Crypto Industry News:

The Paraguayan Senate approved the Cryptocurrency Act, introduced in July. The regulations that define several key terms, including virtual assets and a call for a cryptocurrency mining license, will now be sent to the Vice Chamber for further consideration.

Senator Fernando Silva Facetti, the bill's sponsor, revealed that it was passed in the Paraguayan Senate after a controversial debate. According to the senator, the act also aims to support the development of cryptocurrency mining by using the surplus electricity generated in the country.

The text of the regulations includes the definition of virtual assets, tokens, cryptocurrency mining and VASP (Virtual Asset Service Providers). It also grants the Ministry of Industry and Trade the power to seek assistance from government bodies outside its borders in implementing the law.

The bill clearly states that mining cryptocurrencies is legal, noting that:

"Virtual asset mining is a digital and innovative industry. This industry will benefit from all incentives provided by national legislation."

Paraguay reportedly produces more energy than it consumes. As a result, several companies are interested in setting up cryptocurrency mining operations there to take advantage of this surplus.

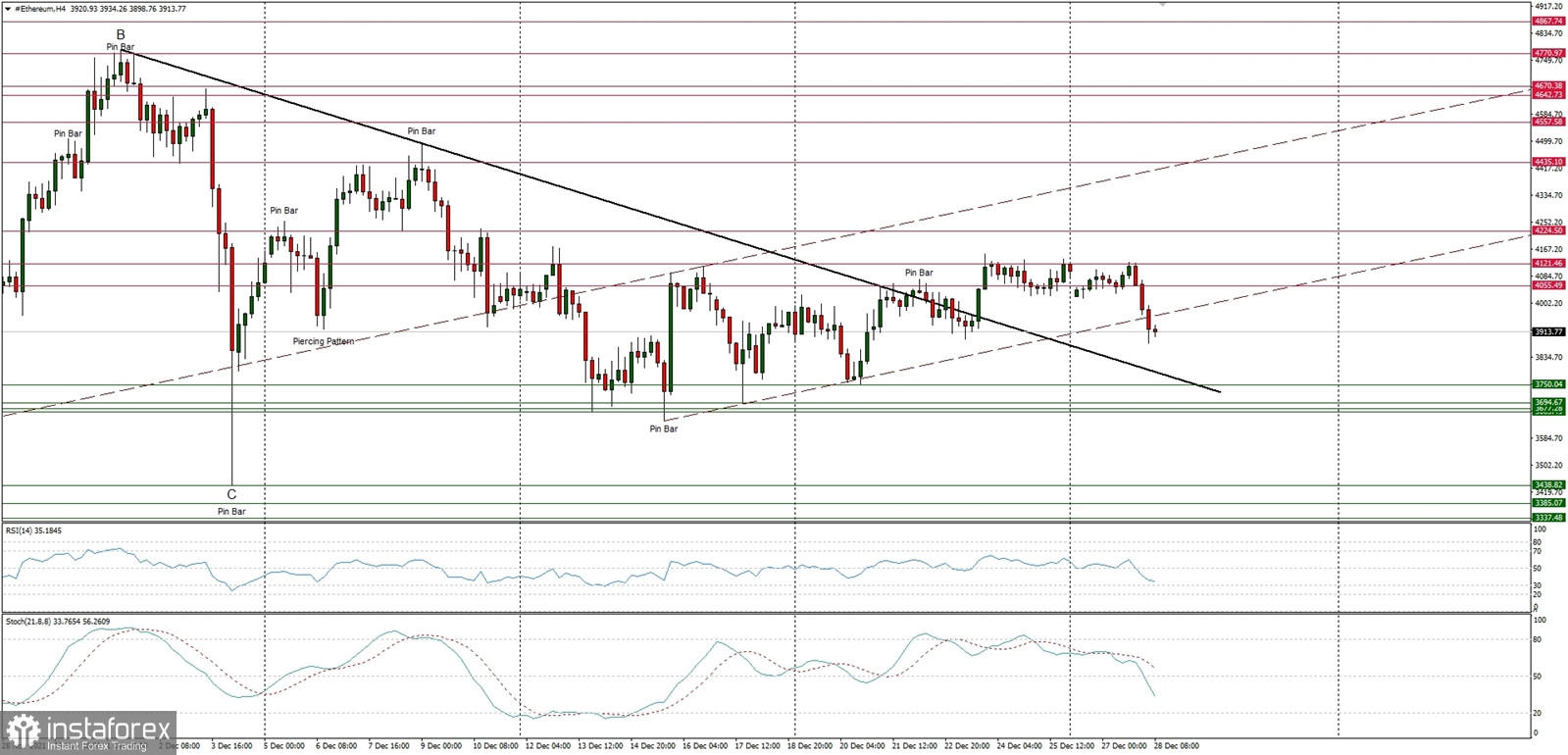

Technical Market Outlook

The ETH/USD pair has been rejected from the level of $4,121 and fell out of the ascending channel as well. The next target for bears is seen at the level of $3,750 as the negative momentum increase. The level of $4,015 and $,055 will now act as the local technical resistance. The larger time from trend, like daily or weekly remains up and there is no sign of trend termination or reversal. The game changing level is the technical resistance located at $4,224.

Weekly Pivot Points:

WR3 - $4,862

WR2 - $4,406

WR1 - $4,271

Weekly Pivot - $4,012

WS1 - $3,876

WS2 - $3,618

WS3 - $3,465

Trading Outlook:

The ABCxABC complex corrective cycle might be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.