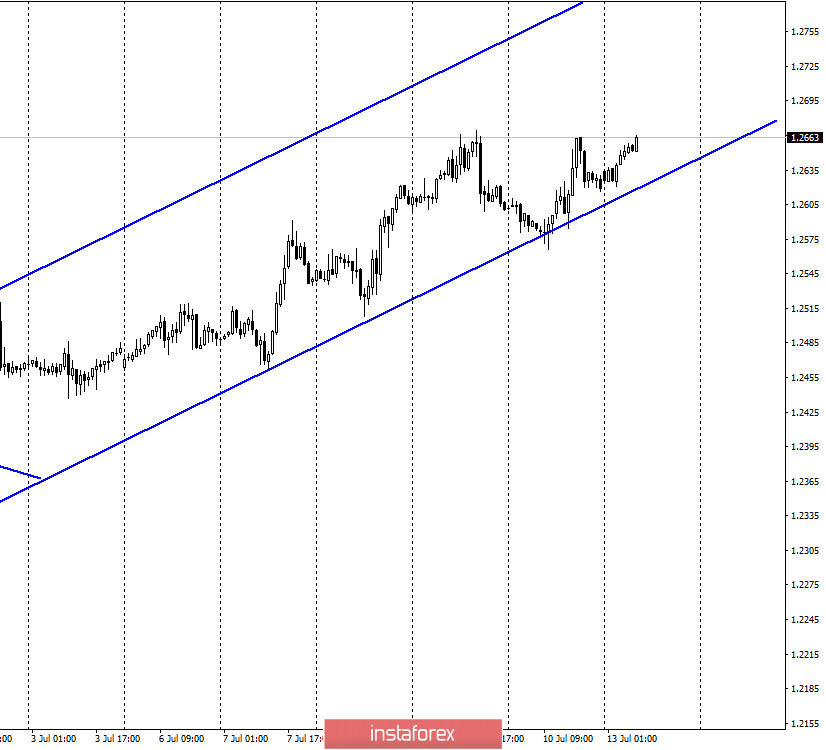

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the quotes of the pound/dollar pair performed a new reversal in favor of the British dollar and resumed the growth process within the ascending trend corridor. Thus, the mood of traders is still characterized as "bullish". There is very little news from the UK right now. Thus, traders have to pay attention to the news flow from the US. And here the key and most important topic remain the theme of the epidemic since a record number of cases of the disease continues to be recorded in America every day, which cast doubt on the rapid "recovery" of the economy. However, there is some good news. US Treasury Secretary Steven Mnuchin said recently that his department is finalizing a new economic aid package and it can be adopted by the end of the month. Thus, the US economy can receive new cash injections at times when they are most needed, which is a positive factor for the dollar. However, I believe that most attention should now be paid to the trend corridor.

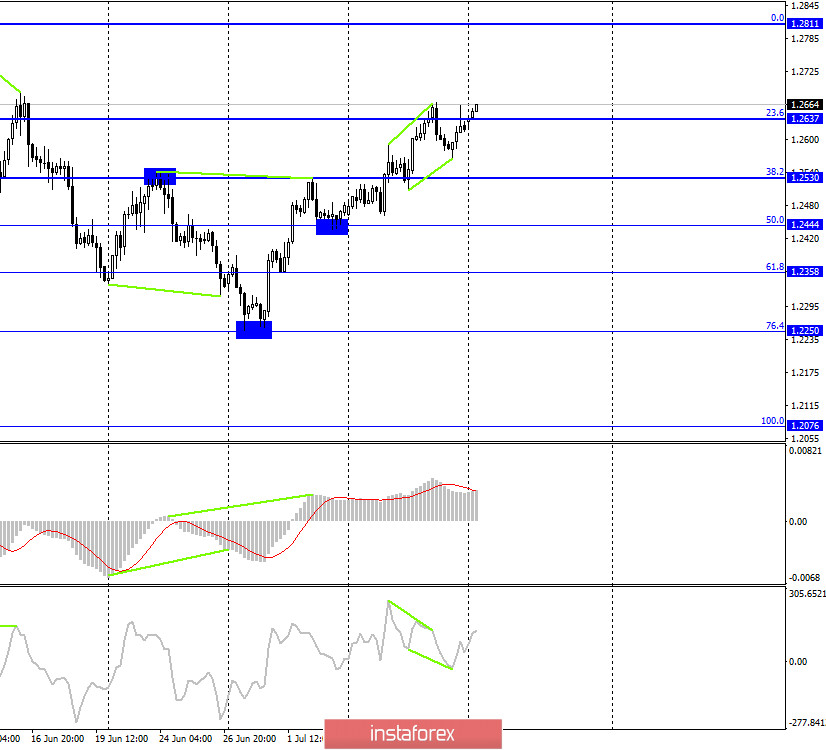

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair performed a reversal in favor of the British currency after the formation of a bullish divergence in the CCI indicator and a new consolidation above the corrective level of 23.6% (1.2637). Thus, traders can again expect to continue the growth process of the pair in the direction of the next corrective level of 100.0% (1.2811). No new emerging divergences are observed in any indicator today. Closing the pair's exchange rate under the Fibo level of 23.6% will again work in favor of the US currency and resume the fall in the direction of the corrective level of 38.2% (1.2530).

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 61.8% (1.2516). Thus, the growth process can be continued in the direction of the Fibo level of 76.4% (1.2776). This option supports an hourly chart at this time.

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

There was no major news or economic report on Friday in the UK and the US. Traders are still waiting for positive information on the coronavirus in the US, on the adoption of a new package of assistance to the US economy, as well as on the Brexit negotiations between the UK and the EU. However, there is nothing like this yet.

News calendar for the US and UK:

On July 13, the US and UK economic news calendars do not contain anything interesting. The information background will again be absent today.

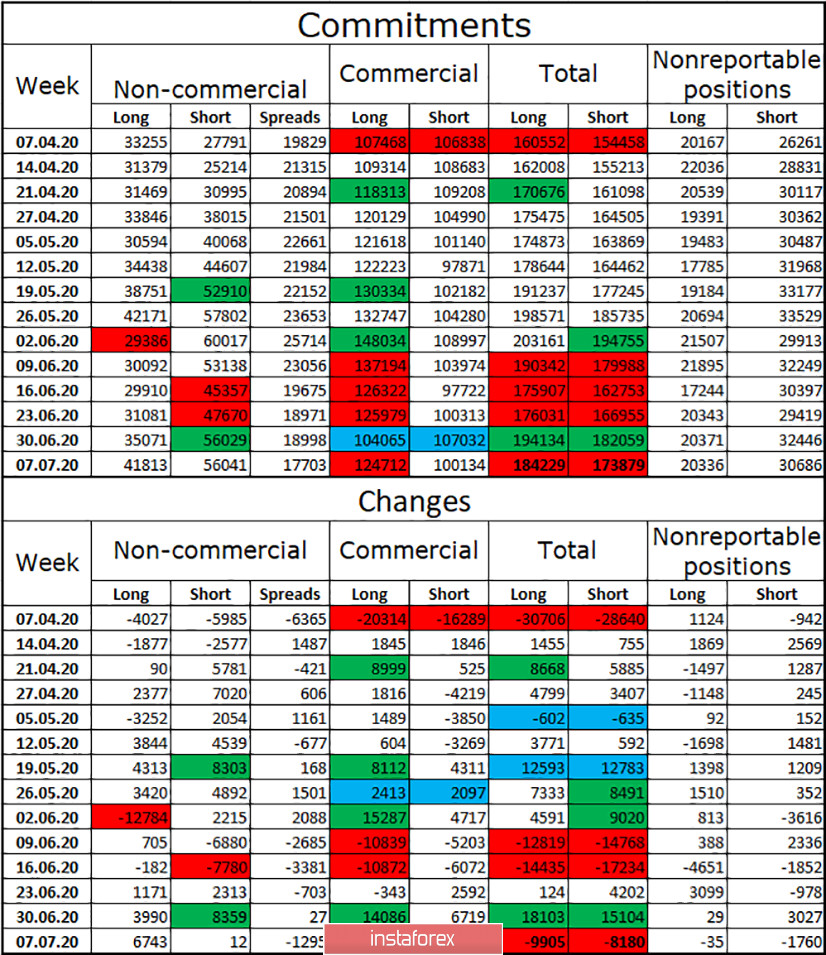

COT (Commitments of Traders) report:

The latest COT report again showed an increase in the number of long-term contracts among the "Non-commercial" group. However, if the last report also showed a strong increase in short contracts, the report for July 7 showed that speculators opened only 12 short contracts in a week. Thus, if you try to track the trend, since the beginning of June, speculators are increasing long, however, the number of short-contracts in their hands has decreased over the same period by 4 thousand. On the face of the "bullish" trend, which completely coincides with what is happening in the market. At the same time, the total number of both groups of contracts for the reporting week decreased by 18 thousand, mainly due to the "Non-commercial" group, which actively got rid of both groups of contracts

Forecast for GBP/USD and recommendations to traders:

I recommend selling the pound today with the goals of 1.2530 and 1.2444 if the closing is performed under the trend corridor on the hourly chart. New purchases of the pair can be opened with a target of 1.2811 if a close above 1.2667 is made.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.