The UK retail sales data has stopped the pair's downward movement. The pair moved up from a 3-week low of 1.2104. However, long positions on the pair are still rather risky. Any rise is a signal to open short deals. Today's retail sales report proved that the country's economy is recovering. However, the BoE's dovish rhetoric, economic record lows, and stagnation in the negotiations between London and Brussels are weighing on the pound sterling. Only one positive report cannot support the UK national currency. Moreover, today's figures are strong only at first sight.

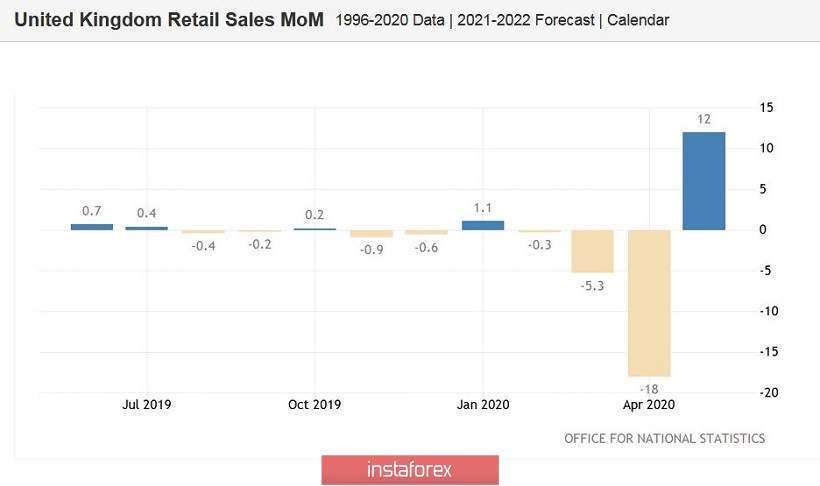

Of course, the main tendency is positive. The UK consumer activity is advancing despite the ongoing pandemic. In May, the UK authorities have loosened the containment measures. As a result, the general volume of retail sales (including fuel) climbed by 12% on a monthly basis and dropped by just 13.1% on a yearly basis. Both indicators exceeded the forecasts. Retail sales without fuel advanced by 10.2% on a monthly basis against the forecast of a 4.5% rise. On a yearly basis, the indicator declined by 9.5% instead of a 14.5% drop.

In other words, the indicator, on the one hand, significantly exceeded the expectations of experts. In fact, most analysts had expected this trend amid the easing of the quarantine measures. Compared to April, there is a clear upward dynamic, which points to the economic recovery. However, if we take a bigger time period, we will see that the retail sales indicators remain lower than in 2019. Moreover, some experts doubt that the current jump may help to disperse the economy after such a strong 20% decline. Thus, today's release did not allow the pound/dollar bulls to develop a large-scale price movement. As a result, traders have started to sell it off again.

At the moment, any rise should be used as a reason to open short positions. The pound sterling is under pressure of many fundamental factors. First of all, it is Brexit and relations between London and Brussels. As recent events have shown, there is no success in the negotiations. Boris Johnson's online meeting with the EU leadership have not brought any results. The head of the European Commission, Ursula von der Leyen, said that the parties had not even reached "the middle of the road". She also noted that at the moment, no one could predict the stage of the negotiations at the end of this year. That is why Boris Johnson's intention to come to an agreement by the end of July looks impossible.

The European Parliament also added fuel to the fire. It accepted its own recommendations for the ongoing negotiations. The political Declaration that the parties agreed on last year remains the framework for further dialogue. The European Parliament also insists on the full implementation of the Brexit agreement, including all additional protocols. Foreign Affairs committee chair, David McAllister, said that the European Parliament will hardly come an agreement with Britain. At the end of June, the first face-to-face talks between the parties are expected to take place.

Assessing the prospects of the British currency, we should not forget about the results of the June meeting of the Bank of England. To the surprise of many market participants, the head of the English regulator again spoke about the possible introduction of negative rates. BoE's economists are studying the relevant experience of other central banks. It is an unexpected event. Thus, the pound sterling tumbled by more than 150 pips against the US dollar.

According to the fundamental analysis, the pound sterling remains weak. Thus, any attempt to rise should be used to open short deals on the pound/dollar pair towards the support level of 1.2300 (the lower border of the Kumo cloud on the daily chart).