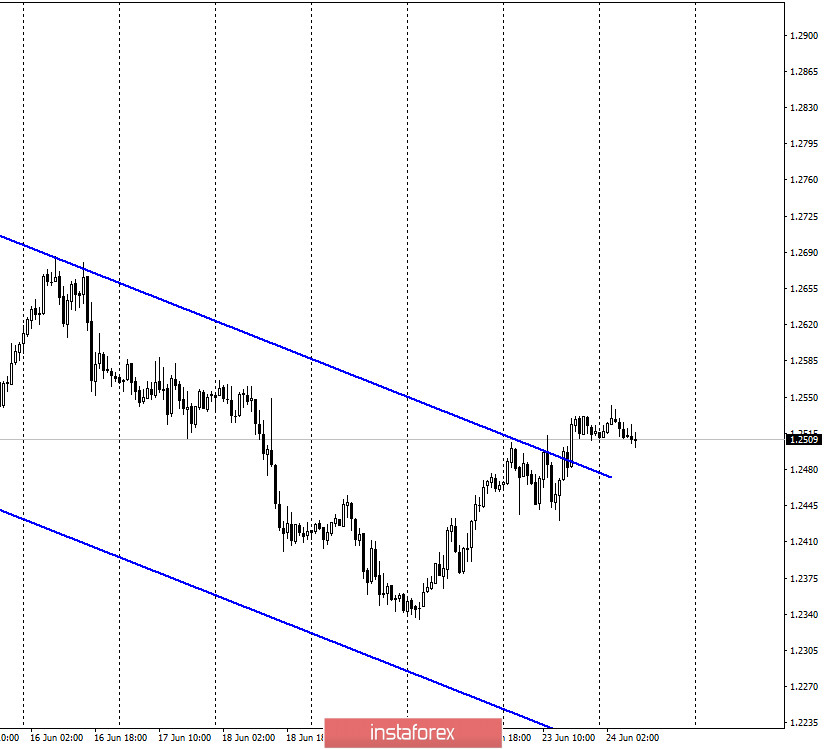

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair also continued the growth process and secured over the downward trend corridor. Thus, the mood of traders on the pound/dollar pair also changed to bullish. The information background is now completely ambiguous for the pair. A huge number of different factors that can affect the mood of traders. Many experts note the utter confusion in the United States with the coronavirus, quarantine, as well as a serious political crisis, which is expressed by the actions of Donald Trump, completely aimed at re-election, and not at solving urgent problems. On the other hand, the US stock market has almost completely recovered from losses. In the UK, Prime Minister Boris Johnson announced a large-scale easing of quarantine measures from July 4, which allows us to draw positive conclusions about the fight against the epidemic in this country, however, the situation with Brexit and the Brexit negotiations is not resolved in any way and is not moving to any positive conclusion for London. Thus, I believe that at this time, traders are paying more attention to the negative from the US, however, they may return to the negative from Britain in the future.

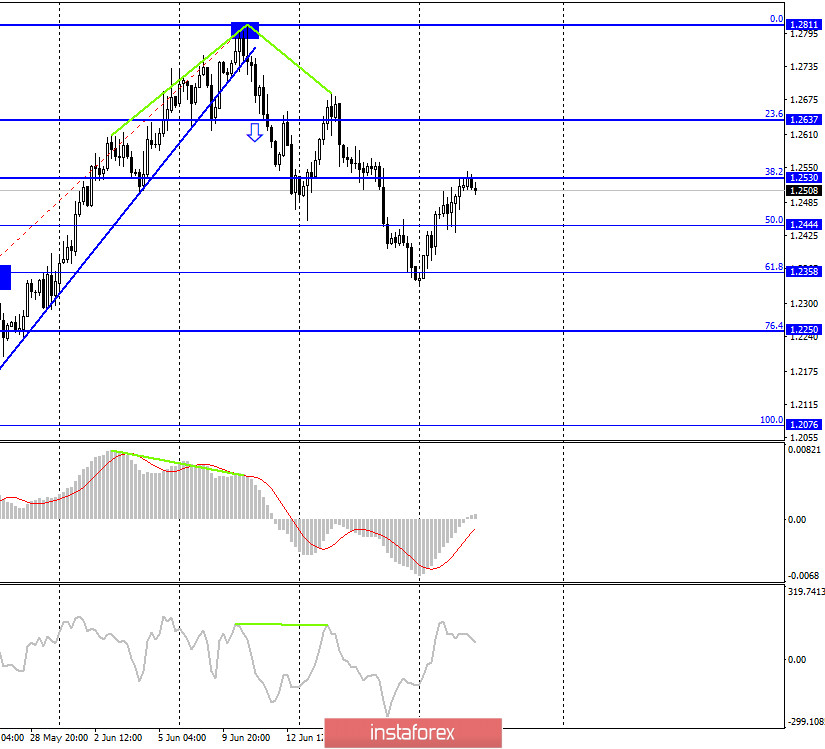

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair performed an increase to the corrective level of 38.2% (1.2530). The rebound of the pair's quotes from this level will work in favor of the US currency and some fall in the direction of the corrective level of 50.0% (1.2444). Today, the divergence is not observed in any indicator. Closing the pair's exchange rate above the Fibo level of 38.2% will increase the probability of further growth towards the next corrective level of 23.6% (1.2637).

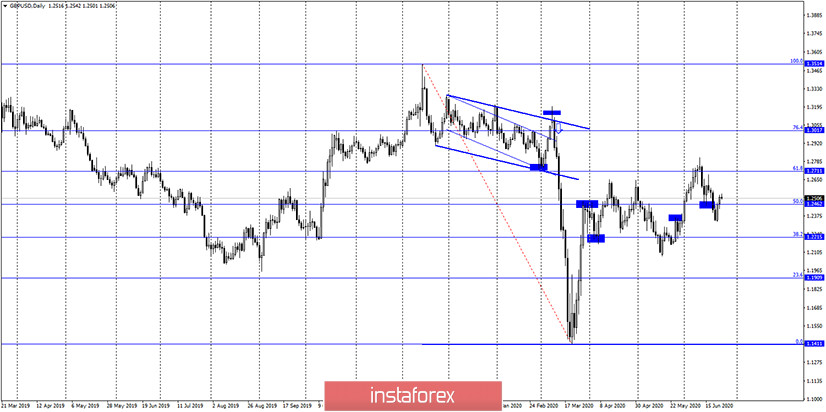

GBP/USD – Daily.

On the daily chart, the pair's quotes performed a reversal in favor of the English currency and fixed above the corrective level of 50.0% (1.2462). Thus, the growth process can be continued in the direction of the Fibo level of 61.8% (1.27110, however, everything will depend on the level of 1.2530 on the 4-hour chart.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Tuesday, the UK and US released business activity indices in the manufacturing and services sectors, which were significantly better than traders' expectations. However, it was the British pound that received support, not the US dollar.

News calendar for the US and UK:

On June 24, there will be no major reports or speeches in the UK or the US. Thus, the information background will be absent and if the pound continues to grow, it will show the serious intentions of bull traders.

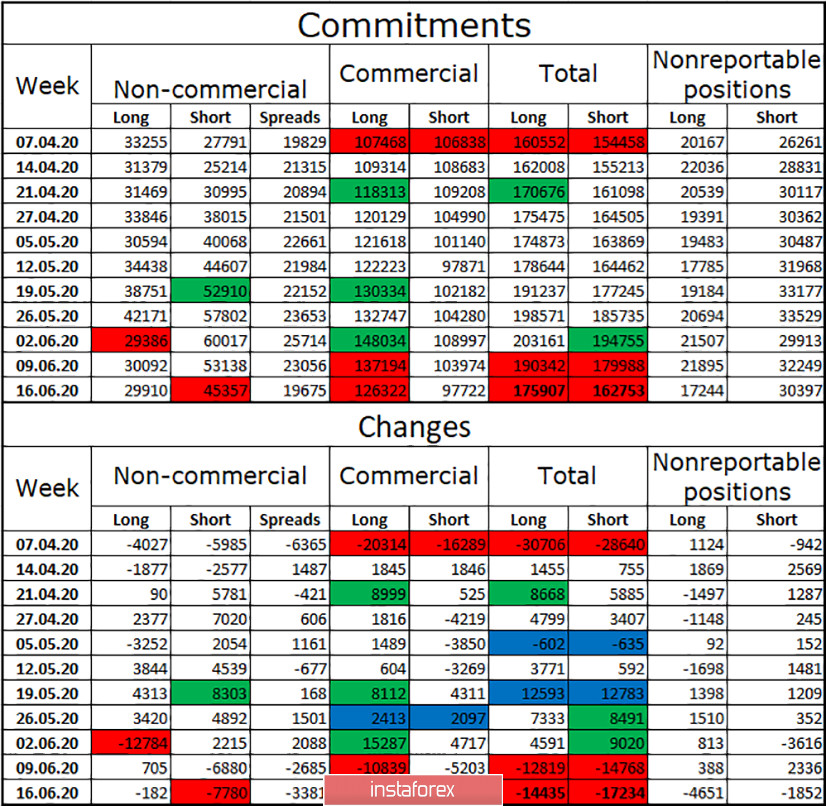

COT (Commitments of Traders) report:

The latest COT report showed the second consecutive strong reduction in short contracts among the "Non-commercial" group - by 7,780 units. This same group of large traders also got rid of long contracts. Thus, among speculators, the Briton did not arouse any interest in the reporting week. Also, the "Commercial" group got rid of short and long contracts. And in total (the "Total" group), about 32,000 contracts were also lost. A week earlier, let me remind you, it was -25,000. Thus, major market players now do not buy the pound and do not sell it. Most likely, assets are being transferred to other more interesting currencies. However, this is not the euro, which also shows a reduction in the reporting week. The deadline for the latest report is June 16. After this date, the pound began to fall, however, the fall was not very long. At the moment, bull traders are back in action, and the pair's growth may resume.

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with the goals of 1.2444 and 1.2358 if the rebound from the level of 1.2530 on the 4-hour chart is completed. I recommend opening new purchases of the pair after closing above the level of 1.2530 with a target of 1.2637.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.