Demand for the US dollar continues to strengthen despite the statistics on Germany, which continues to please buyers of risky assets, which makes us think about a faster return to the life of the economy after the coronavirus pandemic in the Eurozone. However, at the moment, the US dollar is taking the lead, as fears of a new outbreak of coronavirus infections in the US are only increasing, and the trade conflict of the Trump administration with China and Europe is gaining new momentum.

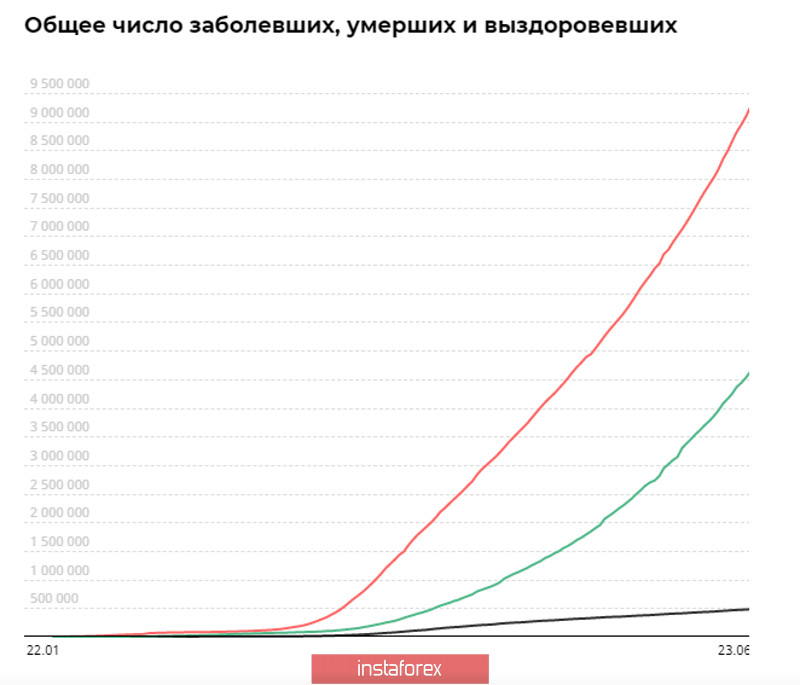

According to the Florida Department of Health, more than 5,000 cases of COVID-19 infection were reported in their state alone yesterday, the highest number ever recorded. In the state of Texas, the number of infected people exceeded 5,500, and in Oklahoma, experts identified 482 new cases of infection. In California, thanks to the earlier removal of isolation measures in quotation marks, a new record number of people were infected in a day. During the day, 7,149 cases of coronavirus infection were recorded in the state.

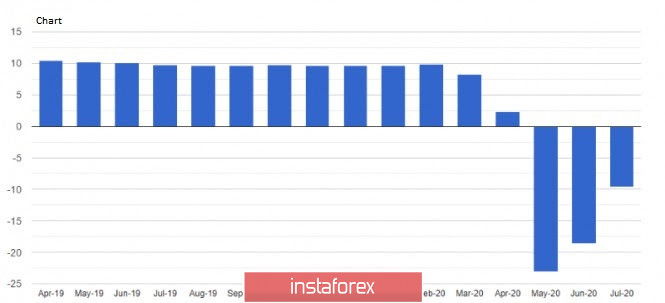

As I noted above, today's data on consumer sentiment in Germany in July of this year is likely to continue to improve after the reduction of quarantine measures against the background of the coronavirus pandemic. Today, a report from the GfK research group was published, which indicated that the leading index of consumer confidence in Germany in July recovered and rose to -9.6 points against the June value of -18.6 points. Economists predicted that the indicator in July will be -15.0 points. Recent data have shown that Germany can well expect a V-shaped economic recovery after a fairly rapid opening of the economy and the resumption of public life. This was due to the timely introduction of quarantine measures and coordinated actions of the authorities.

As for the sub-indices that are used in calculating the full index, overall expectations for the economy, income, and propensity to buy have also increased. The indicator of economic expectations rose to 8.5 points in June, returning to positive territory. Thanks to a large package of economic incentives and support for the population, the index of income expectations also increased, reaching 6.6 points in June. However, the negative factor affecting the index is the reduction of working hours and the increase in unemployment. A good increase was also observed in the indicator of propensity to buy, which jumped immediately to 19.4 points on the background of the removal of quarantine measures and measures of social distancing.

If we talk about the German economy, today we also published data on the growth of German exporters' sentiment, which significantly improved in June this year. So, the index of expectations in the manufacturing sector according to the IFO Institute rose from -26.7 points in May to -2.3 points in June this year, which indicates the recovery of the German industry after the pandemic. A sharp jump is expected in the automotive and pharmaceutical industries.

As for trade relations between the US, China, and the Eurozone, I spoke about this in detail in my morning review. In a nutshell, yesterday US President Donald Trump signed a memorandum on the introduction of new duties to protect the seafood trade. According to the US President, if the trade representative points out that China is not fulfilling its procurement obligations under the agreement on the first phase in relation to seafood, it will lead to the introduction of mirror repressive duties on seafood from China. The Eurozone also got it. It is already known that Washington is considering imposing additional duties on imports from France, Germany, Spain, and the United Kingdom. We are talking about an amount of 3.1 billion dollars. Such categories of goods as trucks, gin, and olives will be subject to duties.

As for the technical picture of the EURUSD pair, the pressure on the euro remains quite high, and the morning breakout of the support of 1.1230 led to another sale of the euro, which I paid attention to. A break of the level of 1.1200 will open a direct path to the lows of the week in the area of 1.1170, which will indicate the resumption of the bear market formed on June 9 this year. To save the situation, buyers of risky assets will need to make a lot of efforts, since only the return of EURUSD to the level of 1.1230 will allow forming a new lower border of the ascending channel in continuation of the growth that we saw at the beginning of the week.