If the White House does not abandon the idea of a V-shaped recovery of US GDP, the Fed is cautious and argues that the return of the economy to the trend will not be as fast as many believe. Optimists believe in an early victory over COVID-19, and pessimists are pointing facts in their faces about the record number of infected people in the United States and around the world. Both the fate of US stock indices and the fate of EUR/USD will depend on who is right in the end.

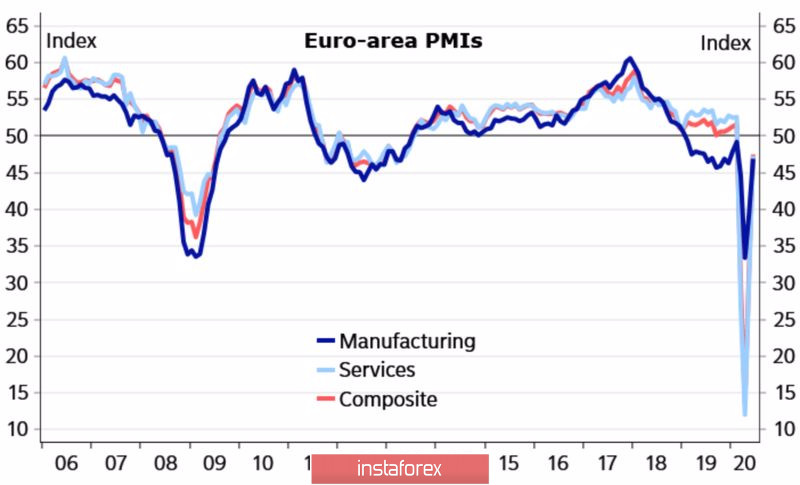

The euro started the last full week of June for health and finished for peace. Impressive statistics on European business activity set up the "bulls" on a major scale. Especially since the minutes of the ECB's last meeting should have contained conciliatory notes about the German Constitutional Court. Indeed, Christine Lagarde and her colleagues noted that they discussed the effectiveness of QE at each meeting and agreed to transmit more detailed information to the Bundesbank for further submission to the German parliament and court. Unfortunately, this was not enough to continue the EUR/USD rally. The weather for buyers was spoiled by the collapse of the US stock indices and the deterioration of the IMF's forecasts for global GDP for 2020 from -3% to -4.9%.

Dynamics of European business activity

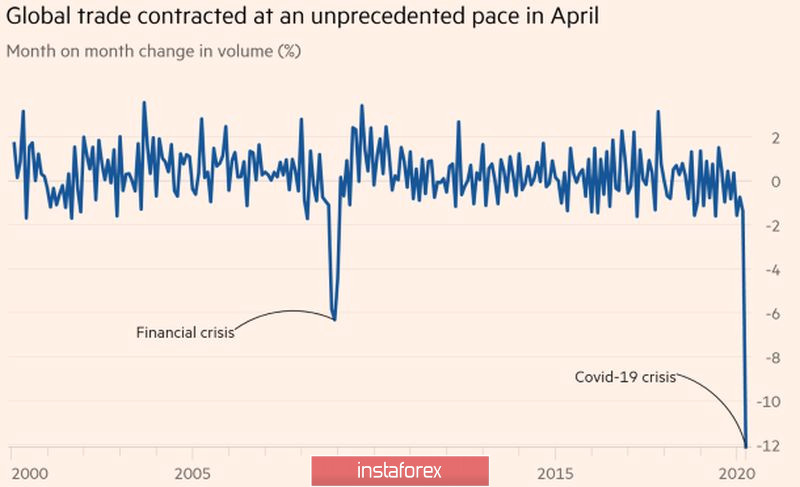

The International Monetary Fund, citing a slower recovery from the crisis and a more severe contraction in economic activity, increased estimates of the depth of the recession. First of all, these affected countries such as France and Spain, which, together with a record sagging of international trade in April, raised serious doubts about the ability of the Eurozone's GDP to recover quickly.

Dynamics of international trade

However, the leading indicators of Bloomberg indicate that Europe will get up from its knees faster than the United States, and there is a logic in this. The epidemiological situation in the Old World is better than in the New, and given the large-scale incentives, the Eurozone economy is quite capable of presenting a pleasant surprise. If it does, the ECB may not spend the entire €1.35 trillion. This is the amount estimated for the scale of the emergency asset purchase program due to the pandemic.

Of course, due to the difficult situation with COVID-19, the "bulls" for US stocks are in an extremely difficult position, however, according to Larry Kudlow, the US economy will not be closed again. At the same time, cheap money from the Fed and verbal interventions by Donald Trump, for whom the strong position of the S&P 500 is almost the only way to win the election, allow us to expect that the stock index correction will not be deep. The good news about a vaccine or medication for coronavirus can return buyers' interest in equity securities. For the euro, this is positive. The return of the quotes of the main currency pair to the resistance at 1.129, followed by its successful assault, will be an occasion for purchases.

Technically, the daily EUR/USD chart continues correction to the 23.6% and 38.2% Fibonacci levels from the AD wave after implementing the 88.6% target for the "Bat" pattern. The end supports should be used for the formation of long positions.

EUR/USD, the daily chart