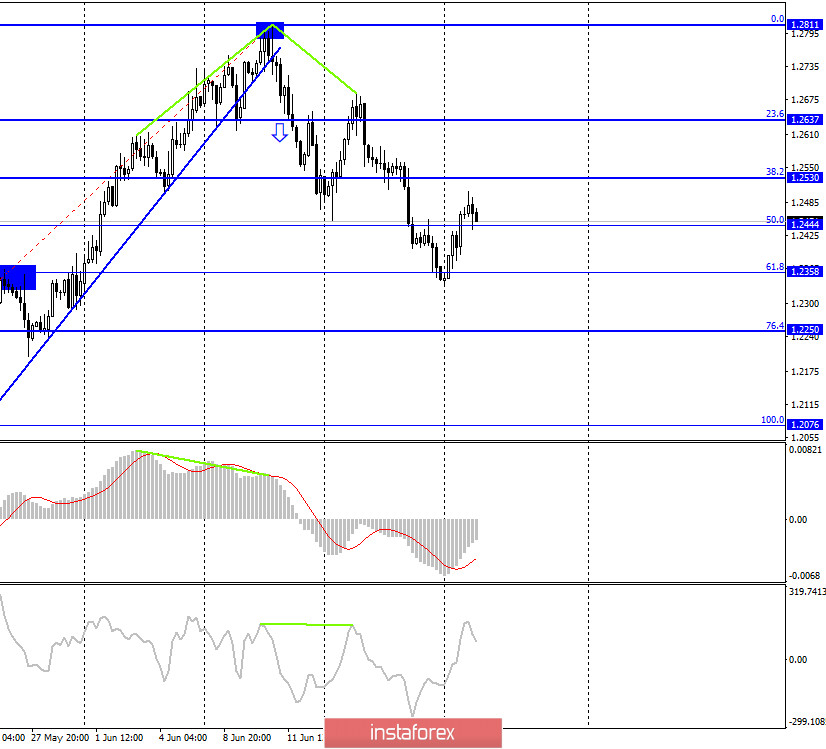

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair performed a sharp reversal in favor of the British dollar on Monday and increased to the upper border of the downward trend corridor. The rebound of the pair from this line will allow it to expect a turn in favor of the US dollar and the resumption of fall towards the lower line of the corridor. That is, the mood of traders will remain "bearish". The US dollar fell yesterday in many currency pairs, although there were no informational reasons for this. Nevertheless, there are a lot of interesting processes going on in America that can influence the mood of traders, especially large ones. Another thing is that there are a huge number of problems in the UK, most of which are related to Brexit and negotiations with Michel Barnier. Therefore, at this time, I would not say that the British or American have a clear advantage in the market. The English currency has been growing for several weeks. It would be logical if the US currency continues to grow now. However, closing above the descending corridor will significantly increase the probability of further growth of quotes.

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair also performed a reversal in favor of the British currency and secured above the corrective level of 50.0% (1.2444). Thus, traders can now even count on the continued growth of quotes in the direction of the next corrective level of 38.2% (1.2530). Fixing the pair's exchange rate under the Fibo level of 50.0% will work in favor of the US currency and resume falling towards the levels of 1.2358 and 1.2250, which will also probably coincide with the rebound from the upper line of the corridor on the hourly chart.

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a close under the corrective level of 50.0% (1.2462), which allows us to expect a continuation of the fall in the direction of the Fibo level of 38.2% (1.2215) if the pair now performs a rebound from this level.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

There were no major economic reports or news in the UK and the US on Monday. However, traders found reasons to buy the British. Will they continue to do so today?

The economic calendar for the US and the UK:

UK - index of business activity in the manufacturing sector (08:30 GMT).

UK - index of business activity in the service sector (08:30 GMT).

UK - Bank of England Governor Andrew Bailey will deliver a speech (08:45 GMT).

US - index of business activity in the manufacturing sector (13:45 GMT).

US - index of business activity in the service sector (13:45 GMT).

On June 23, the UK and the US will release indices of business activity in the services and manufacturing sectors for June, however, the speech of the Governor of the Bank of England is of great importance, which may have a strong impression on traders.

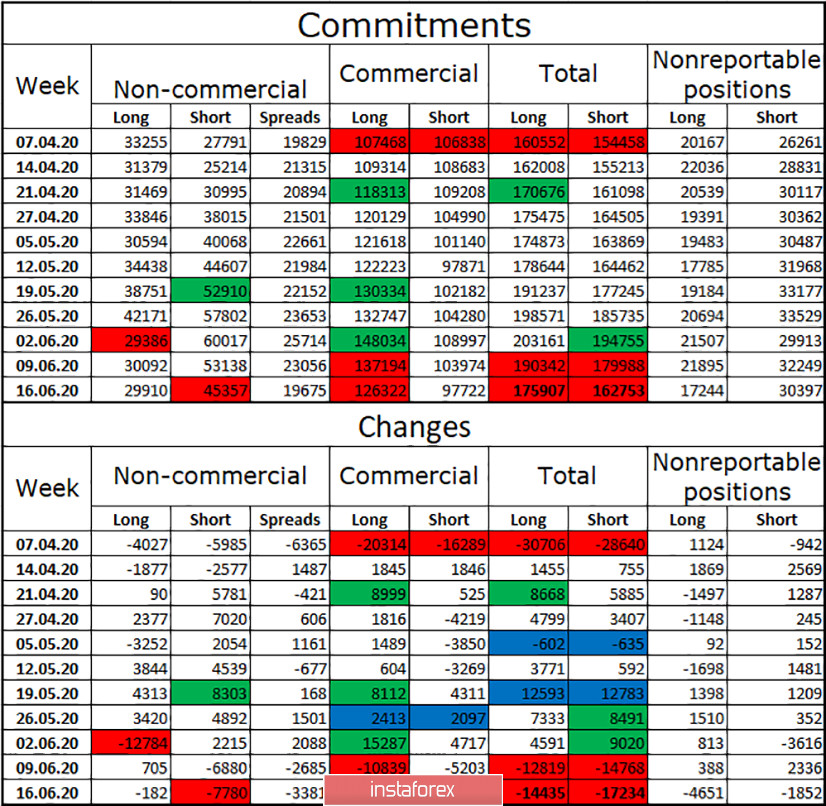

COT (Commitments of Traders) report:

The latest COT report showed the second consecutive strong reduction in short contracts among the "Non-commercial" group - by 7,780 units. This same group of large traders also got rid of long contracts. Thus, among speculators, the British did not cause any interest in the reporting week. Also, the "Commercial" group got rid of short and long contracts. And in total, the "Total" group also lost about 32,000 contracts. A week earlier, let me remind you, it was -25 thousand. Thus, the major market players now do not buy the pound and do not sell it. Most likely, assets are being transferred to other more interesting currencies. However, this is not the euro, which also shows a reduction in the reporting week. The deadline for the latest report is June 16. After this date, the pound began to fall, so the new COT report should show a strong reduction in long contracts for speculators or a strong increase in short.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound with the goal of 1.2358 if the rebound from the upper line of the corridor on the hourly chart is performed (or a reversal near it). I recommend opening purchases of the pair after closing above the trend corridor on the hourly chart with the goal of 1.2637.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.