European stock indexes closed in the red zone after Trump's trade adviser, Peter Navarro stated that the US president intends to break the trade deal with China due to assumptions about Chinese origin of coronavirus. A little later, Trump himself denied this information. The removal of the tension that had arisen earlier led to a return of cautious optimism to the markets.

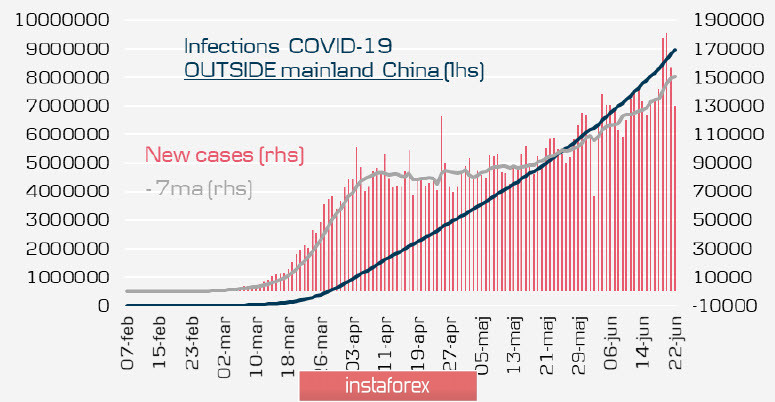

There is growing concern about the increase in the growth rate of the new COVID-19 initiated, and if the Latin America's total growth of 40% mainly affects the economies of developing countries, then 18% in the USA is a sign of the second wave of the epidemic that no one can ignore. The increase in the number of tests does not explain the growth rate of infected people, since there is an increase in new deaths in some states, such as Texas and Arizona.

The probability of reintroducing quarantine measures still remains low, and primarily because the economies of leading countries may not survive another stop.

Politicians are unanimous. Despite the increase in the number of infected people, it is necessary to pretend that the situation is under control. The Cabinet of Ministers of Japan assures that it does not plan new emergency measures, Boris Johnson insists on a number of other measures that are not related to stopping the economy, and Donald Trump is extremely frank – no matter what happens, the country is not supposed to be closed, and suggested (as he assures, in a joking manner) to conduct fewer tests to eventually get less infected.

Thus, despite the coronavirus, the state of the markets will be determined by the support measures implemented by governments and central banks. These measures are aimed at improving financial conditions, which will ultimately contribute to the growth of markets and reduce tensions. At the same time, the situation cannot be called stable, since gold continues its path upside, reaching a maximum in seven and a half years. The rise in gold prices reflects not only a high level of uncertainty, but also the weak prospects of the dollar, since the probability of new stimulus measures by the Fed and the US government is growing amid the lack of positive dynamics in the economy after the restrictive measures have been lifted.

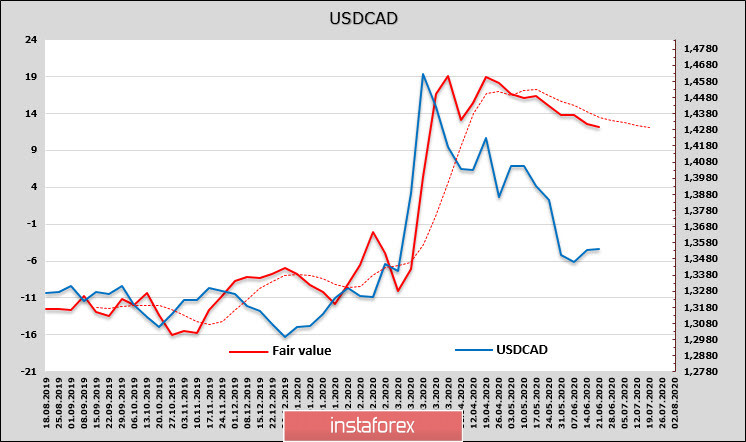

USD/CAD

According to the latest CFTC report, the cumulative short position in CAD remained almost unchanged, having increased by a symbolic $ 32 million, the estimated price is still directed downward, but the dynamics are very weak, and it is also noticeably behind the spot price.

A high level of uncertainty for the CAD remains. A break down from the calculated price implies a corrective increase, while the downward direction of the calculated price implies a continuation of the decline. Fundamentally, the Canadian currency has nothing to rely on but oil prices, since the level of consumer demand in both the US and Canada remains very weak, which will inevitably continue to put pressure on both exports and the current account. Hence, the conclusion is that the most likely trade is in the range, an update to the maximum of 1.3628 is unlikely, but there is no reason to go below 1.3360.

USD/JPY

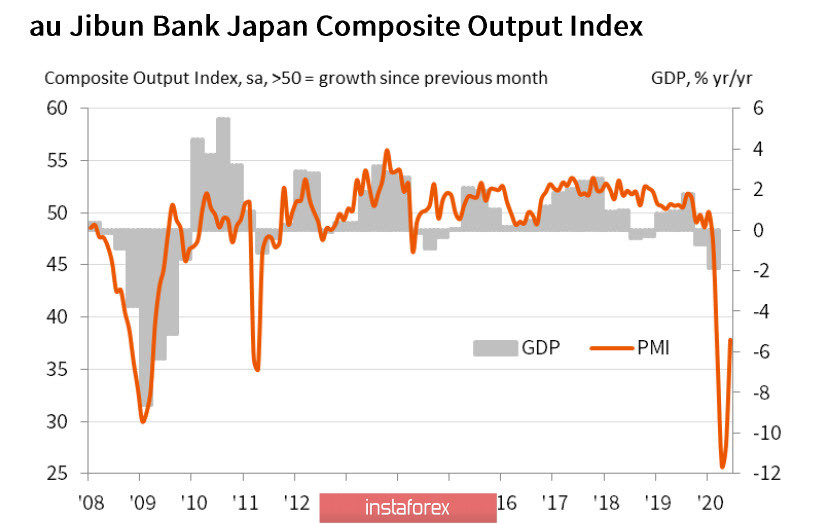

The Japanese economy continues to experience severe pressure, which cannot be explained only by the coronavirus pandemic. The composite PMI index from Jibun Bank grew in June from 27.8p to 37.9p, primarily due to the growth of the index in the services sector, with regard to production, after May 30.3p. In June, only 28.9 pp was recorded, that is, even against the backdrop of the opening of the economy and the completion of quarantine measures, production in Japan continues to decline.

Import and export declined in May by 26.2% yoy and 28.3% yoy, respectively, which is noticeably worse than forecasted. Inflation excluding food declined by -0.2%, that is, in deflationary territory.

Japan confidently loses competition to China.

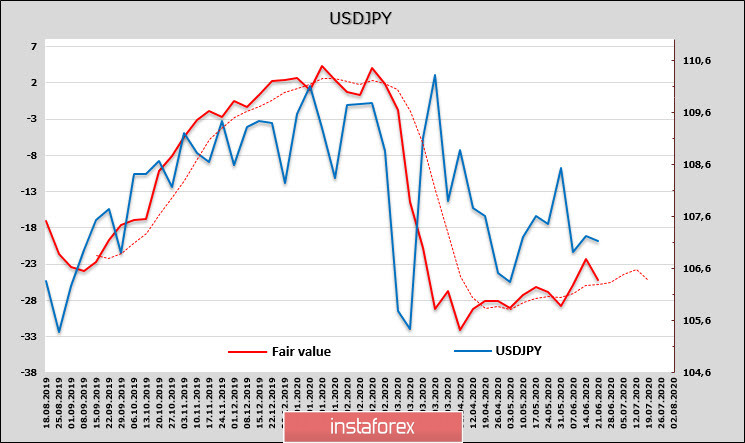

A marked increase in the net long position by 550 million to $ 2.575 billion is undoubtedly a bullish factor for the yen, which suggests that investors see an increase in the risks of another wave of sales and, accordingly, an increase in the demand for protective assets. At the same time, the estimated price has no direction, indicating a lack of consensus.

The support levels are at 106.50 and 105.95, while resistance level is at 107.60 - going out of range is unlikely due to the lack of impulse. The yen looks preferable in the long-term, so a movement to the lower end of the range looks slightly more likely.