Hi fellow traders!

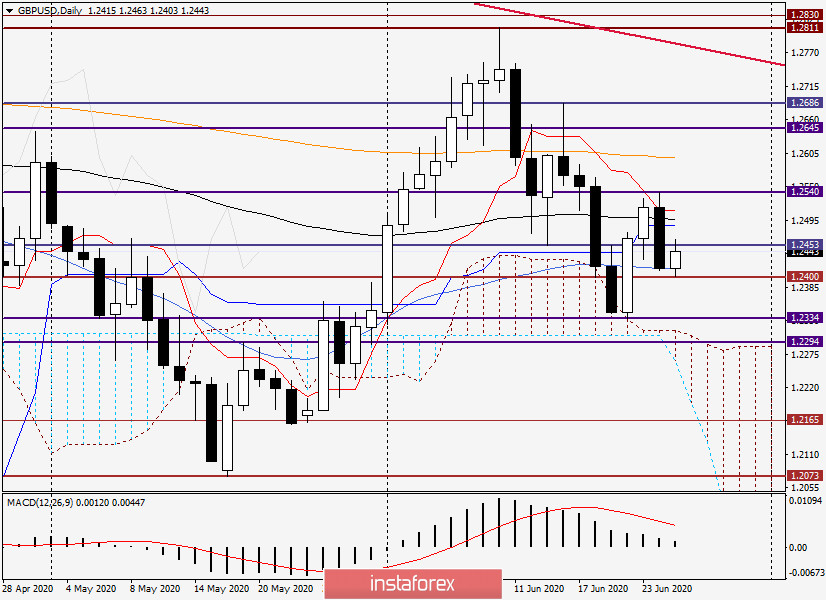

Daily

Yesterday, the pound sterling tried to assert strength against the US dollar, but these efforts were in vain. Having reached the strong technical level of 1.2540, GBP/USD reversed downwards and closed at 1.2416 on Wednesday. By the way, that level was picked as the nearest target in case the downward scenario comes true. As we see, a 50-period moving average is going through here that supported the pair, shielding it from a further decline.

Today at the moment of writing this article, the currency pair has already tested the level of 1.2400 which showed resilience and gave impetus for a further growth. At the European trade opening, GBP/USD was extending gains trading at near 1.2452. Here comes the important thing for pound bulls. First, the pair failed to stay firmly above the technically and psychologically important level of 1.2500. Second, there is cluster of lines in the area of 1.2485-1.2510 such as the Kijun Line of the Ishimoku cloud indicator, an 89-period exponential moving average, and the Tenkan line. All the above-said lines make up powerful resistance which could be a challenging task to breach without meaningful drivers for market participants. As of now, GBP/USD is not able to break upwards the level of 1.2453.

The door downwards will be open on condition of breaking the important and strong level of 1.2400. Another condition is that the price should trade firmly under that mark. In this case, the target level for bears will be 1.2334, the lowest point of June 22.

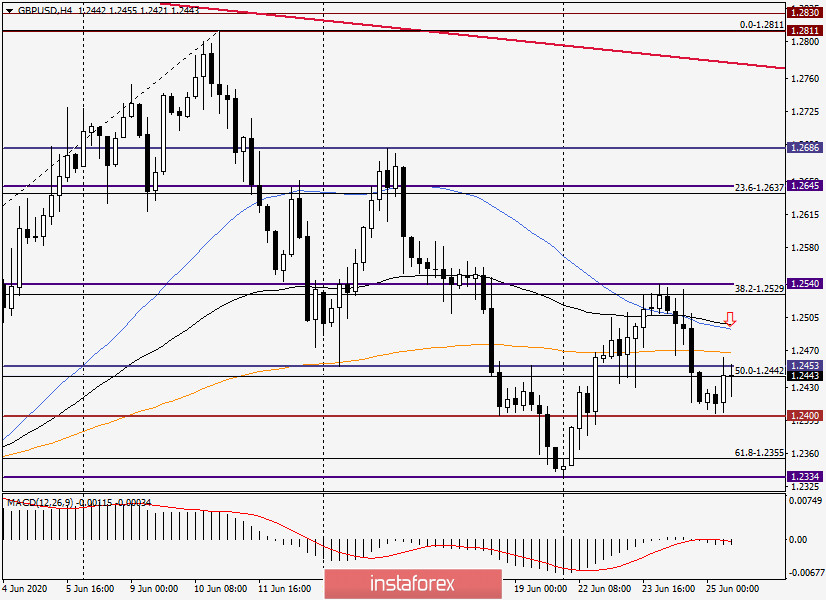

H4

According to this timeframe, GBP/USD is trading below a 20-period, 50-period, and 89-period moving averages. Each of them is capable of resisting stubbornly any growth attempts.

Trading tips for GBP/USD

Bearing in mind the overall technical picture as well as the odds of the second COVID-19 wave, the US dollar has nice prospects for remaining a lucrative investment option. Another point is that economic data from the US has been improving lately. So, the basic recommendation is to open short positions on GBP/USD following minor correctional dips. The targets for short deals could be the following levels: 1.2460, 1.247, 1.2487, 1.2505, and perhaps 1.2525.

Just in case market sentiment changes, the currency pair will be able to overcome sellers' resistance at 1.2540 with confidence. Thus, the bearish scenario will have to be revised or even cancelled. Once again, let me say again that long deals on GBP/USD pose a risk under the current market conditions. So, it would be better to stay away from opening long positions until clear signals emerge again.

Good luck!