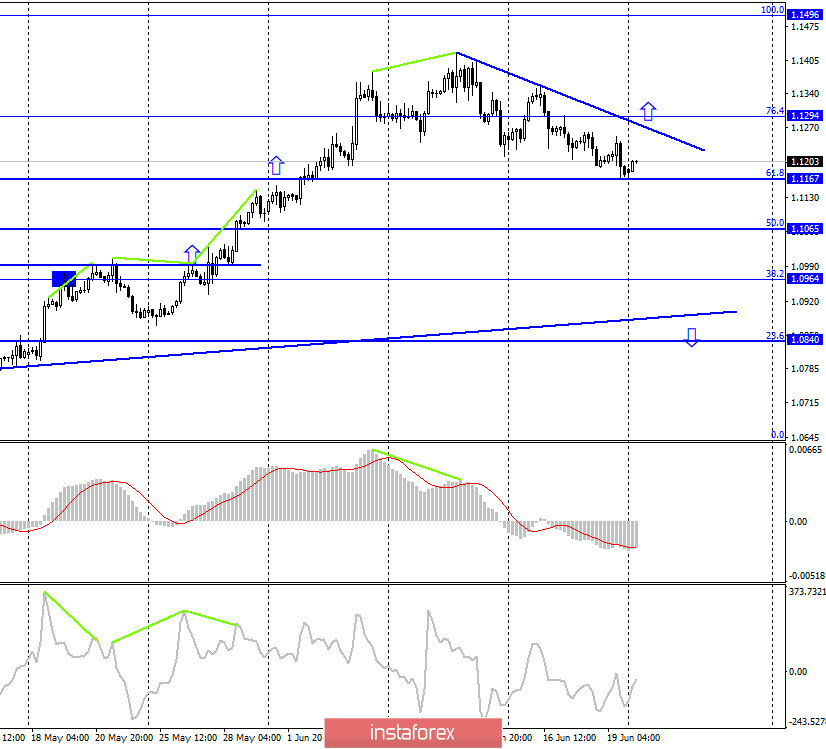

EUR/USD – 1H.

Hello, traders! As seen on the hourly chart, the euro/dollar pair continued a stable drop in quotes within the downward trend corridor. Thus, the main conclusion remains unambiguous - traders remain "bearish". As for the information background, the entire past week was devoted to the speeches of Jerome Powell, of which there were three. On Friday, the last one took place, however, it was not much different from the previous two. In general, Powell said that the US economy needs additional funds to counter the effects of the coronavirus, called on Congress to approve new aid packages, and said that the US economy will recover long and hard. And the final result of recovery will depend solely on the results of the fight against COVID-2019. In general, it is difficult to say whether these speeches were positive or negative. The dollar has been growing throughout the week, so Powell's speech did not spoil the mood of bear traders. In the European Union, nothing interesting happened on Friday. The results of the EU summit have only become known, however, no decisions have been made regarding the 750 billion euro aid package.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair fell to the corrective level of 61.8% (1.1167). The current chart also has a downward trend line, which also characterizes the mood of traders as "bearish". The pair's rebound from the Fibo level of 61.8% will allow traders to expect a reversal in favor of the European currency and some growth in the direction of the trend line. Closing quotes above this line will increase the probability of further growth in the direction of the corrective level of 100.0% (1.1496). Fixing quotes below the Fibo level of 61.8% will increase the chances of continuing to fall in the direction of the next corrective level of 50.0% (1.1065).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation under the Fibo level of 127.2% (1.1261). Thus, now the fall in quotes continues in the direction of the next corrective level of 100.0% (1.1147), which corresponds to the indications of the younger charts.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is being postponed for now.

Overview of fundamentals:

On June 19, there was no news in the European Union again, and in the US, Federal Reserve Chairman Jerome Powell spoke again. All day long, traders continued to get rid of the euro currency and increase dollar purchases.

News calendar for the United States and the European Union:

On June 22, the news calendar in the European Union and America is completely empty. Thus, the information background today will not help traders in trading.

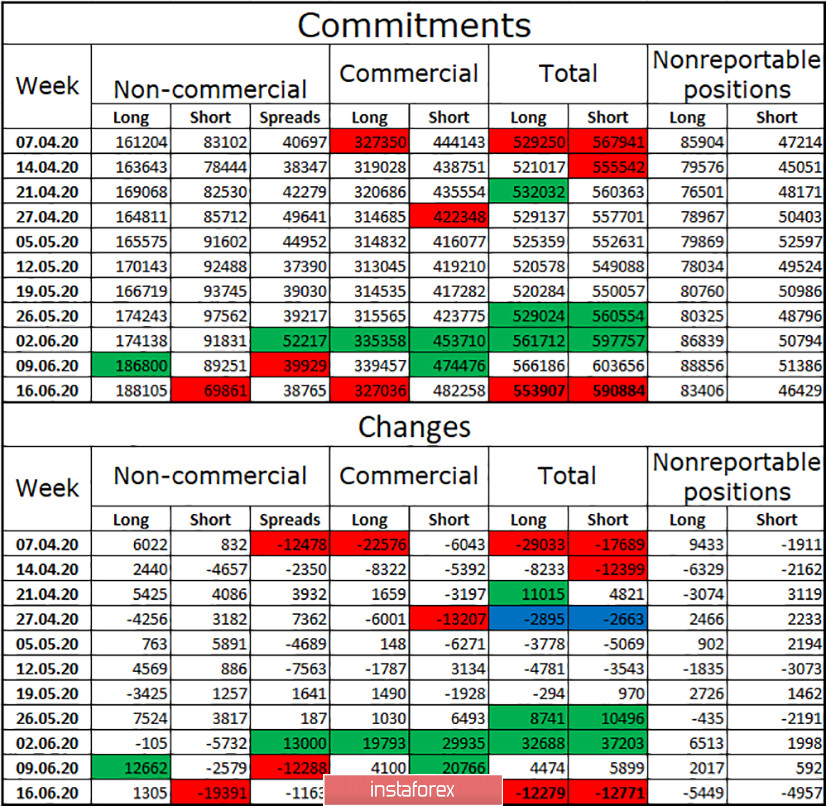

COT(Commitments of Traders) report:

The latest COT report, released last Friday, showed very interesting changes. First, the "Non-commercial" group, which is considered the most significant, has been actively getting rid of short-term contracts for the euro during the reporting week. It seems that this was the reason for the growth of the euro currency in the reporting week (until June 16). Major traders almost never opened long contracts. Secondly, hedgers "picked up" not all the contracts dropped by speculators, increasing only 7783 contracts for sale, but getting rid of 12,500 contracts for purchase. In total, the euro currency lost 25 thousand contracts. Thus, major market players lost interest in the euro currency during the reporting week in any case. Perhaps because the US dollar is becoming attractive again. In any case, the demand for the euro has been growing over the past two reporting weeks. However, the drop in prices last week suggests that the major players may have already had enough.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1065, if the close is made under the level of 1.1167 on the 4-hour chart. Purchases of the pair can be opened when closing above the ascending corridor on the hourly chart or above the trend line on the 4-hour chart with a goal of 1.1496.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.