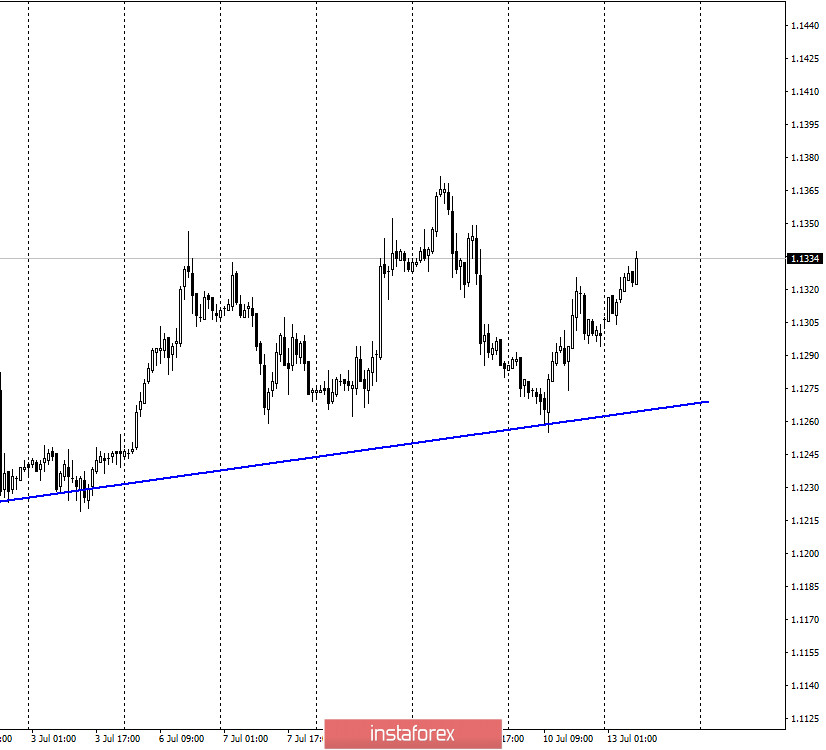

EUR/USD – 1H.

Hello, traders! On July 10, the euro/dollar pair again performed a fall to the upward trend line, rebounding from it and turning in favor of the European currency. Thus, the trend line did not allow the bears to start a downward trend 6 times already. The "bullish" mood persists, however, the euro currency is very reluctant to grow recently. The information background is currently slightly "blurred". News, on the one hand, seems to be enough, but on the other – all of them do not force traders to trade more actively. For example, this week, an important event will take place for Europe and the euro currency – the EU summit, during which the issue of the recovery fund after the coronavirus pandemic should be resolved. If the parties fail to adopt a package of measures worth 750 billion euros, the European economy may experience serious problems. The "information bomb" came from China, where one of the TV channels was interviewed by a woman named Li-Meng Yan, who claims that she is a virologist and has fled from China. Yan said that Chinese authorities knew about the coronavirus long before they announced it to the world. According to her, it was she who researched the pandemic that could have saved lives, however, the results of these studies were ignored by the management. It is difficult to say whether this woman worked with COVID or whether America just found the "right person".

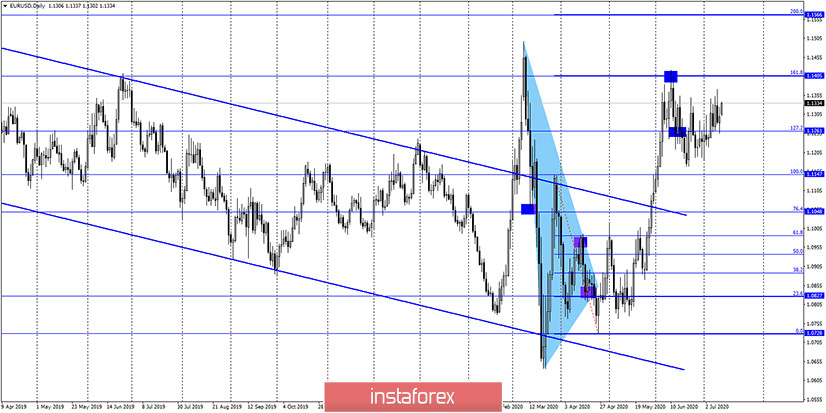

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair again performed a reversal in favor of the EU currency and began the growth process in the direction of the 1.1347 level, from which the quotes were rebounded three times before. A new rebound from this level will again work in favor of the US currency and begin to fall in the direction of the corrective level of 61.8% (1.1167). However, as in the previous few times, it is unlikely that the pair will reach this goal. Closing quotes above 1.1347 will increase the probability of further growth towards the next Fibo level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed another reversal in favor of the US currency and returned to the corrective level of 127.2% (1.1261). This level is not important since the pair's quotes easily overcome it. Thus, closing under it or rebounding from it will not be a signal.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). Several charts allow for possible growth in the direction of 1.1500 (1.1600).

Overview of fundamentals:

On July 10, there were no economic reports or events in America or the European Union. Thus, there was no information background, which did not particularly affect the nature of the pair's trading.

News calendar for the United States and the European Union:

On July 13, the information background will again be absent. Thus, I do not expect active trading today, but interesting information may arrive during the day.

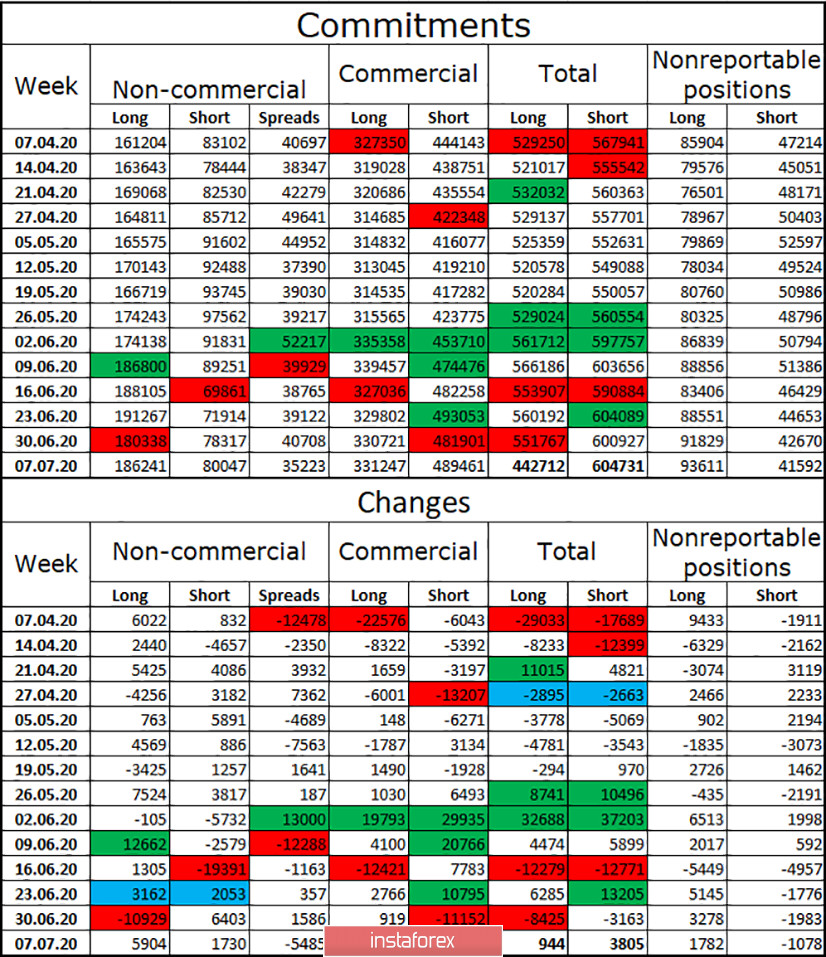

COT (Commitments of Traders) report:

The latest COT report showed exactly the changes in the mood of traders that I expected to see. The first thing to note is the growth of long-contracts by the "Non-commercial" group and a much smaller number of open short-contracts. Thus, speculators in the reporting week looked in the direction of purchases of the British. However, the "Commercial" group on the contrary increased short-contracts, and in total, the greater number belongs to short. However, the first group of traders is still more important. And the trend, if you look at the upper half of the illustration, is clearly "bullish". At the beginning of April, there were 161 thousand contracts in the hands of speculators, now – 186 thousand.

Forecast for EUR/USD and recommendations to traders:

Today, I recommend buying the euro currency with the goal of 1.1496, if a new close is made above the level of 1.1347. However, I recommend that you be careful with your purchases since the previous signal was false. I do not recommend rushing with sales of the pair yet. To do this, wait for the quotes to close below the trend line on the hourly chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.