Good day, dear traders!

Taking advantage of the weakness of the US dollar and the propensity of market participants to take risks, the British pound rose against the US currency on June 22. However, more on this later in the technical part of the review.

In the meantime, a little on the subject of COVID-19, which can not be bypassed. Voices are growing louder about the second wave of a new type of coronavirus infection, and some facts confirm this. For example, in North Wales, which is known to be part of the United Kingdom, there has been an outbreak of coronavirus diseases. As noted by the World Health Organization (WHO), the second wave of the pandemic in European countries is a matter of time. If this happens, it will be difficult for the UK to avoid a second wave of COVID-19. Let me remind you that along with Italy, Spain, and France, Britain was the most vulnerable in terms of the number of people infected and killed by the insidious pandemic.

If you look at today's economic calendar, the UK at 09:30 (London time) will publish the PMI manufacturing activity index, as well as the PMI in the services sector. Reports on business activity in the manufacturing and services sectors will be received from the US at 14:45 (London time)).

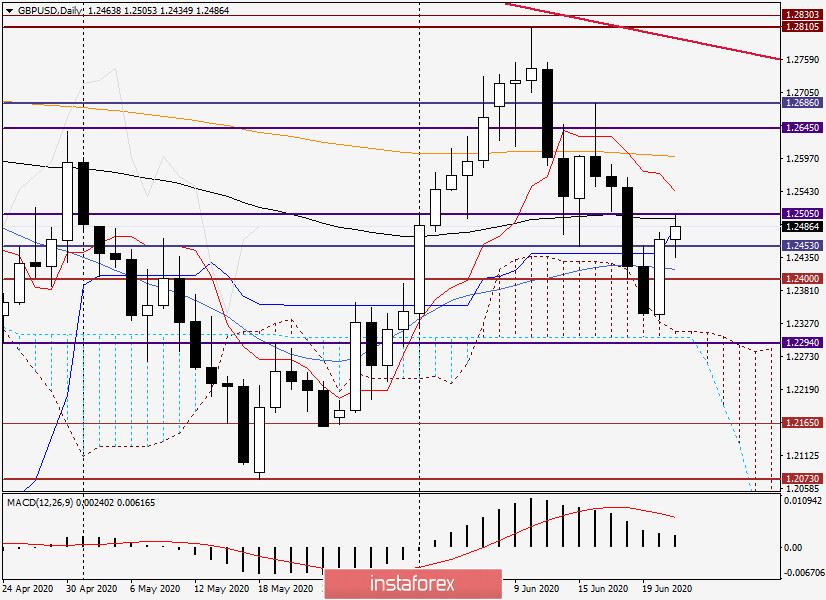

Daily

In yesterday's trading, the pair tried to return above the psychological level of 1.2500, but could only rise to 1.2475, ending Monday's session at 1.2464. During today's trading, the pound bulls continued to raise the rate and have already marked at 1.2505. However, it has not yet been possible to hold on to the reached heights and at the moment of writing, the pair is trading near 1.2470.

Strong resistance to attempts to continue the rate rise is provided by the Kijun line of the Ichimoku indicator, as well as the 89 exponential moving average. A very important day for the pair. A confident close above 1.2500 will signal the further readiness of the quote to move in the north direction. If a bearish model of candle analysis appears on the daily chart following the results of today's trading, this will be a signal to open sales for GBP/USD.

The nearest target at the top of the daily timeframe looks like the Tenkan line of the Ichimoku indicator, which is located at 1.2543. In the case of a downward trend scenario, the nearest target will be 50 simple moving average, which runs at 1.2416.

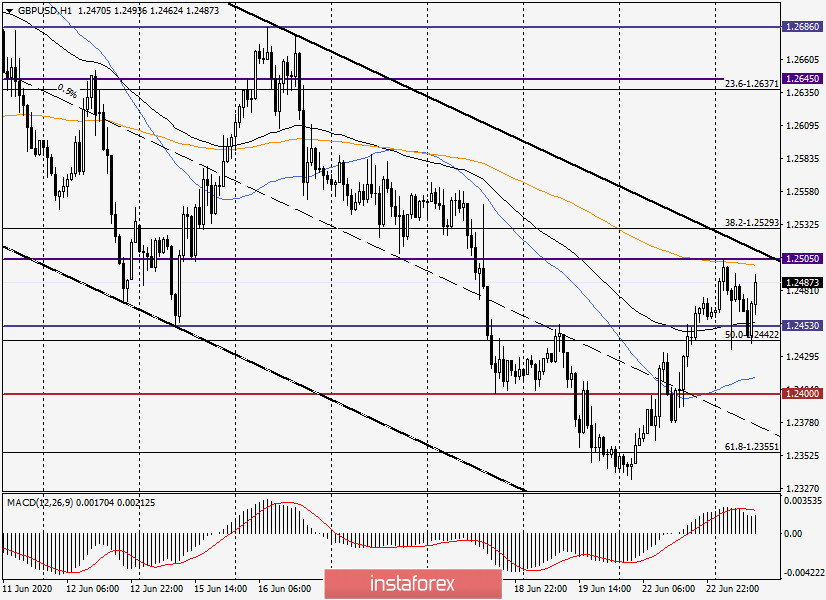

H1

On the hourly chart, the pair is trading in the upper part of the descending channel, whose parameters are 1.2811-1.2680 (the resistance line) and 1.2453 (the support line). To indicate their advantage, the pound bulls need to bring the price up from this channel, however, it seems that the 200 exponential moving average, which is located directly below the channel's resistance line, is quite capable of providing additional and quite strong resistance to attempts to exit the channel up. If a bearish reversal candle (or candles) appears in the price zone of 1.2525-1.2500 with a closing price below the psychological level of 1.2500, this will be a signal to open short positions on GBP/USD.

In the case of a true breakout of the resistance line, on a pullback to it and the level of 1.2500, it is already worth considering buying. In the meantime, everything is very shaky, everything is very uncertain. At the time of completion of the article, the "Briton" shows intentions to move in a northerly direction. Perhaps it is better not to rush and take a pause, waiting for good and clear signals to enter the market.

Good luck!