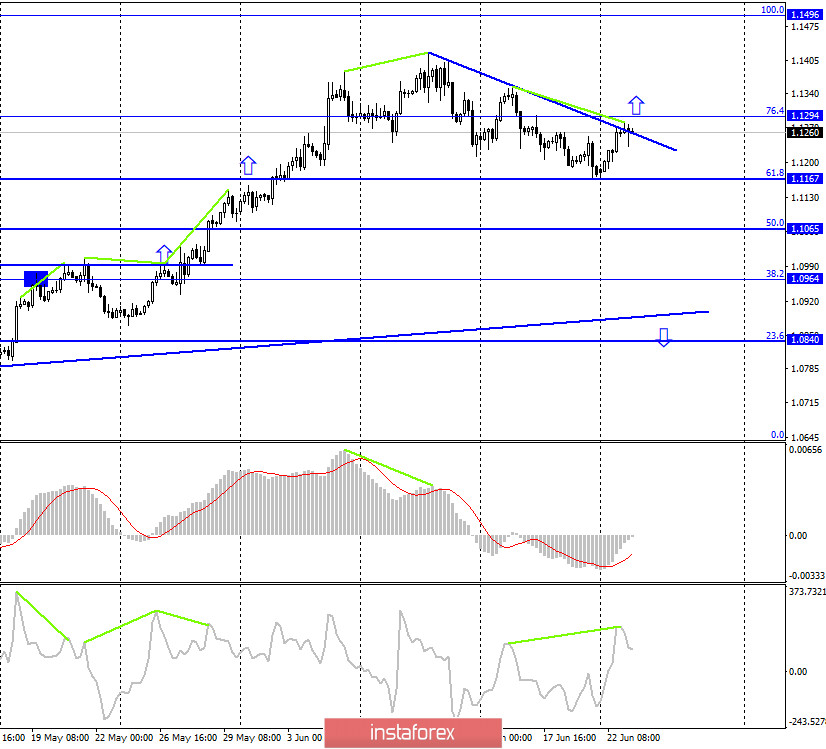

EUR/USD – 1H.

Hello, traders! On June 22, the euro/dollar pair performed a fairly strong growth towards the upper border of the downward trend corridor. And even managed to perform a close over this line, which changes the current mood of traders to "bullish". However, first of all, there were no events in the world yesterday that could have raised the European currency so much. Secondly, the anchoring over the corridor is not very confident and precise. In general, with the current graphical picture, I believe that both options for further movement remain equal in probability. The information background for the past day was practically absent. However, traders could still note the fact that Washington and Beijing are not going to further escalate the conflict, which this time may not only be a trade conflict. The White House has been "rattling" threats against China for several months, and so far none of them have been executed. Thus, I believe that in the conditions of the global economic crisis, neither Beijing nor Washington are ready to finish off their economies and will go to another escalation of the conflict only as a last resort.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair performed an increase to the downward trend line and performed the same incomprehensible fixation over it, as on the hourly chart over the descending corridor. Thus, the current chart does not add clarity to the current picture either. Moreover, yesterday a bearish divergence was formed in the CCI indicator, which allows traders to count on a reversal in favor of the US currency and a slight fall in the direction of the corrective level of 61.8% (1.1167). Thus, the rebound from the trend line will work in favor of the dollar. Closing the pair's exchange rate on June 23 above the 76.4% Fibo level will increase the chances of further growth in the direction of the next corrective level of 100.0% (1.1496), and the mood of traders will change to "bullish".

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation under the Fibo level of 127.2% (1.1261) and almost immediately returned to it. Thus, now the fall of quotes can be resumed in the direction of the corrective level of 100.0% (1.1147) if the rebound from the level of 1.1261 follows.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is being postponed for now.

Overview of fundamentals:

On June 22, there were no news or economic reports in the European Union or the United States. Nevertheless, traders were quite active in buying the euro currency, which once again proves that there is no need for a strong information background to actively trade the pair.

News calendar for the United States and the European Union:

Germany - index of business activity in the manufacturing sector (07:30 GMT).

Germany - index of business activity in the service sector (07:30 GMT).

EU - index of business activity in the manufacturing sector (08:00 GMT).

EU - index of business activity in the service sector (08:00 GMT).

US - index of business activity in the manufacturing sector (13:45 GMT).

US - service sector PMI (13:45 GMT).

On June 23, the news calendar in the European Union and America contains indices of business activity in the services and manufacturing sectors. They can have a certain impact on the mood of traders.

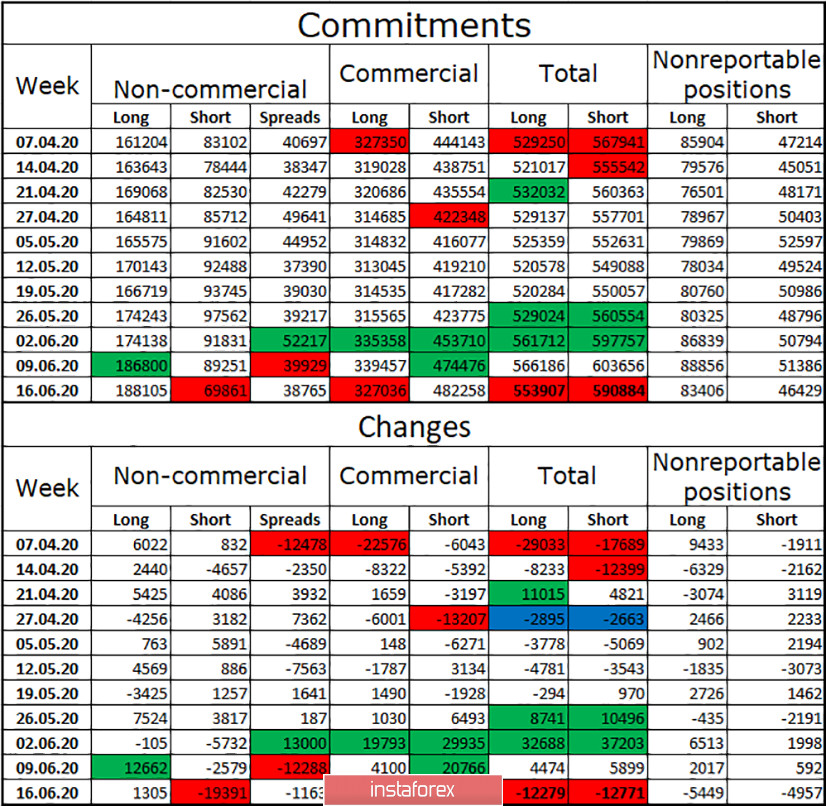

COT (Commitments of Traders) report:

The latest COT report, released last Friday, showed very interesting changes. Firstly, the "Non-commercial" group, which is considered the most significant, strenuously got rid of euro short-contracts throughout the reporting week. It seems that this was the reason for the growth of the euro currency in the reporting week (until June 16). Large traders seldom opened long contracts. Secondly, hedgers "picked up" not all the contracts dropped by speculators, increasing only 7783 contracts for sale, but getting rid of 12,500 contracts for purchase. In total, the euro currency lost 25 thousand contracts. Thus, major market players lost interest in the euro currency during the reporting week in any case. Perhaps because the US dollar is becoming attractive again. In any case, the demand for the euro has been growing over the past two reporting weeks. One way or another, however, the drop in quotes last week suggests that the major players may have already had enough.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goals of 1.1167 and 1.1065, if the rebound from the trend line is performed on the 4-hour chart. Purchases of the pair can be opened when closing above the level of 1.1294 on the 4-hour chart with a target of 1.1496.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.