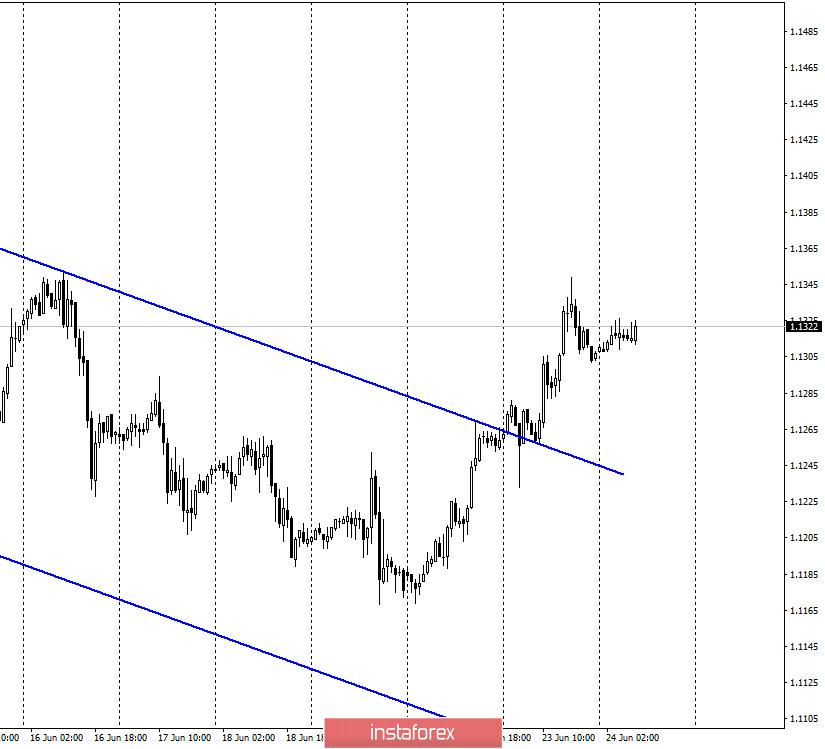

EUR/USD – 1H.

Hello, traders! On June 23, the euro/dollar pair performed a consolidation over the downward trend corridor, so the mood of traders officially changed to "bullish". Goals should be defined on older charts. But the information background, in contrast to the determination of traders, remains very strange. It seems that the coronavirus is again coming out on top in importance, at least in America. While in most countries of the world (especially in Europe), the spread of the virus has been slowed down or even stopped. In America, everything is exactly the opposite. COVID-2019, as it was distributed a month or two ago, is now being distributed. Every day in the United States, new 20-30 thousand cases are recorded, that is, there is no decline in infection rates. The total number of cases in America is already 2.347 million. The number of deaths is 121 thousand. In the UK, Germany, France, Italy, Spain, and other European Union countries, the number of new cases is minimal. Thus, it is the United States, along with Brazil, Russia, and India, which is now the world leader in COVID-2019. However, we are not interested in Brazil and India. Major players may fear a second "lockdown" in the US or a massive epidemic of Americans.

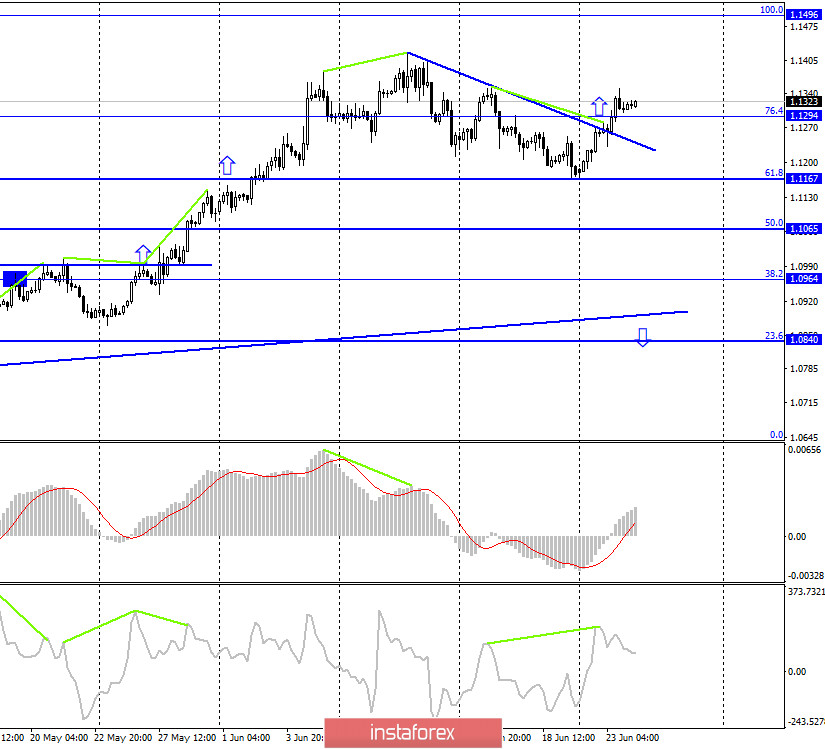

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair were fixed above the descending trend line, paying no attention to the bearish divergence of the CCI indicator and the trend line itself. Thus, the consolidation above the Fibo level of 76.4% (1.1294) was also performed. As a result, the growth process on June 24 may be continued in the direction of the next corrective level of 100.0% (1.1496). I don't want to talk about the prospects of bear traders now, because I don't even see potential signals for the euro/dollar pair to start falling.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair made a consolidation above the Fibo level of 127.2% (1.1261). Thus, now the process of price growth can be continued in the direction of the corrective level of 161.8% (1.1405).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). However, the lower charts are now in a more bearish mood, so working out this goal is being postponed for now.

Overview of fundamentals:

On June 23, Germany and the European Union released business activity indices for May. All six indices exceeded traders' expectations, and some came close to the level of 50.0, which is key for this type of report. Any value below it is negative. So far, all six indices have remained below it, but have shown significant growth. The same picture for indices in the United States.

News calendar for the United States and the European Union:

On June 24, the news calendar in the European Union and America does not contain anything interesting, because the information background will have almost no effect on the mood of traders today.

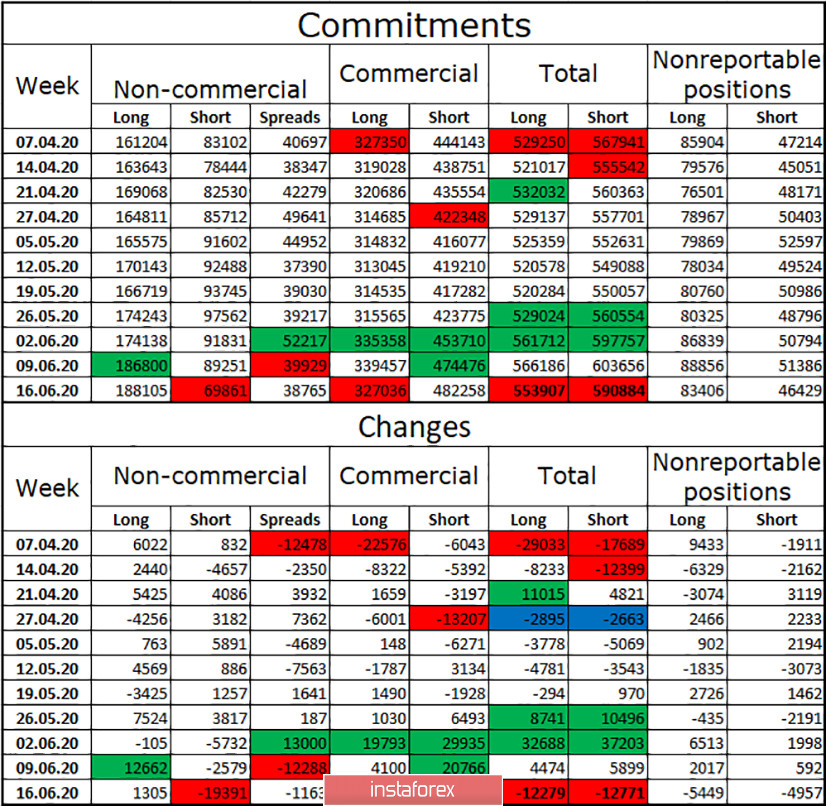

COT (Commitments of Traders) report:

The latest COT report, released last Friday, showed very interesting changes. First, the group "Non-commercial", which is considered the most significant, strenuously got rid of short-contracts for the euro throughout the reporting week. It seems that this was the reason for the growth of the euro currency in the reporting week (until June 16). Large traders seldom opened long contracts. Secondly, hedgers "picked up" not all the contracts dropped by speculators, increasing only 7,783 contracts for sale, but getting rid of 12,500 contracts for purchase. In total, the euro currency lost 25 thousand contracts. Thus, major market players lost interest in the euro currency during the reporting week in any case. Perhaps because the US dollar is becoming attractive again. However, in the middle of this week, I can say that the euro has resumed growth, which means that major market players are again either getting rid of short-contracts or increasing long.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend buying the euro currency with the goals of 1.1405 and 1.1496, since the closing was performed over the trend corridor on the hourly chart and the trend line and the peak of divergence on the 4-hour chart. I do not recommend considering selling the pair today since there is not a single brewing signal.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.