GBP/USD

Analysis:

On the chart of the British currency in the last 3 months, a large-scale corrective figure is formed. They have the form of a stretched plane. From June 10, the final part of the structure is formed.

Forecast:

In the next trading sessions, the general flat mood of the movement is expected. By the end of the day, the probability of a return to the bearish rate increases. A breakout of the support zone is unlikely today.

Potential reversal zones

Resistance:

- 1.2450/1.2480

Support:

- 1.2370/1.2340

Recommendations:

Purchases of the pound today can be used in an intra-session style of trading. When the price reaches the resistance zone, it is recommended to track the instrument's sell signals.

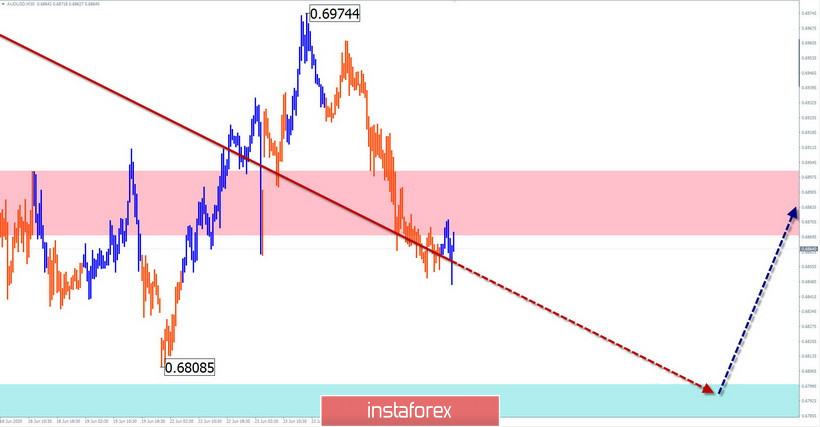

AUD/USD

Analysis:

Since mid-March, the Australian dollar has been forming an upward trend. Since the beginning of June, the price has been adjusted sideways, forming a flat correction along with a strong large-scale resistance level. The wave has entered its final phase.

Forecast:

Today, the general downward mood of the movement is expected. The end of the decline and the formation of a reversal is most likely in the area of calculated support. The option of a short-term puncture of its lower border is not excluded.

Potential reversal zones

Resistance:

- 0.6870/0.6900

Support:

- 0.6800/0.6770

Recommendations:

Sales in the market today have priority. It is worth taking into account the limited reduction potential. After the formation of reversal signals in the area of the support zone, it is recommended to track the purchase signals of the instrument.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!