels will be in the area of 1.1160 and 1.1100.

GBP / USD

The British pound remains under pressure after the decision of the Bank of England yesterday to expand its bond purchase program by another £ 100 billion pounds and maintain interest rates at its current levels. Additional problems were also provided by the reports that claim that the EU does not intend to reciprocate the UK, which plans to introduce a six-month grace period for customs duties after the end of the Brexit transition period. Such a solution would help partially alleviate the problems that companies and businesses may experience after the complete breakdown of previous trade relations. The EU was assured that from January 1, 2021, there will be no more exemptions for goods from the UK. All imports will undergo full customs control and inspection.

The pound was also not supported by the recent statement of Bank of England Governor Andrew Bailey, who said that the economic downturn in the UK is not as deep as the central bank suggested. Bailey reassured the markets, noting that negative rates and controlling the yield curve were not discussed at the meeting. If the Bank of England nevertheless makes such a decision, it will have a serious impact on the income and profits of banks, insurance companies and pension funds. Accordingly, the reaction of the British pound to this decision will be similar. However, one should not be afraid that the decline will occur simultaneously, as markets will approach this scenario gradually.

Bailey also noted that despite the problems observed in the labor market, the data on industrial production signals a faster economic recovery.

Meanwhile, traders are wondering why Bank of England Chief Economist Andy Haldane voted yesterday against increasing the quantitative easing program. It arose theories that perhaps, the chief economist thinks that negative interest rates would be a more effective tool at this stage.

As for the technical picture of the GBP/USD pair, the bears should more actively fight today to protect the resistance at 1.2480 and in no case should the trading instrument return above the level of 1.2450. A breakout from the support level of 1.2405 will only increase pressure on the pound, which will lead it directly to the monthly lows 1.2340 and 1.2290.