The dollar continues to be under the background pressure of many fundamental factors. The dollar index showed a downward trend during the US session on Monday, reflecting a significant decline in demand. At the moment, dollar bulls are trying to return to the framework of the 97th figure, but their behavior is uncertain. After Friday's rally, the greenback was unable to maintain its position, and the increased interest in risk only exacerbated the situation of dollar bulls. Actually, the growth itself was due to a surge in anti-risk sentiment: the risk of the second wave of the epidemic and geopolitical conflicts made traders nervous, while the dollar, in turn, skimmed off the situation.

But this week, the external fundamental background changed its color quite sharply, increasing interest in risky currencies. First of all, the degree of intensity of geopolitical tension decreased. India and China sat down at the negotiating table and exchanged prisoners, while North Korea did not realize the threat of a military invasion of the South - Pyongyang decided to limit itself to (so far) a "propaganda war". The North Korea's military were brought back to the border with South Korea, and North Korean printing houses printed more than 12 million campaign leaflets. These events do not have any significant significance in the context of the foreign exchange market, so the market switched to other fundamental factors that were not in favor of the dollar.

First, dollar bulls were disappointed with the rhetoric of White House Economic Adviser Larry Kudlow. He commented rather vaguely and uncertainly on the prospects for adopting the next US economic assistance program. The official suggested that a corresponding agreement "may well be reached this summer", but no decisions have been made in this regard at the moment. He also said that even the estimated amount of aid has not yet been determined.

It is worth recalling that in the second half of May, US Treasury Secretary Steven Mnuchin said that the White house is seriously considering additional direct payments to people "as part of the bill for the next phase of anti-crisis assistance in connection with the coronavirus." According to him, the help should also be given to industries that are trying to resume work, including the hotel business and tourism. Later, in an interview with one of the TV channels, he said that he was ready to personally go to Congress for additional funds to protect jobs and employees.

The dollar significantly strengthened after the words of the head of the Ministry of Finance, as rumors circulating in the press spoke about the possible adoption of a two or even three-trillion stimulus package. But judging by Kudlow's recent words, such plans are still in their infancy. In the meantime, the bill on the allocation of three trillion dollars already passed by the House of Representatives hovered at the stage of approval in the Senate. As you know, the Upper House of Congress is controlled by Republicans, who criticized the initiative of the Democratic Party "to the nines". US President Donald Trump joined in criticizing the Republicans, making it clear that he would not sign the document in its current form. The main political battles around this bill will unfold in the Senate in July (when the deputies will return from parliamentary vacations), but it is now clear that the full amount of the assistance will not be provided in any case. As for the relevant legislative initiatives of the White House, they have not yet been formalized as a "tangible" bill, as already mentioned above.

Also, Kudlow once again neutralized concerns about the repeated lockdown in the United States. According to him, the second wave of the coronavirus pandemic in the United States is not observed, despite outbreaks in some states. Therefore, large-scale restrictive measures throughout the country are "unlikely." On the one hand, this is good news for the American economy - and it is logical to assume that this information guide should support the greenback. But the whole point is that the market is using the dollar as a protective tool, so it grew in price in a panic mood relative to the second wave of the epidemic. As soon as this fundamental factor lost its influence, the dollar immediately lost one of its trump cards for its growth.

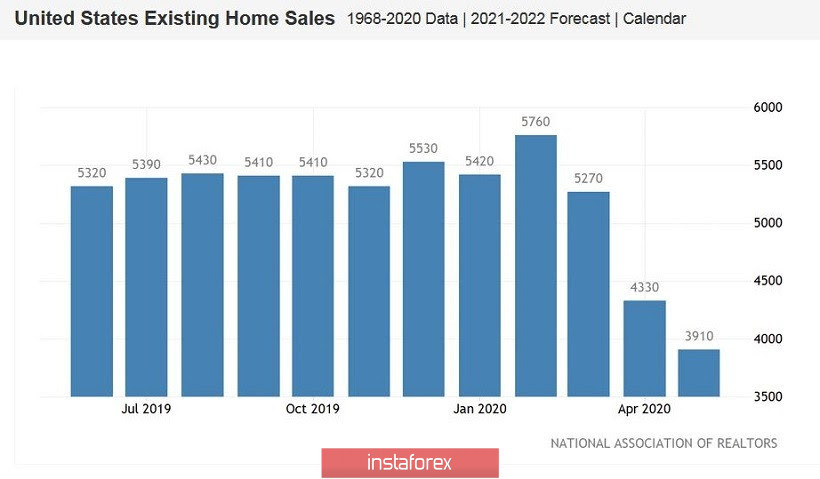

Macroeconomic statistics also failed to support the US currency yesterday. On the one hand, the May index of business activity of the Federal Reserve Bank of Chicago has significantly recovered - to the level of 2.6 points, following the April decline to -17.8 points. On the other hand, real estate data disappointed: home sales in the secondary market fell to a 10-year low. The indicator crashed by 9.7% (with a forecast decline of 5.6%) - this is the worst result since 2010.

Thus, the dollar quite reasonably lost its position yesterday, as it lost its main advantages, and the remaining fundamental factors were not in its favor. Today's attempts to restore the greenback are also quite understandable. The dollar reacted positively to Trump's decision in the field of migration policy. It became known that the US president will suspend the issuance of work visas to some foreign workers until the end of 2020. The restrictions cover L-1 visas for employees of American companies that are transferred from abroad to an office in the United States; H-1B for highly skilled workers; H-2B for low-skilled non-farm workers; J-1 for exchange students; as well as H-4 visas for spouses. According to the White House, by the end of the year, the number of people who will not be able to enter the United States due to restrictions will be about 525,000 (that is, according to the logic of Washington, these jobs will automatically go to the Americans).

In my opinion, this fundamental factor will have a short-term effect on the dollar due to its indirect effect and ambiguity. In particular, H-1B visas are very common among giant companies such as Amazon and Google, as well as Microsoft and Facebook. A number of companies and the U.S. Chamber of Commerce have already criticized Trump's move, saying it will make it difficult to recover from the damage caused by the pandemic.

All this suggests that the dollar index can resume a downward movement today. Speaking directly about the euro-dollar pair, the situation here has not changed since yesterday, despite the price increase. Bulls still need to overcome the 1.1290 mark (Tenkan-sen line on the same timeframe). In this case, the Ichimoku indicator will form a bullish Parade of Lines signal, and buyers will open their way to the 1.1422 mark (three-month high).