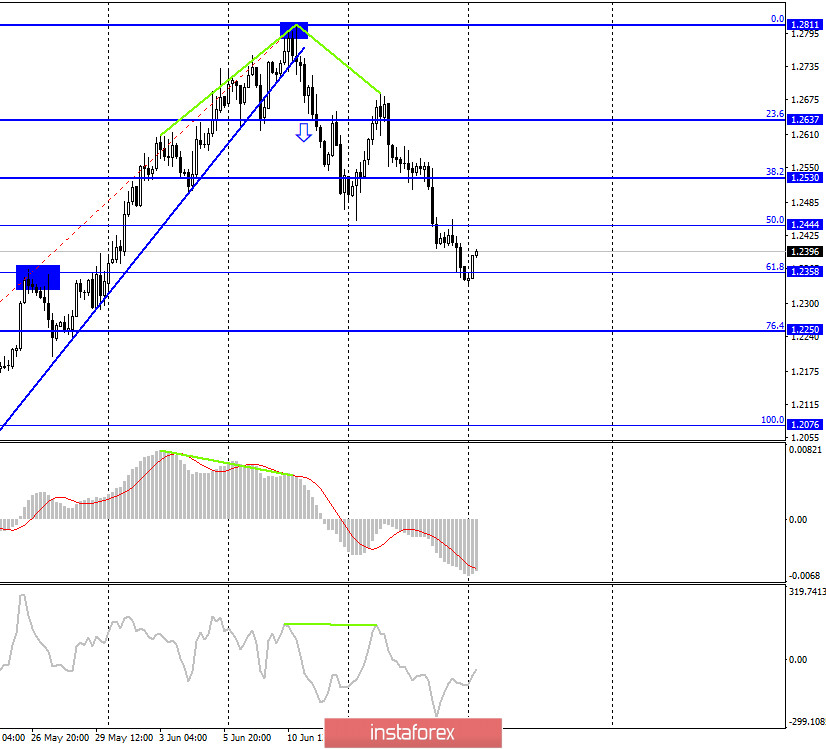

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair on Friday continued the process of falling within the downward trend corridor, which characterizes the current mood of traders as "bearish". The information background on Friday for the pound/dollar was the same as for the euro/dollar. That is, it was expressed only by the speech of Jerome Powell. But from the UK, traders still can't wait for any interesting information. The British dollar has managed to improve its position quite significantly in the last three weeks, however, the last week has already passed under the aegis of high demand for the US dollar. And at the moment, the mood of traders does not change. Given that the information background from the UK is currently absent, all attention is still focused on America. But it is difficult to say what should happen in America for traders to stop buying the dollar. Probably, a new escalation of the conflict with China is needed, then international investors may begin to fear the consequences of a new trade conflict or the "cold war". But I don't think things will go that far between Beijing and Washington any time soon. Although, given the fact that the US President is Donald Trump, you can expect anything.

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair performed a fall to the corrective level of 61.8% (1.2358), however, it seems that it is going to rebound from it with a reversal in favor of the British and start the growth process in the direction of the corrective level of 50.0% (1.2444). Fixing the pair's exchange rate under the Fibo level of 61.8% will work in favor of the US currency and resume the process of falling in the direction of the corrective level of 76.4% (1.2250). Today, the divergence is not observed in any indicator.

GBP/USD – Daily.

On the daily chart, the pair's quotes continue the process of falling and closed under the corrective level of 50.0% (1.2462), which allows us to count on the continuation of the fall in the direction of the Fibo level of 38.2% (1.2215). More important now is the 4-hour chart, which preserves the "bearish" mood of traders, however, a correction is possible.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Friday, the UK released a report on retail trade, which can even be called encouraging, as the final figures were not as weak as expected by traders. Compared to April, retail sales increased by 12%.

The economic calendar for the US and the UK:

On June 22, no major reports or events are expected in the UK or the US. There will be no background information on this day.

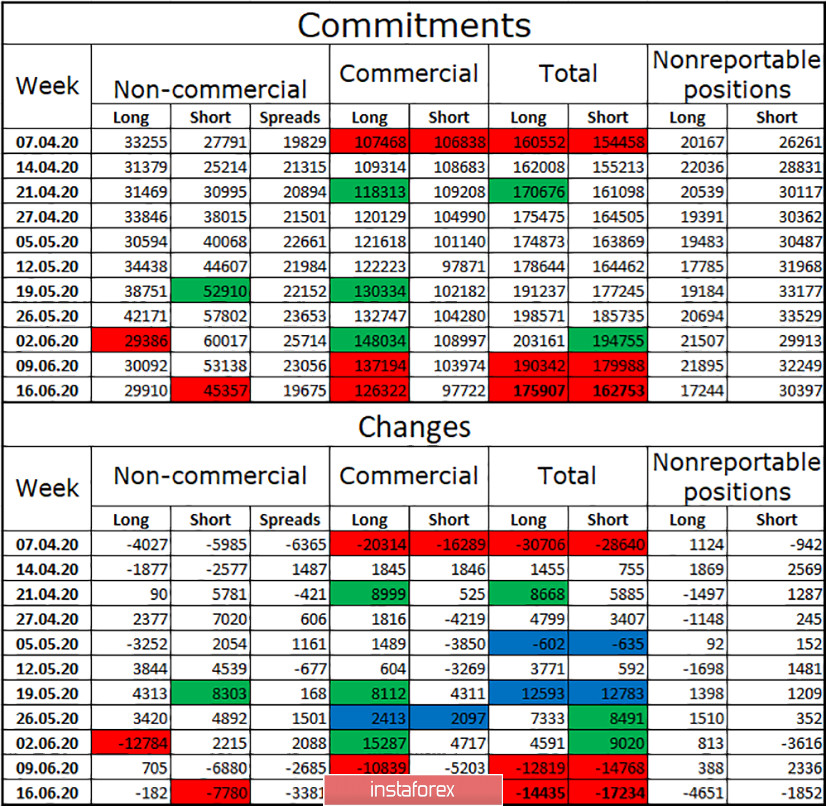

COT (Commitments of Traders) report:

The latest COT report showed the second consecutive strong reduction in short contracts among the "Non-commercial" group - by 7780 units. This same group of large traders also got rid of long contracts. Thus, among speculators, the Briton did not arouse any interest in the reporting week. Also, the Commercial group got rid of short and long contracts. And in total, the "Total" group also lost about 32 thousand contracts. A week earlier, let me remind you, it was -25 thousand. Thus, major market players now do not buy the pound and do not sell it. Most likely, assets are being transferred to other more interesting currencies. However, this is not the euro, which also shows a reduction in the reporting week. The deadline for the latest report is June 16. After this date, the pound began to fall, so the new COT report should show a strong reduction in long contracts for speculators or a strong increase in short.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goal of 1.2250 if the consolidation is made under the level of 61.8% (1.2358) on the 4-hour chart. I recommend opening purchases of the pair after closing above the trend corridor on the hourly chart with the goal of 1.2637.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.